Tariffs: the noise is the signal

Plus: altcoin season, the Fed debate, and market froth

“One of the chief chores in the next economy is to restore the symmetry of knowledge.” – Kevin Kelly ||

Hello everyone, I hope you’re doing well! Today’s newsletter is a bit rushed as I have a schedule squeeze, apologies in advance for typos and half-finished paragraphs – I have a growing backlog of deeper crypto trends, though, looking forward to sharing those.

Programming note: I’m afraid I have to miss publication on Friday, but will be back with the free weekly on Saturday!

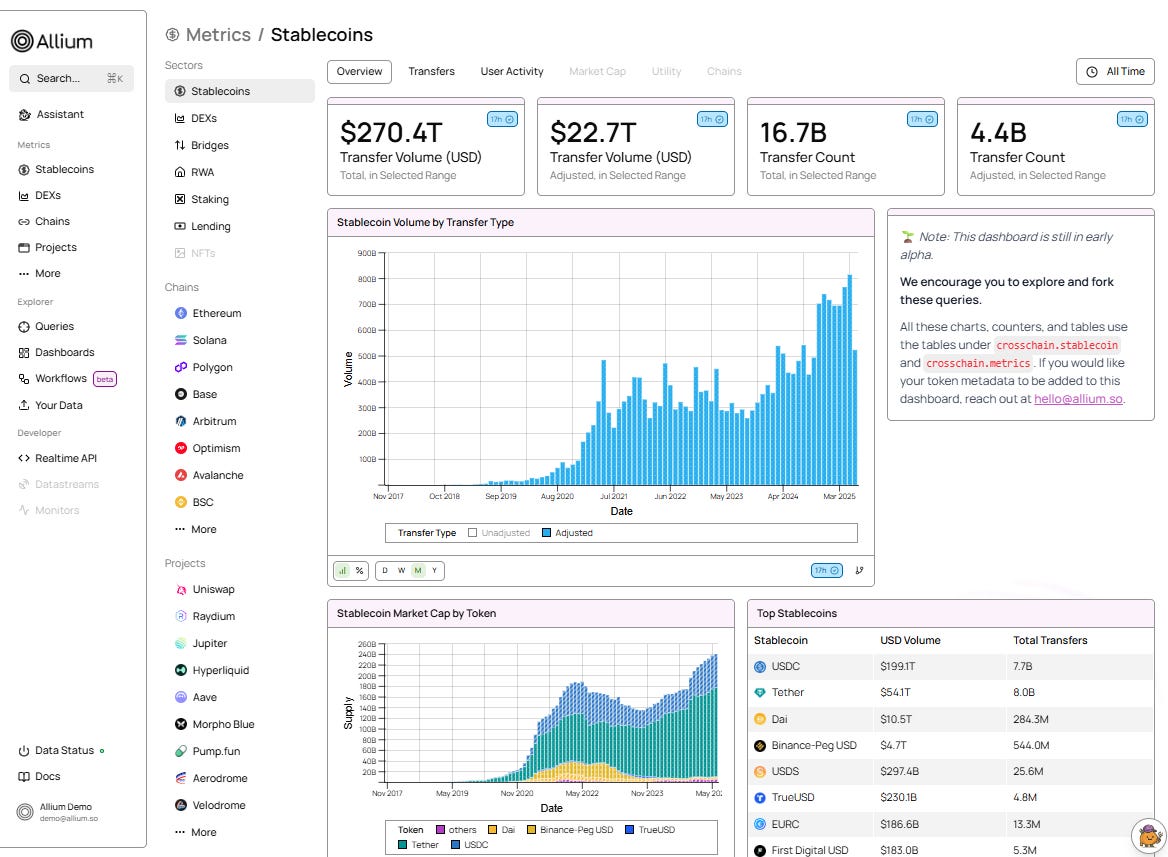

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Tariffs: the noise is the signal

Markets, rates and the Fed

Altcoin season?

RIP Ozzy

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Tariffs: the noise is the signal

I am looking forward to writing less about tariffs, but for now they do matter for geopolitics, domestic economies and therefore also the outlook for crypto. It’s not just the relative resilience for portfolios of hard assets in the face of fiscal stimulus to offset the damage to global trade; it’s also the need for independent havens amid mounting uncertainty as to the future of alliances, social turbulence and creeping censorship.

The trade war unleashed by President Trump is not, as we are seeing, just about trade, which is why I’m paying more attention to it than I enjoy. It’s loud and distracting, but also representative of a deeper reset. All the related news, statements and broken promises may seem like noise, but that itself is part of the signal that points to a bigger-picture shift in both power and what we understand by “economics”.

So, diving in…

Japan

I wrote yesterday that it didn’t look like there had been progress on Japan’s negotiations with the US – well, yesterday President Trump stepped in and after a meeting with Japan’s chief negotiator in the Oval Office, a deal has been reached. This involves 15% tariffs on Japanese imports to the US, up from the 10% baseline but down from the threatened 25%, which can be spun as either a loss or a win depending on your mood. Considering the longstanding military and trade alliance between the two countries, it doesn’t feel like a win to me, and will further cement Japan’s scramble to reduce reliance on the US relationship while exacerbating domestic political polarization.

Japan will also create a $550 billion fund to invest in the US, with 90% of profits going to US entities. Since it’s unlikely to want to increase overall dollar exposure, I wonder if Japan will be selling US treasuries to finance this commitment. If not, where will the money come from? Higher fiscal spending was already on the table after Sunday’s legislative election in which the ruling party lost its majority, with strong gains from the far right.

Also, Japan will accept US auto imports that do not comply with Japan’s safety standards, which would only go down well with the public if they are much cheaper, and perhaps not even then. I’m not sure why the US sees this as a win.

Now that the deal is done, reports are circulating that Prime Minster Shigeru Ishiba will resign in August, although he is denying this (then again, that is what besieged politicians do right up until they resign).

But, rather than trigger a scramble for the “safety” of government bonds, the news has caused a sell-off, pushing Japan’s 10-year benchmark yield to its highest since 2008. And yesterday’s auction of 40-year government bonds had the weakest bid-to-offer ratio since 2011.