The CFTC opens big crypto doors

plus: Hashkey and China, yield curves, consumer mood and more

“What lies behind you and what lies in front of you, pales in comparison to what lies inside of you.” – Ralph Waldo Emerson ||

Hello everyone! I hope you’re all doing well and getting into the festive spirit! I might have mentioned this before, but Madrid is SO gorgeous in December – the lights, the Christmas markets, the chestnut stalls… Hard not to feel festive, whatever markets are doing.

Speaking of festive, this newsletter will skip publication on Friday because I’m actually going to celebrate my birthday this year (rare, for me), and that involves a day pottering around downtown, popping into cafés, maybe doing some Christmas shopping.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

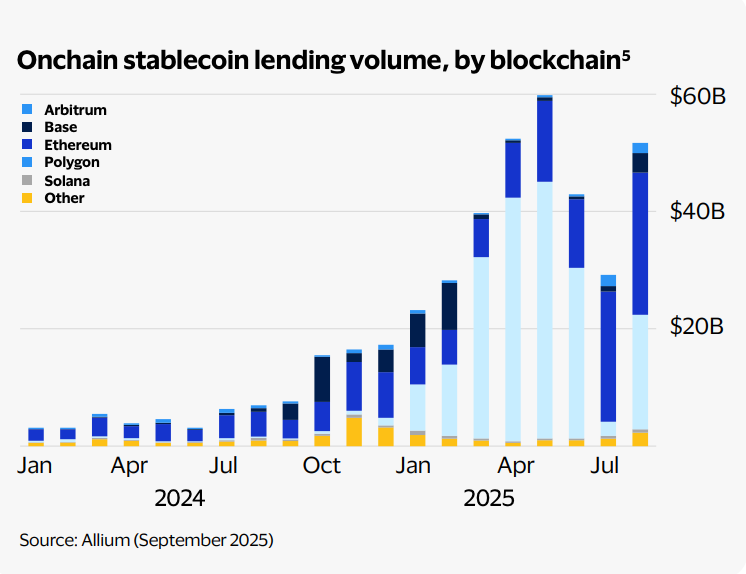

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The CFTC opens big crypto doors

Hashkey and China’s crypto “clampdown”

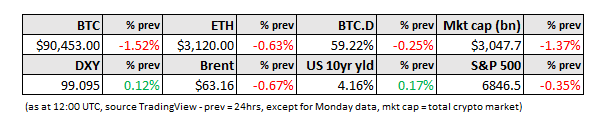

Markets: steepening and YCC

Macro: consumer blues

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

The CFTC opens big crypto doors

You have to hand it to Caroline Pham. She is currently Acting Chairman of the US Commodity Futures Trading Commission (CFTC), and has been the only remaining sitting Commissioner since September. Yet, despite announcing her intention to leave as far back as May, she has managed to get a lot done, as we are seeing in a flurry of announcements over the past couple of weeks. This is no mean feat – any official announcement from a government agency only comes after an unimaginable amount of pushing and pulling. And while she no doubt has a competent staff, she pulled this off as the sole Commissioner.

In late November, she put out a call for crypto CEOs to form part of an innovation council. The interest in industry input is especially relevant given the enhanced oversight role for the agency proposed in the crypto regulation bills currently working their way through Congress.

Then, last week, Pham confirmed that spot crypto assets can now trade on CFTC-registered derivatives exchanges. Binomial is first out of the gate to actually do so with trading expected to start this week, but we can be pretty sure others, including the CME, won’t be far behind.

This is a big deal: