Tectonic plates are shifting

OPEN TO READ, no premium subscription required

“May you live in interesting times.” – unknown origin ||

Hi everyone, I hope you’re all hanging in there!

I have a now substantial backlog of tokenization, stablecoin and CBDC topics that need addressing – and I’m behind on my regular (cough) round-ups of key developments – but every time I pull out that sheet, the shifting tectonic plates of global alliances make so much noise it’s impossible to concentrate, especially with the rollercoaster of markets screaming for attention.

So, since we are living an exceptional moment in history, I’m going to go with the flow and accept that my self-imposed structure will need to be flexible. The blockchain utility updates will be coming, and I’ll drop some in if daily word limits leave some room.

Meanwhile, we have to strap in because what’s happening out there will end up affecting us all – not only those of us that spend our days glued to the screen, but also the people who pack our groceries, teach our kids, make our cars, serve our coffee, drive our trains, keep our museums clean… I could go on.

I’m not suggesting that we’re at the brink of anything catastrophic, I don’t think we are – surely global leaders are not that stupid. But it’s hard to deny that we’re at a tipping point of some type, and markets are condensing emotions into a picture of expectations that, right now, signals widespread confusion as well as short-termism.

Again, sorry for the late send, it’s a theme this week, I know. It will not become a habit – I’m perhaps naively counting on the noise settling down soon. Since this is so late, I’m making it open to all, no subscription required, so feel free to share with anyone you think might be interested.

Last night I had a great chat with Maggie Lake on her excellent Talking Markets show – appropriately for the discussion below, it opened with “Are we in a new era?”. You can watch that here.

Programming note: this newsletter has to skip publication on Monday, March 10th.

IN THIS NEWSLETTER:

Tectonic plates are shifting

The German shock

The market reaction

What now?

