Stablecoins, real estate tokens, inflation

Plus: tariffs, markets and GDP

“I love deadlines. I love the whooshing noise they make as they go by.” – Douglas Adams ||

Hi everyone, and happy Friday! I am convinced that this week and month have whizzed by EVEN faster than usual, which is saying something. It’s not just the firehose of news which for sure widened by a few apertures – it’s also a scientific fact that time accelerates when the weather is good.

So much happened this week that there are many items I have yet to get to – two illuminating stablecoin reports, CBDC struggles, sovereign BTC interest, a global risk report and more. Monday! Let’s hope the weekend news is relatively quiet.

IN THIS NEWSLETTER:

PCE vs CPI: what’s the difference?

The two narratives of real estate tokens

Macro-Crypto Bits: macro, markets, tariffs and stablecoins

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

PCE vs CPI: what’s the difference?

With the US Personal Consumption Expenditures (PCE) data for April due later today, it’s worth looking at why the US Fed pays more attention to this report than to the more headline-grabbing CPI report out earlier in the month.

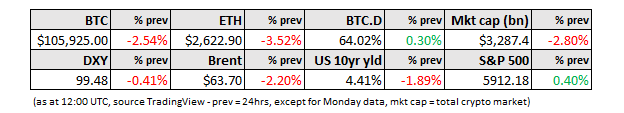

First, let’s look at the numbers:

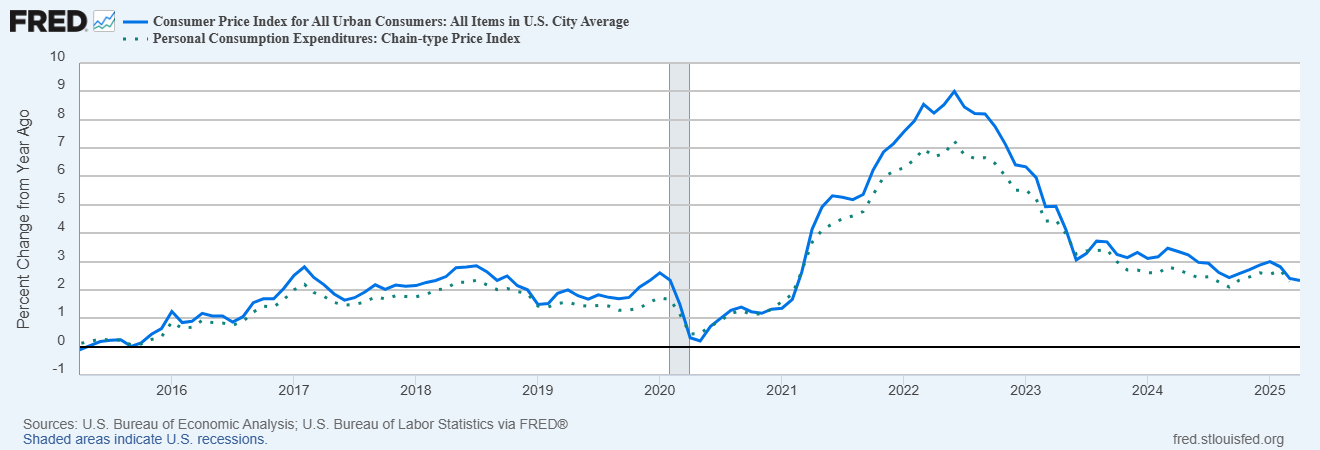

For April, US CPI came in at 2.3% year-on-year. Core CPI, which strips out food and energy, grew 2.8%.

The PCE index for April is expected to have grown by 2.2% year-on-year, with core coming in at 2.5%, in both cases slightly below the previous month’s 2.3% and 2.6% respectively.

(chart via the St. Louis Fed)

The two measures practically touching is not unheard-of, but it is unusual – normally, the PCE growth is slightly lower. Why?

For one, they measure different things. The CPI aims to reflect the average prices paid by urban consumers for a basket of goods and services. The PCE tracks the prices of all goods and services consumed by households, urban or not, and includes those paid for by third parties such as health insurance, government subsidies, etc. CPI is interested in what urban consumers pay; PCE wants to show the economic market value of what all US consumers use.

Second, the CPI measures prices of a fixed basket, with weights based on consumer surveys and adjusted every two years. It has a much higher weight for housing than the PCE, since that accounts for the bulk of urban consumer outlays – housing inflation has been particularly sticky since the pandemic.

The PCE basket weights are much more dynamic, changing every month according to a model that analyses consumer spending patterns. This enables the index to reflect the impact of climbing prices on spending behaviour, accounting for product substitution and other economization strategies. Also, its lower weight for housing makes the index less volatile.

So, one reason the Fed prefers PCE is that it captures a wider range of expenditures and consumers.

Another is that, while CPI represents the price increase hit to the wallets of urban consumers, PCE reflects the economic activity of all consumers.

The public and the media, however, pay more attention to the CPI, since the term has become synonymous with inflation in our psyches and that’s hard to dislodge. Plus, it better reflects our conscious consumption experience. And, the Fed’s official PCE focus has only been in place since 2000.

This can matter should the gap between the CPI and PCE widen, affecting the public perception of inflation while not necessarily budging Fed policy. The rocketing inflation expectations we see in consumer surveys? That’s CPI, not PCE.

Fed Chair Jerome Powell has said in the past that he and his team pay attention to CPI and to consumer inflation expectations, as they can influence behaviour which in turn influences spending and prices. But when it comes to being “data dependent”, it’s the PCE the US central bank focuses on.