The debt crisis is unfolding

plus: jobs, rates expectations, what's ahead this week and a lot more

"If you're going to open Pandora's Box, make sure to stand behind the lid when you do so." – Wayne Chambliss ||

Hi everyone, I hope you all had a great weekend! I had a wonderful time wandering around Madrid with a very dear friend visiting from New York, a special person I don’t get to see nearly enough. When the noise in our feeds gets loud and confusing, even a bit of time in the company of someone you love puts into perspective why all this matters.

Apologies for the late send today, I had a technical issue with Substack, I think it’s fixed. Perhaps it was unhappy with the length, because today’s is loooong, so much to cover and even then I didn’t get to everything. Back to a more normal length as of tomorrow.

A special thanks to Kyle for today’s quote! 😎

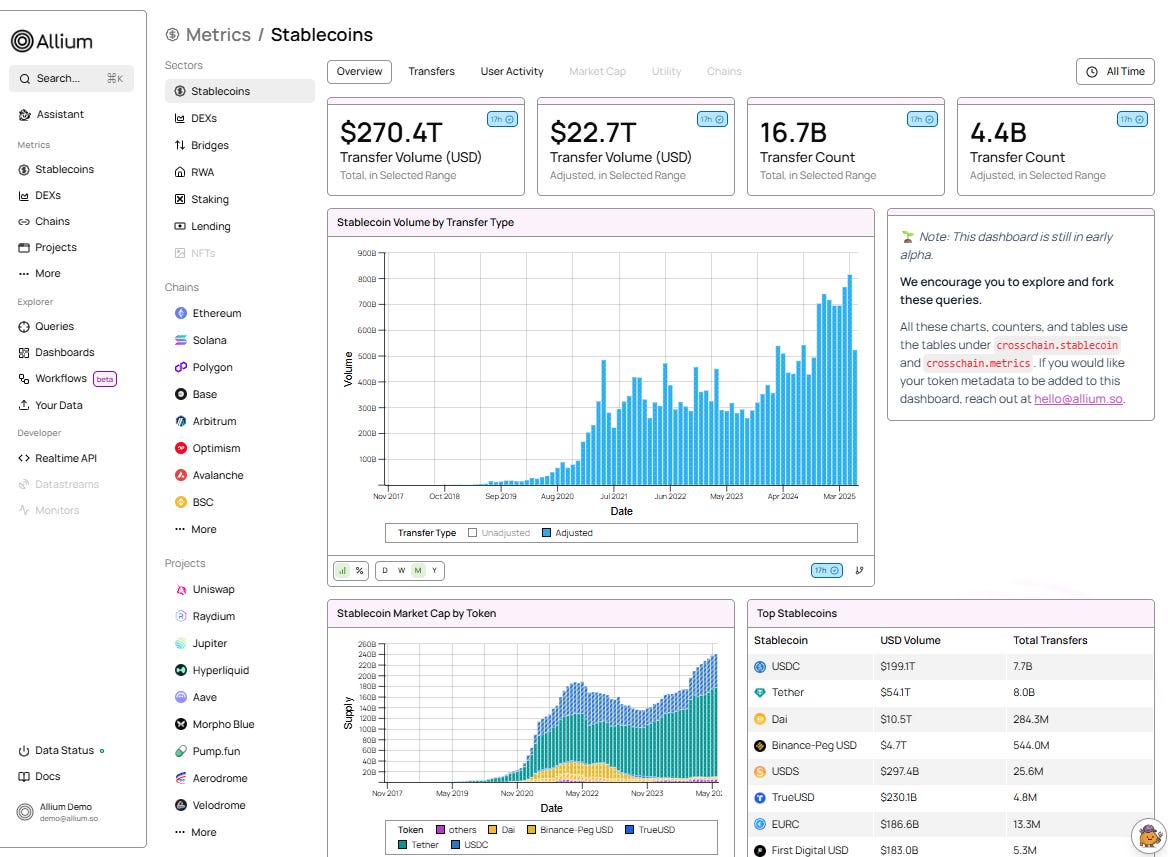

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up this week: CPI, France, BIS, jobs revisions and more

The debt crisis is unfolding

Macro-Crypto Bits: the jobs data, rates expectations

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up this week:

There are three big deals for the macro and crypto outlooks this week: the US inflation data out on Thursday, and the BLS payrolls revision expected tomorrow – both will weigh heavy on rate cut expectations. And there’s the French vote tonight, more on this below.

Today, the lower house of the French parliament votes on whether they have confidence in Prime Minister François Bayrou – the likely result is no, and there is a sobering lesson in here for all developed economies (more on this below).

Also today, BRICS countries hold an online summit to discuss a coordinated reaction to US tariff policies. Convened by Brazil, it will feature a speech by Chinese President Xi Jinping as well as participation by Russian President Vladimir Putin. It will not be attended by Indian President Narendra Modi, however, who will instead send his foreign minister.

And we get the New York Fed 1-year inflation expectations, as well as the Consumer Board employment trends index.

On Tuesday, we get the QCEW establishment survey employment data adjustments from the US Bureau of Labor Statistics – I’ll dive into this more tomorrow.

We also get NFIB small business optimism.

And the BIS (the central bank’s central bank) kicks off its annual three-day Innovation Summit. This year’s title is “Future-proofing Central Banks”, and on Wednesday there will be a panel on public sector tokenization. I didn’t see much on the agenda specifically about stablecoins, but Neha Narula of the MIT Digital Currency Initiative is speaking and there are plenty of sessions about cross-border payments, so we can be sure they’ll come up.

On Wednesday, we get US Producer Price Index, a gauge of wholesale inflation.

And European Commission President Ursula von der Leyen delivers the annual State of the Union speech to the European Parliament, which should be depressing and frustrating.

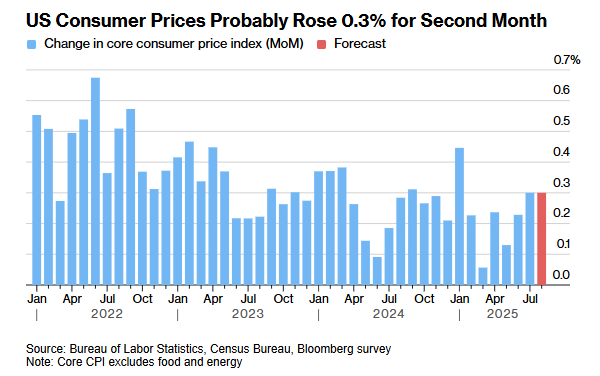

On Thursday, we get the US CPI for August, the last major economic report before the FOMC meets next week. The consensus forecast is for the core rate, ex-food and energy, to hold steady at a 3.1% year-on-year increase. Only a much worse figure would at this stage be enough to avert a rate cut next week (more on this below).

(chart via Bloomberg)

We also find out more about employment trends via the weekly unemployment data. And we get real average hourly and weekly earnings, as well as an update on the federal budget.

Friday brings the preliminary read of the University of Michigan Consumer Survey for September, which the Fed uses to track inflation expectations.

The debt crisis is unfolding

Below, I look at three examples of how issues with government debt are bringing down governments. This is dysfunctional, and is just getting started.