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

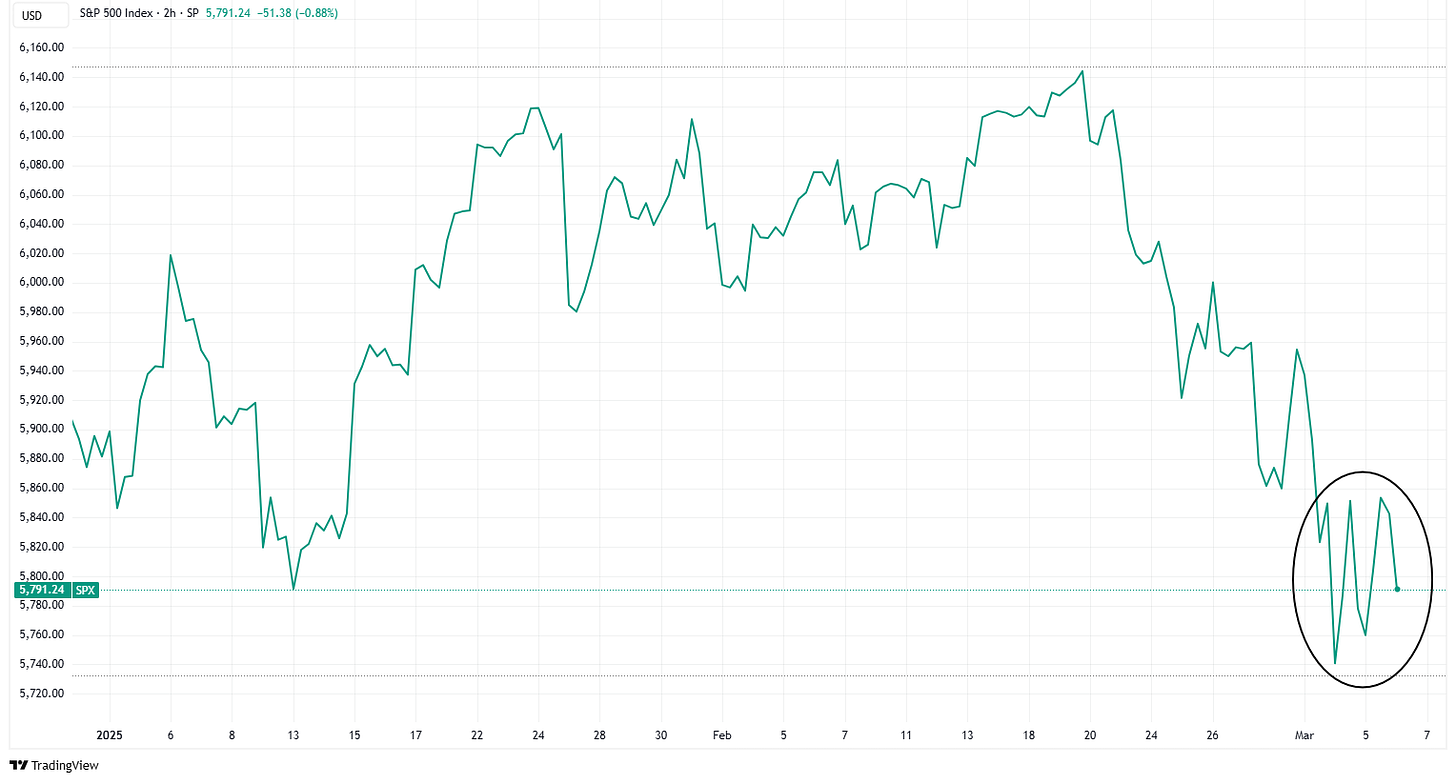

WHAT I’M WATCHING:

Tectonic plates are shifting

Since the inauguration of Donald Trump’s second term as US president just a month and a half ago, we’ve had more signs than we can reasonably handle that the global order is changing. But this week, the pace feels like it kicked into turbo drive.

We have the imposition by the United States of hefty tariffs on its three largest trading partners, kicking off the broadest trade war in almost 100 years.

We have a post yesterday on X by the Chinese Embassy in the US, echoed in today’s official briefing on the just-ended National People’s Congress, that said China was ready for “a tariff war, a trade war or any other type of war”, and would “fight till the end”. An astonishingly blunt statement by any account.

(post by @ChineseEmbinUS)

We also have the US decision to suspend intelligence sharing with Ukraine, and to ban other Five Eyes members – specifically the UK – from doing so. This is an even more blatant “hanging them out to dry” than the pause in hardware shipments, as without insight into Russian movements and target locations, Ukraine forces are effectively shooting blind with limited ammunition.

And there’s the not-so-subtle flex from French President Emmanuel Macron in the form of an offer to extend its “nuclear security umbrella” to Europe. According to the Federation of American Scientists, France has around 290 warheads, which would make it the fourth largest nuclear power in the world behind Russia, the US and China.

Macron also said he will convene a meeting next week of European army leaders willing to send peacekeeping troops to Ukraine should there be a deal with Russia – I don’t know who would be on that list. Russia, meanwhile, has rejected the idea.

Meanwhile, EU leaders are gathering today in an emergency summit, joined by Ukraine President Volodymyr Zelenskyy, to discuss a coordinated approach to defence. It is expected to produce an agreement to activate a mechanism that would relax the current member limits on debt and deficits to 60% and 3% of GDP respectively. On Tuesday, European Commission President Ursula von der Leyen sketched out a target of €800 billion in additional national spending, including €150 billion of EU loans to member stages. Ambitious, vague and controversial, but an astonishing pivot nevertheless.

And, embellishing all of the above with a decisive flourish, Germany has upended decades of history to embark on a new phase of industrial and military expansion.

The German shock

Late on Tuesday, the incoming chancellor Friedrich Merz announced that the outgoing government will vote to amend the country’s constitution to relax debt limits and allow the borrowing of up to €900 billion (~$971 billion) to fund defence and infrastructure investment.

It’s impossible to overstate the significance of this move, which is all the more astonishing given that Merz campaigned on opposition to fiscal expansion. The news is a material turning point for the country which has been facing economic stagnation and domestic unrest with no clear solution in sight, given the political paralysis resulting from deepening polarization.

The proposal has to be approved by the outgoing government before March 25 as right-wing AfD, which is against fiscal expansion, will hold enough sway in the new legislature to block such a move. A possible glitch is that the backing centrist coalition will need the cooperation of the declining-in-relevance Green party, who are reportedly upset that the announcement did not promise carbon neutrality.

Assuming that gets smoothed over, this is extremely good news for Germany, at least in the short-term. It will hopefully put a floor under the industrial decline of the past decade while strengthening local manufacturing for local consumption at a time of rising trade barriers. It should inject both funds and urgency into reforming the energy grid and transport infrastructure. It will also jolt leaders out of their fear of debt and politically motivated limits on investment, and its example just might be the incentive the European Union needs to actually do something about its paralyzing regulation and preference for the status quo.

There is a big caveat, however, and that is the deepening political tension.

Almost half of Germany’s youth voted for parties on the far left or the far right – both extremes are not happy about the militarization. The next elections are years away, but unless the investment triggers an astonishing economic recovery, the AfD will most likely win a controlling position in government, possibly carrying out its threat to take Germany out of the European Union.

And within Europe, rifts are widening. Resentment at the creep of centralization, seen by many countries as a power grab, could further weaken the bloc’s ability to implement necessary reforms and present a credible threat deterrence. Hungary has said it won’t block increased defence spending, but its stance so far has been to veto direct aid to Ukraine. There are moves under way to get around Hungary’s block, which would no doubt further antagonize the US and Russia – but this would need all other nations to agree, and Hungary does have allies.

