The CPI debate: did tariffs hurt?

plus: rates, time, jobs, Brazil, tokenization and more

“Militarism has been by far the commonest cause of the breakdown of civilizations. The single art of war makes progress at the expense of all the arts of peace.” – Arnold Toynbee ||

Hi everyone – I hope you’re all doing better today. What a week, and TGIF.

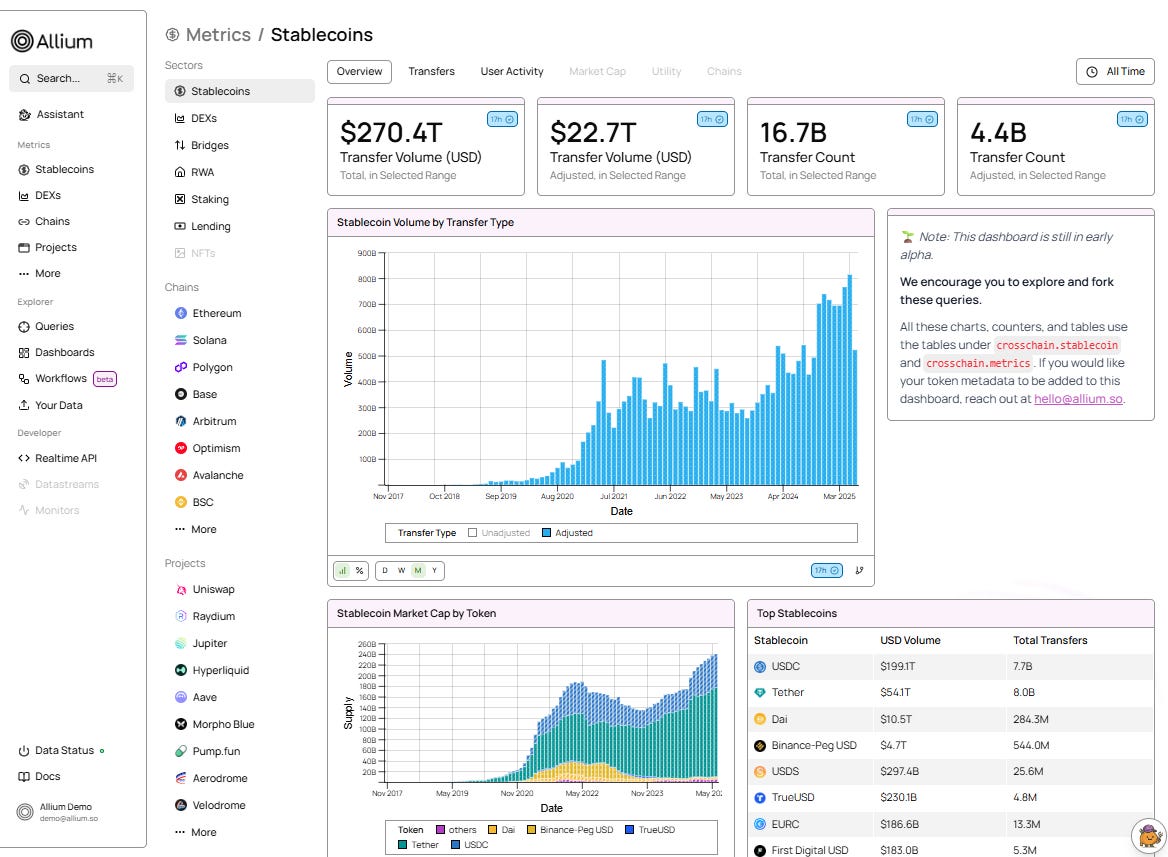

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

The CPI debate: did tariffs hurt?

Unemployment claims spike

The rates risk

The literal weaponization of time?

Also: China + stablecoins, polarization, Brazil, BlackRock and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

The CPI debate: did tariffs hurt?

Yesterday’s CPI report, as usual these days, contained both good and bad news. Tariff pressures are more moderate than I expected, but inflation is undoubtedly ticking up.

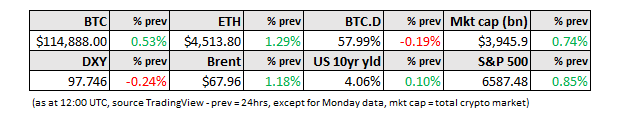

The headline CPI increase for August was 0.4%, higher than the average forecast of 0.3% and July’s 0.3%, and the highest monthly read since January.

