Stablecoins: When is a dollar not a dollar?

Plus: banks + public blockchains, stablecoin services, US jobs, BTC buys

“I wouldn’t have seen it if I hadn’t believed it.” – Marshall McLuhan ||

Hello everyone! I hope you’re all taking care of yourselves.

I was planning to publish a short newsletter early tomorrow before I head to the airport but, looking at the timing, I’m realizing that’s ambitious, and so this will be the last newsletter of the week. Much to catch up on when I’m back at my desk on Monday!

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

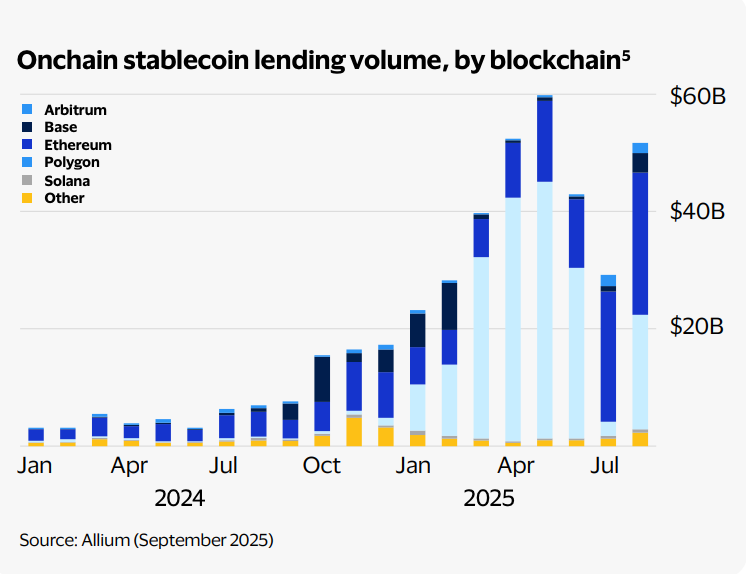

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

When is a dollar not a dollar?

BNY: banks and stablecoin services

OCC: Banks and public blockchains

Macro-Crypto Bits: BTC buyers, US jobs

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

WHAT I’M WATCHING:

When is a dollar not a dollar?

Here’s an interesting stablecoin twist: a dollar-pegged token issued by a country closely allied with Russia. Wait, it gets better.

Last week, Kyrgyzstan minted over $50 million worth of its national dollar stablecoin USDKG. Only, it’s not backed by dollars – it’s pegged to a dollar, but it’s backed by gold.

Several threads to pull on here.