The market reaction

Markets are understandably freaked out.

The yield on Germany’s 10-year bund jumped yesterday by 30 basis points, the most since the aftermath of the fall of the Berlin Wall in 1989.

(German 10-year bund yield, chart via TradingView)

This is not necessarily the work of bond vigilantes protesting the debt increase. For one, Germany’s debt is still low by global standards. Even after the spike, yields are still under 3%, also low by global standards. Just two weeks ago, Bloomberg reported that investors were urging Germany to issue more bonds – and there is likely to be demand for what’s coming, at least at first, and especially if it turns around the waning economic outlook.

True, there’s no doubt some reaction to the unexpected scale of the coming flood. But it’s also possibly the result of the sudden attractiveness of German industrial equities triggering some portfolio rotation. And it’s an acknowledgement that today’s ECB rate cut could be the last for a while.

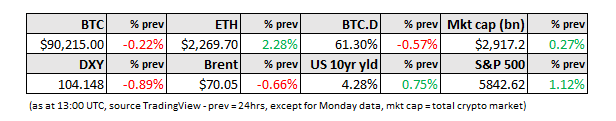

Other European bond yields have followed suit.

(chart via TradingView)

The euro has surged against the US dollar, reaching its highest valuation since the US election and upending the “American exceptionalism narrative”.

(EUR/USD chart via TradingView)

And just when you’d think all the talk of war would send the world scurrying into safe havens such as the US dollar, it’s falling against not just the euro but also against other major anchors such as the yen and the Swiss franc.

(DXY dollar index chart via TradingView)