(chart via Bloomberg)

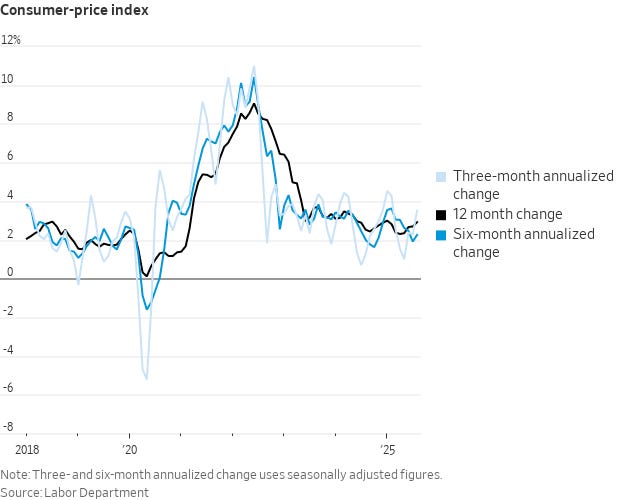

On a year-on-year basis, headline inflation ticked up to 2.9%, in line with expectations and higher than July’s 2.7%. Headline inflation is now higher than it was a year ago on a 1-month, 3-month, 6-month and 12-month basis, for the first time this year.

(chart via @NickTimiraos)

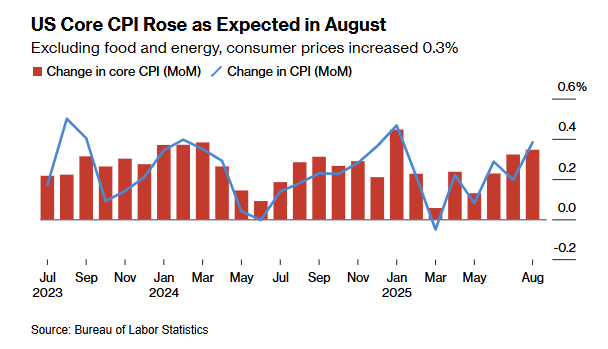

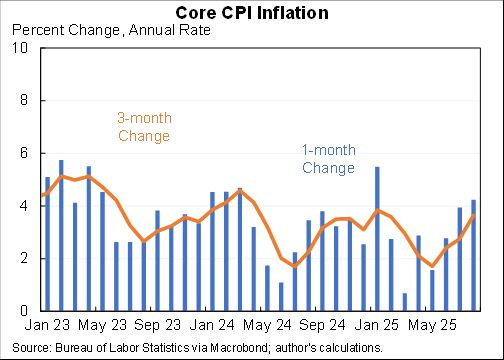

The core CPI index, which strips out food and energy, came in at 0.35% month-on-month, near the high end of estimates, slightly higher than July’s 0.32%, and the highest since January.

The year-on-year rate for August held steady at 3.1%, in line with expectations. Annualizing the 1-month rate puts the core CPI at over 4%, the highest since January. The three-month annualized rate is now up to 3.65%, also the highest since January.

(chart via @jasonfurman)

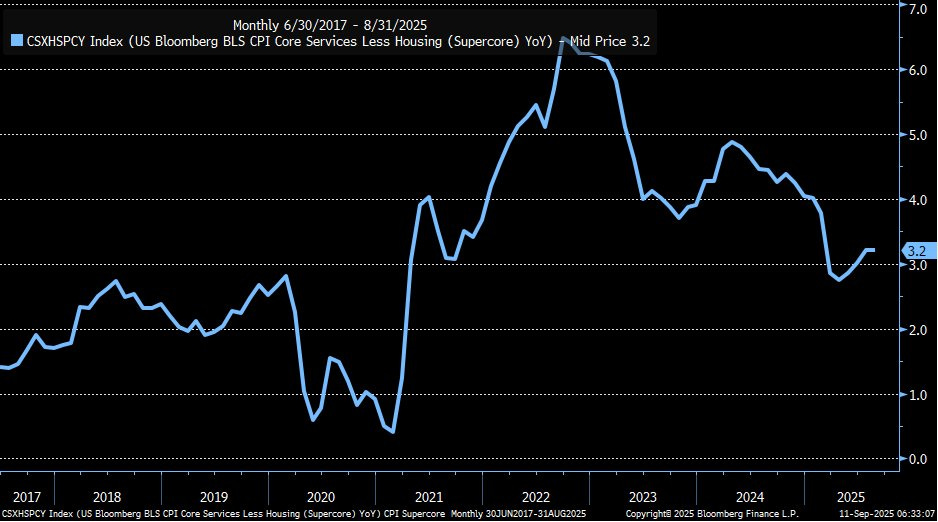

The supercore index, which strips out food, energy and housing, was unchanged year-on-year at 3.2% – still elevated.

