The EU deal: the end of the beginning, or the beginning of the end?

plus: negotiations, Fed, BTC, geopolitics, inflation and more

“Civilizations in decline are consistently characterized by a tendency towards standardization and uniformity.” – Arnold Toynbee ||

Hello everyone! I hope you all had a good weekend. We had new windows put in on Friday (which is why I couldn’t publish, my home became a construction site), so I spent the weekend recovering from the chaos and dust. Cough. What was I thinking…

A really long one today, as the US-EU deal has some potential consequences markets are overlooking.

Later today I’m doing a livestream with the wonderful Maggie Lake on her Talking Markets show – we kick off at 4:30pm ET, and I think you’ll be able to catch that here.

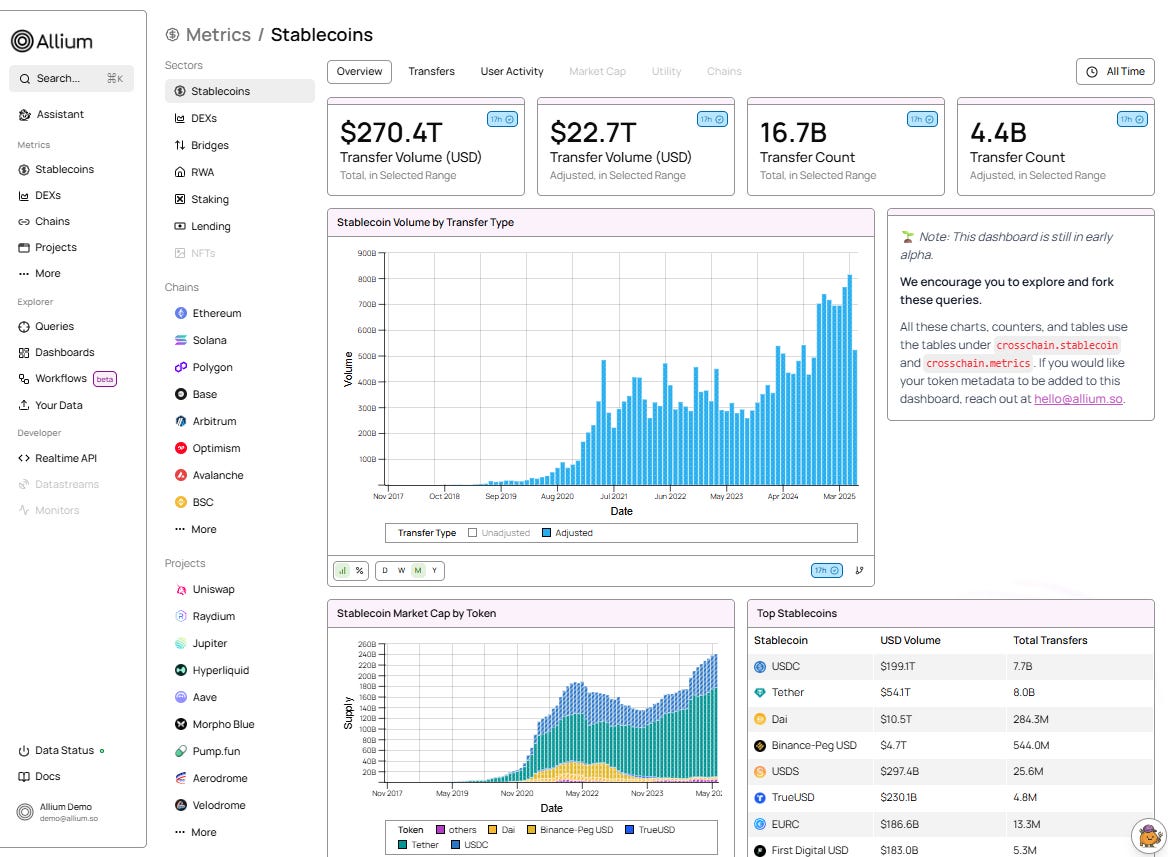

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: negotiations, the Fed, PCE, jobs and a lot more

The EU deal: the end of the beginning, or the beginning of the end?

Macro-Crypto Bits: the Fed, BTC, the dollar and more.

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up:

Brace for one of the most intense weeks in months, for both macroeconomic releases and geoeconomic headlines.

Today, the US and China pick up on trade negotiations in Stockholm. This comes as the South China Morning Post reported yesterday that sources on both sides indicate that the approaching August 12th deadline will get another three-month extension.

On Tuesday, we get the first of the week’s US employment numbers, with the JOLTS job openings report for June. This is expected to show a slight decrease from 7.77 million to 7.49 million, still a healthy figure.

Tuesday also delivers reports on US inventories, house prices and trade balance, as well as the latest CB consumer confidence survey.

