Stablecoins: the Korean dilemma

plus: tariff trembles, military might, muted manufacturing, Bitcoin blockbusters and more

“The information you have is not the information you want. The information you want is not the information you need. The information you need is not the information you can obtain. The information you can obtain costs more than you want to pay.” – Peter L. Bernstein ||

Hi everyone, I hope you’re all doing well!

Programming note: I know I’ve already missed one day this week, but I have to miss another one on Friday, and won’t be publishing the free weekly on Saturday – back to normal schedule next week.

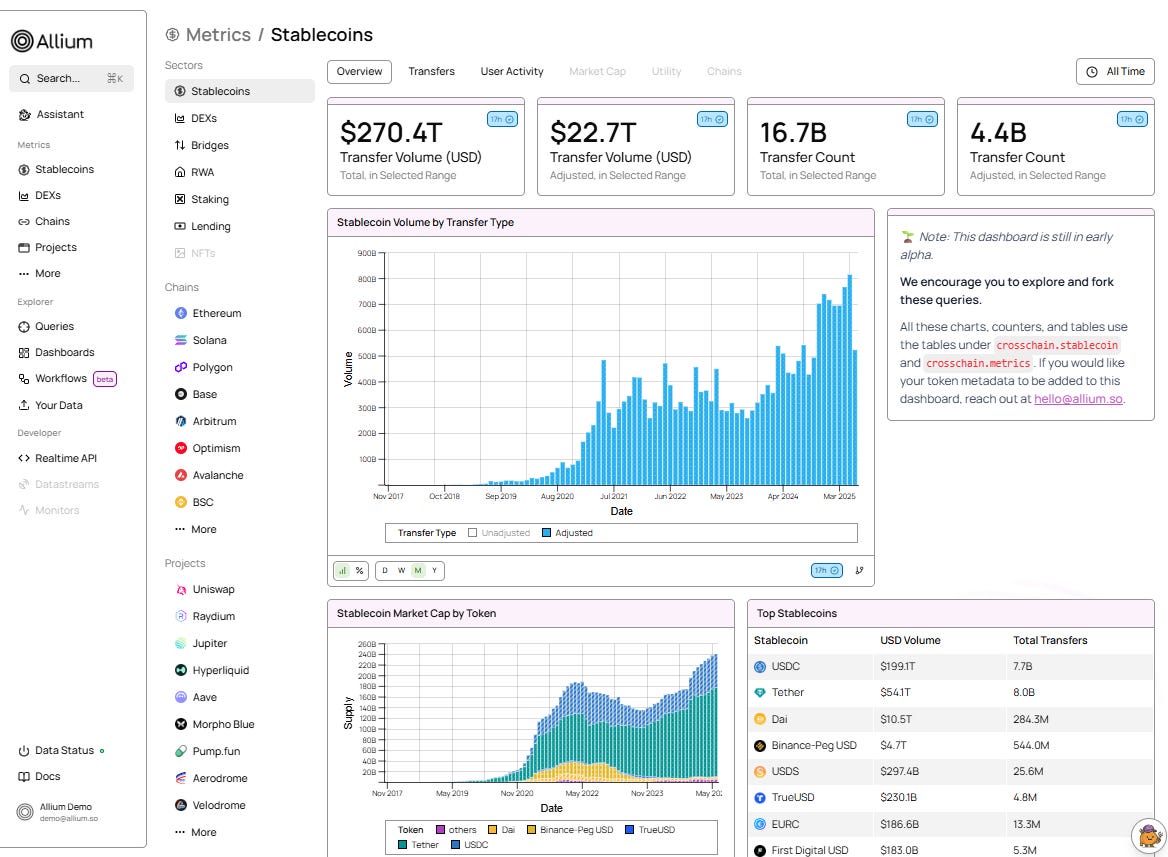

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Stablecoins: the Korean dilemma

A tariff unravelling?

Military might

Macro-Crypto Bits: manufacturing, long bonds, blockbusters

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Stablecoins: the Korean dilemma

In early July, I wrote about the stablecoin frenzy in South Korea that was injecting a degree of froth into the stock market despite little progress on the regulatory front. After an eventful couple of months, it’s time for an update, especially since an intriguing dilemma is emerging.

At least four different versions of a stablecoin bill are currently being considered, with a final draft expected to be presented in October – but, according to reports, negotiations are currently at a standstill over whether or not to limit who can issue won-backed stablecoins. It’s not about the required level of capital, it’s about the underlying business. The Bank of Korea (BOK) is urging lawmakers to only allow commercial bank stablecoin issuers, while some of the proposed bills expand the permitted range to include tech firms.

The thing is, in South Korea, there is often little difference.