(chart via @KathyJones)

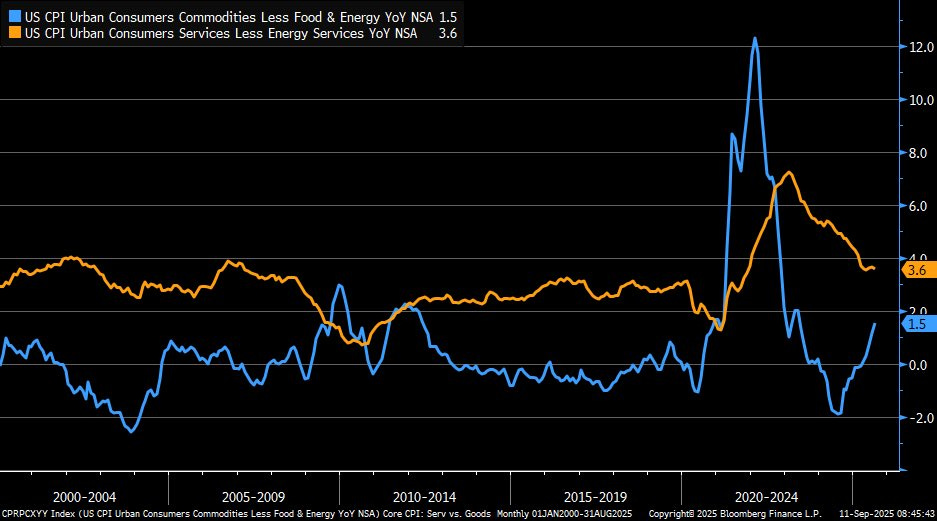

This is still largely driven by services, although core services inflation eased slightly to 3.6% year-on-year from 3.7%.

Worryingly, the disinflation in core goods we saw last year looks to be well and truly over – the index growth is positive and accelerating, now up 1.5% year-on-year.

(chart via @LizAnnSonders)

Tariffs? My feed yesterday was split more or less evenly between experts who say “see, tariffs don’t impact inflation!” and those who insist we are seeing some spillover. I’m in the latter camp – just look at those core goods.

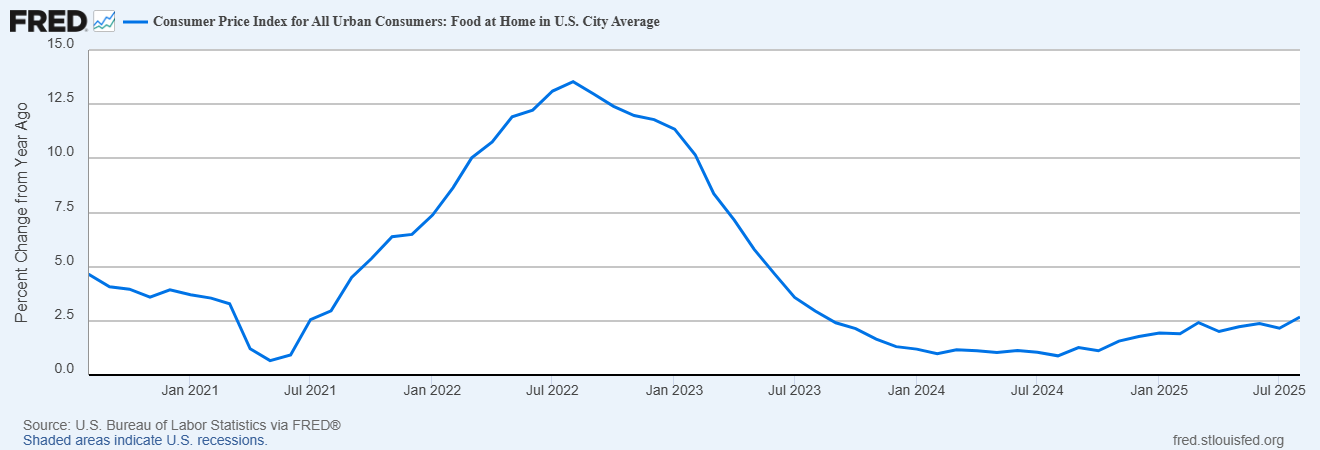

And looking at food prices (not included in core), fruit and vegetables are up 1.6% on the month, food at home is up 2.7% year-on-year – the last time it reached this level while heading up was in August 2021, when the inflation surge was just getting started.

