The evolving realignment

plus: frayed friendship, AI sentiment, long bonds, Venezuela and more

“Politicians should read science fiction, not westerns and detective stories.” – Arthur C Clarke ||

Hello everyone, I hope you’re all doing well!

I’ve been meaning to share this for a while: it’s a private link to the chat on Real Vision’s Pro channel last week, I’ve been told I can share it here but not on social media.

And here’s a link (paywalled, sorry!) to my op-ed in American Banker last week, on how new layer-1s point to a new architecture for payments – it’s not just about the flexibility of additional services and connectivity between ecosystems, it’s also about who owns the rails.

Programming note: Along with most of you, I’ll be taking Labor Day (Monday) off – back on Tuesday!

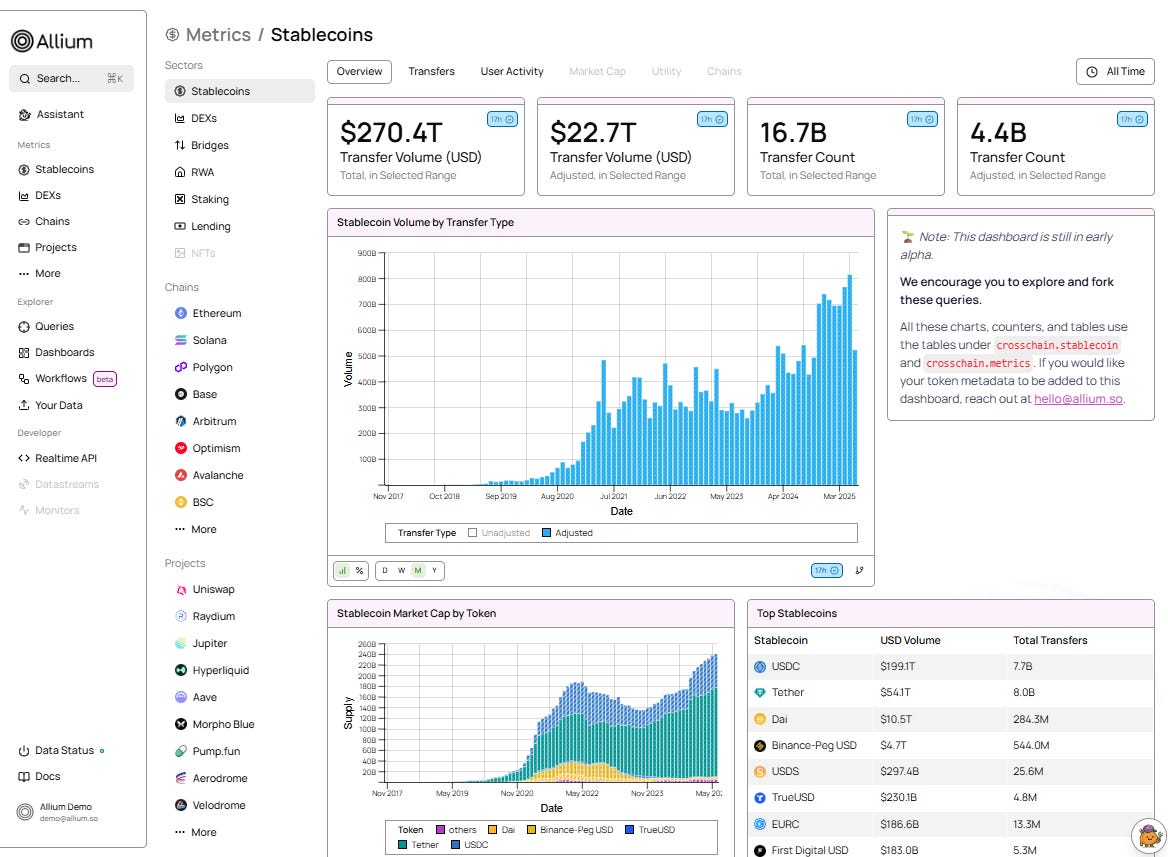

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

The evolving realignment

Frayed friendship

Macro-Crypto Bits: NVIDIA, long bonds, Venezuela

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Realignment

Trump’s 25% additional tariffs on India came into effect yesterday, bringing the total to 50%. This is – along with Brazil – the highest penalty so far, as even the US arch-rival China is still on an extension of the negotiations.

What’s more, Trump came down heavy on a country the US has traditionally courted as a ballast against growing Chinese influence in the region – the largest democracy in the world, its fifth-largest economy, a founding member of the intelligence-sharing diplomatic partnership known as the Quad (along with Japan, the US and Australia), and a significant market for US energy and technology.

The US justification for the squeeze is that India buys oil from Russia, and the US wants it to stop doing so, to help pressure Russia to negotiate an end to the war in Ukraine. India insists on maintaining neutrality in that conflict, and that its commercial relationship with Russia has deep and lasting roots. Plus, in buying from Russia, it gets cheaper oil.