And Tuesday kicks off the two-day FOMC rate-setting meeting, with an official statement released at 2pm ET on Wednesday, followed by a press conference at which Fed Chair Jerome Powell will answer and dodge questions. Given the recent pressure and last week’s meeting with President Trump, this should be spicy. What’s more, it’s possible we see the first dissents since Governor Michelle Bowman’s official objection to the September 2024 decision to cut the fed funds rate by 50bp. Ironically, Governor Bowman is widely expected to dissent again this week, only this time on the decision to hold rates steady. She is expected to be joined by Governor Chris Waller – if so, it would be the first time two governors have dissented together since 1993.

Also on Wednesday, Microsoft and Meta report Q2 earnings.

And we get the preliminary Q2 GDP growth for both the EU, expected to slow from 1.5% year-on-year to 1.2%, and the US, which is expected to deliver 2.4% year-on-year growth, up from Q1’s 0.5% drop.

Wednesday also brings the US ADP non-farm payrolls number, a private version of the official jobs report, which is expected to show growth of 82,000 in June, vs a drop of 33,000 in May.

As if all that weren’t enough for one day, we also get China’s manufacturing and non-manufacturing Purchasing Managers Index (PMI), expected to show a slight contraction and expansion, respectively.

Early on Thursday (late Wednesday, US east coast time) the Bank of Japan will deliver a policy statement and outlook report, complete with a press conference. It’s not expected to move rates at this meeting, but a lot is riding on its plans for hikes over the second half of the year.

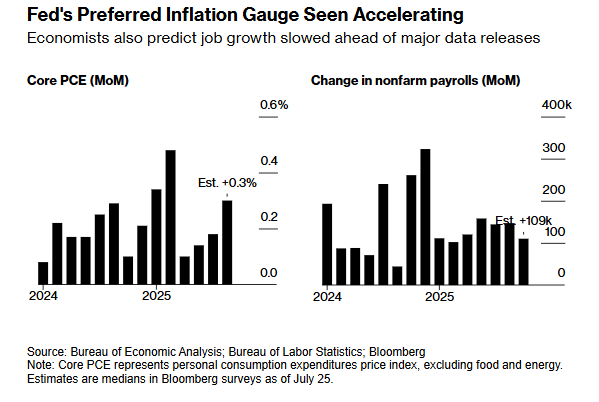

Thursday (likely to be an insane day) also gives us the US Personal Consumption Expenditures (PCE) data for June, with the core price index expected to show an acceleration from 0.2% month-on-month, to 0.3%. Personal spending is forecast to accelerate to 0.4% month-on-month, from a contraction of 0.1% in May.

(chart via Bloomberg)

We also get the US Employment Cost Index (ECI) for Q2, which hints at potential wage inflation. The report is expected to show a deceleration from 0.9% quarter-on-quarter, to 0.8%.

We’ll also get the Challenger job cuts report for July, as well as the weekly unemployment data.

In earnings, it’s the turn of Apple and Amazon. Given the market weight of large-cap tech companies, US equity indices this week could be volatile.

Also on Thursday, the Federal Circuit courthouse in Washington D.C. will hear oral arguments in the appeal against the unanimous ruling by the US Court of International Trade in May that President Trump does not yet have the authority to impose sweeping tariffs on trading partners – put differently, using the International Emergency Economic Powers Act (IEEPA) as an excuse won’t cut it. Notably, the case will be heard by the full bench of active judges of the Appeals court, a rare move usually reserved for matters of exceptional legal significance.

Friday brings the long-awaited and much-trumpeted August 1st tariff deadline.

We also get a preliminary read on EU CPI inflation for July, with the core price index expected to hold steady at 2.3% year-on-year.

For the US, we get manufacturing PMIs for July from both S&P Global and ISM – both have manufacturing activity continuing in contraction, but not severe. And, we get the July University of Michigan consumer survey report – the preliminary release showed expectations of inflation one year out had dropped from 5.0% to 4.4%.

Arguably the most important data drop for markets on Friday is the official jobs report for June. Consensus forecasts have non-farm payroll growth dropping to 108,000 in June, from 147,000 in May. This would be a trend drop, but it’s worth noting that the official number has significantly exceeded the average expectation for the past four reports.

The EU deal: the end of the beginning, or the beginning of the end?

Scraping in before the August 1 deadline, the US and the EU seem to have reached a trade deal.

The EU will get hit with a 15% tariff on exports to the US, which is higher than the 10% baseline but better than the threatened 30%. In addition, the EU agreed to purchase $750 billion of US energy, invest $600 billion in the US on top of existing commitments, buy “vast amounts” of US-produced military equipment, and reduce tariffs on US imports to 0%.

Yet there is much confusion and controversy, more than relieved markets seem to realize just yet. And the likely consequences of the US-EU deal could end up being really bad for global finance.