(chart via St. Louis Fed)

Food is stripped out of the measures the Fed looks at in its decisions on monetary policy. But it is felt by consumers, and feeds into their inflation expectations which the Fed does pay attention to.

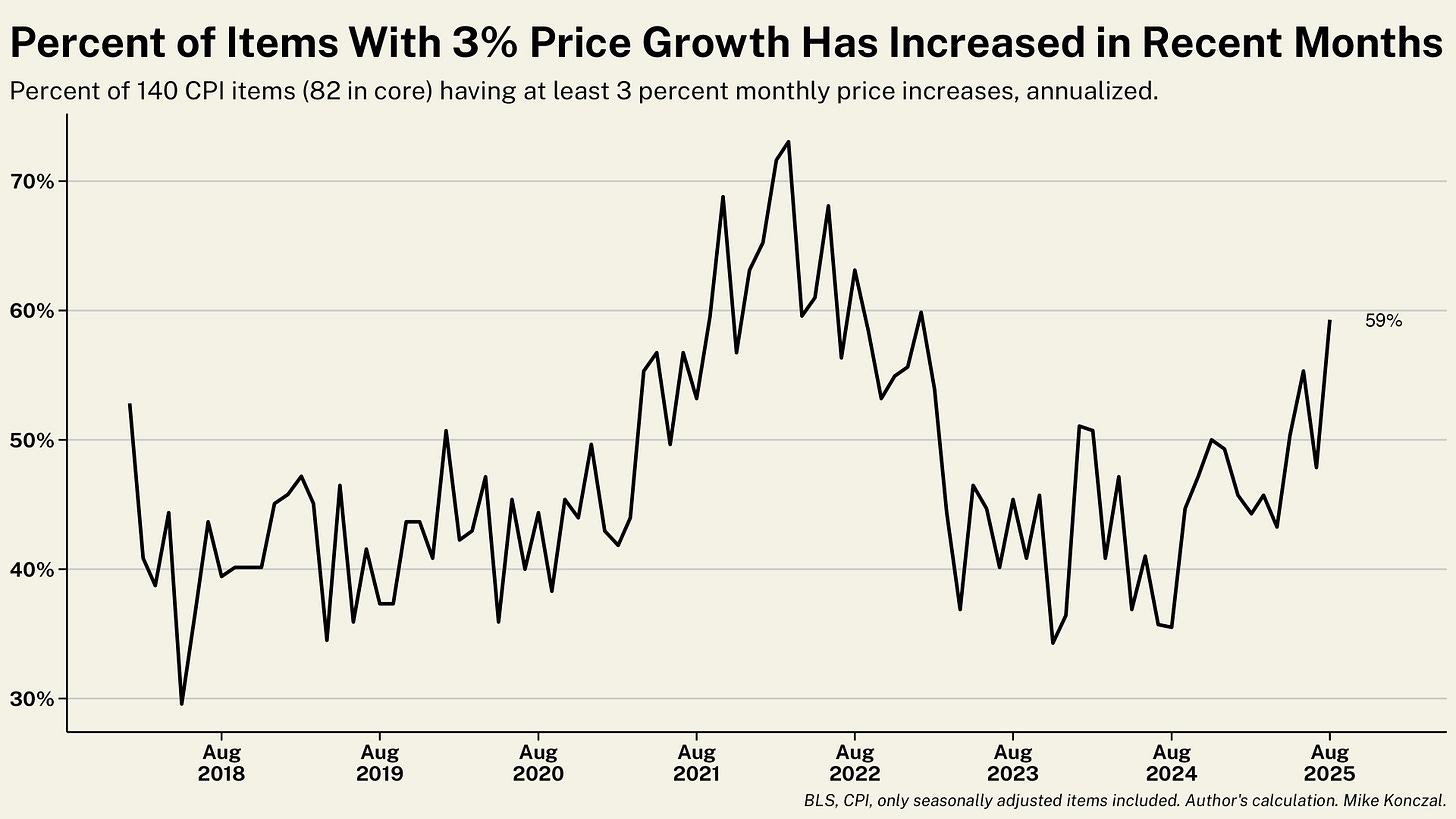

Finally, the number of items in the CPI basket with inflation of 3% or over has reached the highest level since late 2022, when the inflation battle was in full swing.

(chart via @mtkonczal)

The next significant inflation data drop is the Personal Consumption Expenditure, due near the end of the month, and forecasts are being revised up – the core PCE is now expected to be up 3.0% year-on-year, vs 2.9% in July and 2.6% in January. It is not moving in the right direction.

The unemployment claims spike

Despite ominous signs in inflation, many were more spooked yesterday by the initial unemployment claims, which came in at the highest in four years.