What’s more, Modi can’t be seen to cede to Trump’s demands for political reasons – simply put, he could lose his job from the backlash as farmers and businesses are already unhappy about the original trade “deal”. And Modi is bristling from Trump’s new friendship with Pakistan, his insistence that he and he alone negotiated the ceasefire when a skirmish broke out between the two Asian neighbours earlier this year, and Tump’s calling the Indian economy “dead” on one of his social media rants. White House trade adviser Peter Navarro sure isn’t helping (for a change) by calling the Ukraine conflict “Modi’s war”, especially when the US has not demanded that China – Russia’s largest energy customer – stop buying Russian oil.

So, for now there’s a stalemate. The 50% tariffs are active, but India does not look eager to negotiate. According to a usually reputable German newspaper, President Trump has tried to talk to Modi on the phone four times, but Modi is not taking the calls. A US trade delegation was due to visit New Delhi this week – that trip has been cancelled.

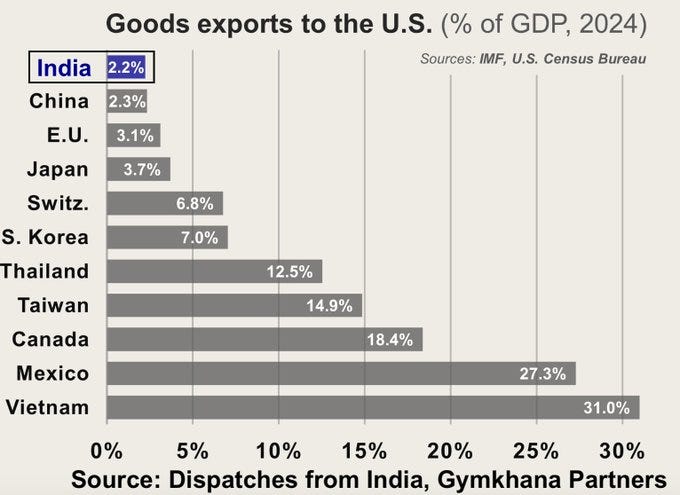

This could go on for a while. Some reports suggest that, while the economic hit to India is real, it’s not insurmountable as Indian exports to the US are only around 2.2% of total GDP.

(chart via @JackFarley96)

Meanwhile, there are plenty of signs Modi is working on a Plan B. In recent weeks, he has been exhorting Indians to “buy local” in a bid to cushion what he sees as an inevitable blow.

And he is working on strengthening non-US alliances. Earlier this month, Modi called Putin a “friend” and stressed his commitment to the “India-Russia Special and Privileged Strategic Partnership”.

(post by @narendramodi)

A few days later, Chinese Foreign Minister Wang Yi visited India for the first time in three years.

This weekend, Modi is in China for the first time in seven years, and is expected to have a face-to-face meeting with President Xi Jinping.

What’s more, last week China and India announced that direct flights between the two are being reinstated for the first time since the pandemic. India has reinstated tourist visas for Chinese nationals, and a growing number of Indian businesses are seeking Chinese partnerships.

So far, it looks like Trump’s tariff aggression is pushing India further away, a move the US could well come to regret as it turns its military focus to Asia.

And the realignment is not just between India, Russia and China. The Economist ran a report last week quoting a South Korean official: “The first step is to make concessions to America. The second is to look elsewhere.”

Both South Korea and Singapore are offering funding for small firms looking for export opportunities in South Asia, the Middle East and Mexico. African farmers are sending more produce to China. Lesotho is redirecting textiles from the US to regional buyers. Brazil’s President Lula is working the phones with his BRICS counterparts, proposing new partnerships and trade routes.

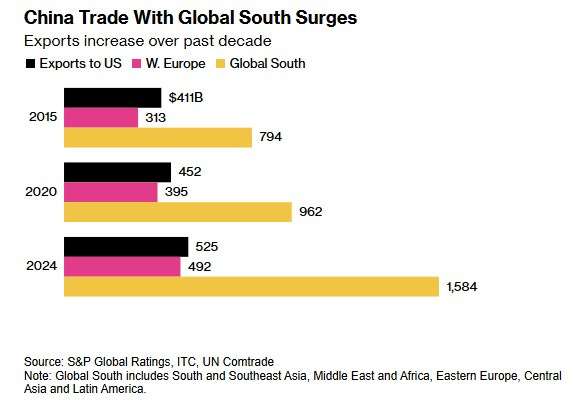

And China’s trade with the “Global South” has surged in recent years, especially since Trump’s first term, according to a report published earlier this month by S&P Global.

(chart via Bloomberg)

Like others, Modi is not just betting on the Trump Always Chickens Out (TACO) trade. When it comes to India, he probably will – but trust, once broken, is hard to replace. If you were Vladimir Putin or Xi Jinping, you’d take this as a huge win. The connections and incentives being redrawn will last a lot longer than Trump, and it’s not clear the Administration realizes how this weakens the US global position longer term.

Global shifts

(A new section where I’ll share short comments on details and ideas behind the deep geopolitical and ideological shifts we’re seeing, as they may not move markets short-term but they are setting the stage for what’s next. I’ll do my best to keep this brief.)