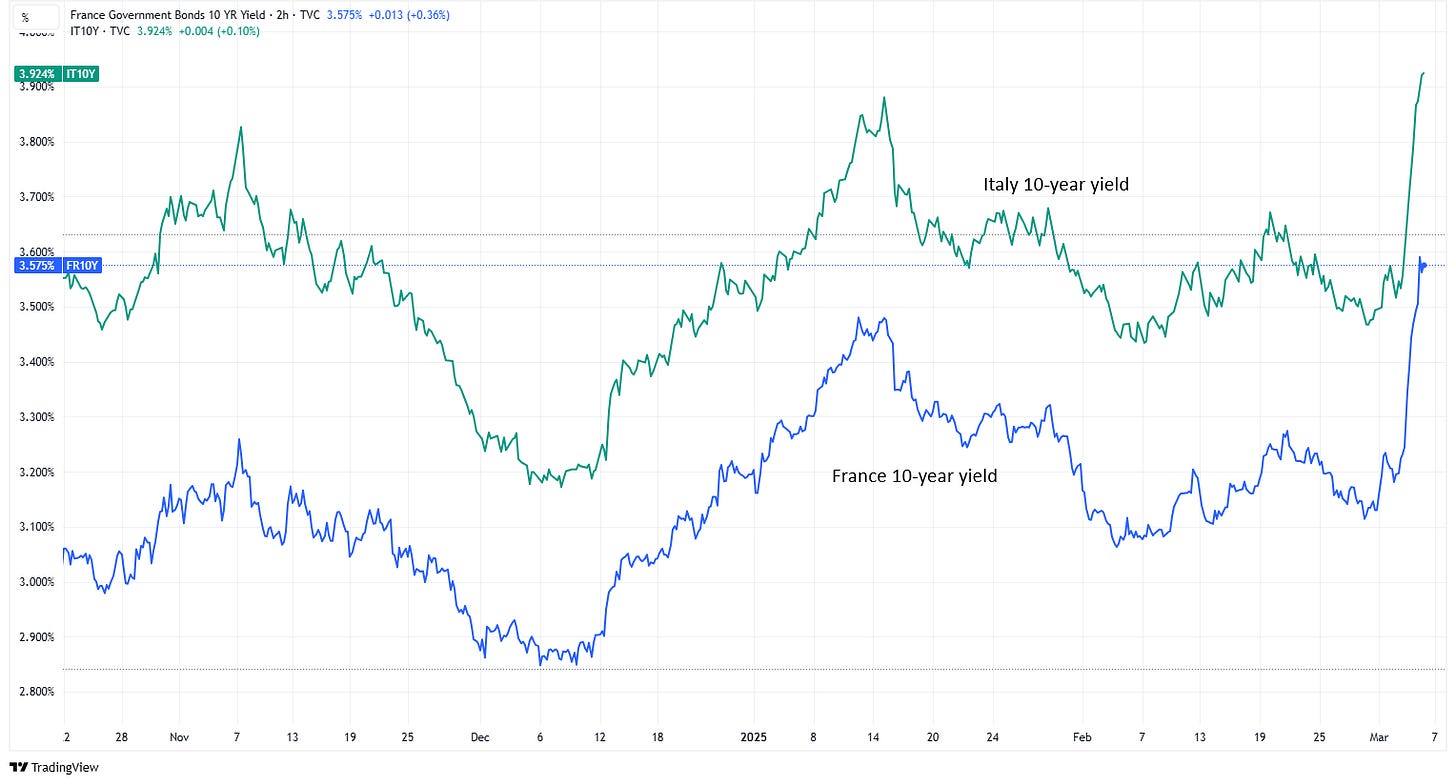

US equities don’t yet know what to make of this, especially since it comes at a time of acute tariff uncertainty. A lower USD is good for the US manufacturing outlook, but it tends to be inflationary as imports – already groaning under actual or threatened tariffs – get more expensive.

(S&P 500 chart via TradingView)

Meanwhile, the US bond market seems to be ignoring the inflation threat, instead choosing to focus on a greater likelihood of rate cuts given signs of a slowing economy. Consensus expectations for tomorrow’s official US employment report point to an increase of 160,000 jobs which, given the federal hiring freeze and the weakness in yesterday’s private ADP figures, puts a high likelihood on a negative surprise, in a market primed for bad news.

In sum, macro jitters are crisp, news is coming thick and fast, and none of us fully understand the ramifications of what we’ve seen so far this week, especially since safe haven indicators – gold, US government bonds and BTC – are not yet reflecting the escalating talk of war.

BTC is holding up relatively well, perhaps in part because of the dollar weakness, but also due to expectations for positive announcements after tomorrow’s first official White House Crypto Summit. That it’s not doing better underscores how macro concerns still weigh heavy on crypto assets.

(BTC/USD chart via TradingView)

What now?

In a world so used to focusing on monetary and economic indicators, so primed for signs of greater liquidity, so unfamiliar with deep geopolitical swings, I worry that we’re overlooking bigger risks. Even if they’re remote, they shouldn’t be ignored.

I’m in favour of more defence spending for Europe, it’s about time, and it will lead to stronger civilian infrastructure as well as faster development of new home-grown technologies.

I’m also appreciative of the drastic moves needed to shake Europe out of its lethargy and paralysis.

But, we don’t yet know what Europe’s new focus on defence expenditure will do to welfare budgets or inflation. This will matter as higher consumer borrowing costs start to reflect the higher yields, when protest can be registered at the ballot box. Support for right-wing parties across Europe is surging, a trend that could accelerate should current leaders continue to talk about making sacrifices for a war most Europeans sadly but understandably got tired of a while ago.

What we do know is that a well-armed nation is more likely to flex muscle.

We also know that the US is no longer the power it once was – even its Secretary of State Marco Rubio recently acknowledged we are now living in a “multipolar world”. The withdrawal of the US from long-standing allegiances and associations, at a time it is urging allies to be more self-sufficient, may boost American manufacturing – but at the cost of its global influence. We don’t know what the impact of this will be on smaller nations previously reliant on the US umbrella, nor on other powers eager to step into perceived gaps.

Regular readers will know I’ve been flagging geopolitical shifts for some time, as I believe crypto is not just a haven and a protector of individual agency as politics gets crazy – it’s also a new tool in the box for nations navigating shifting alliances. It’s not hard to conclude that we’re no longer sleepwalking, we’re actively rushing into a world in which this is will become uncomfortably relevant.

These are scary times, which are difficult for most but which always produce opportunities, especially for those focused on adapting to the likely landscape when the dust settles, which it always does. And while fear centralizes, its corollary – lack of trust – does the opposite. This battle, between centralization and decentralization, will be the tussle of the first half of this century, and will impact governments, social structures, economic outlooks and adoption of new technologies.

There’s a Persian saying I cherish: “They can pull the carpet out from underneath your feet. But you can also learn to dance on a moving carpet.”

We certainly can. And we’ll need some tools, good friends and plenty of internal resilience to help us do that.

LISTEN/READ:

Last night I had a great chat with Maggie Lake on her excellent Talking Markets show – appropriately for the discussion below, it opened with “Are we in a new era?”. You can watch that here.

To scratch any doomer itches out there, this episode of Merryn Talks Money (Spotify link, transcript) features Jeremy Grantham talking about why the stock market is due for a sharp correction, and what that could look like.

WHAT I’M LISTENING TO: I feel like we could all use some fighting spirit today – Warriors, from League of Legends, by 2WEI and Edda Hayes.

If you find Crypto is Macro Now useful, would you mind hitting the like button? ❤ I’m told it feeds the almighty algorithm.

And if your friends and colleagues sign up via your referral link, you get a free month!

HANG IN THERE!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.