The FOMC’s overlooked message

Plus: what’s next, crypto liquidity, soft wage inflation and more

“The key is to keep company only with people who uplift you, whose presence calls forth your best.” – Epictetus ||

Hello everyone! I hope you’re all doing well.

Yesterday, I had a great chat with Maggie Lake on her show The Market House – if you’re not a subscriber to her Substack channel, it’s a strong recommend, not just for the economic and market insight she delivers every other day, but also for her humanity.

Tomorrow is my birthday, and so for the first time ever, I’m actually going to take the day off. I’ve never given the celebration much importance, just another day, and the years fly by. But I’ve realized that, precisely because they fly by, certain anniversaries are worth commemorating, not in an attempt to slow things down, but to celebrate that we get to witness the passage of time. And so, I’m going to spoil myself by wandering around downtown Madrid, eating good food, catching up on some reading, and appreciating the moment. 😁

Of course, this does not help my backlog. Coming up next week: South Korean stablecoins, EU tokenization, tradfi adoption, new geopolitical flashpoints, and more.

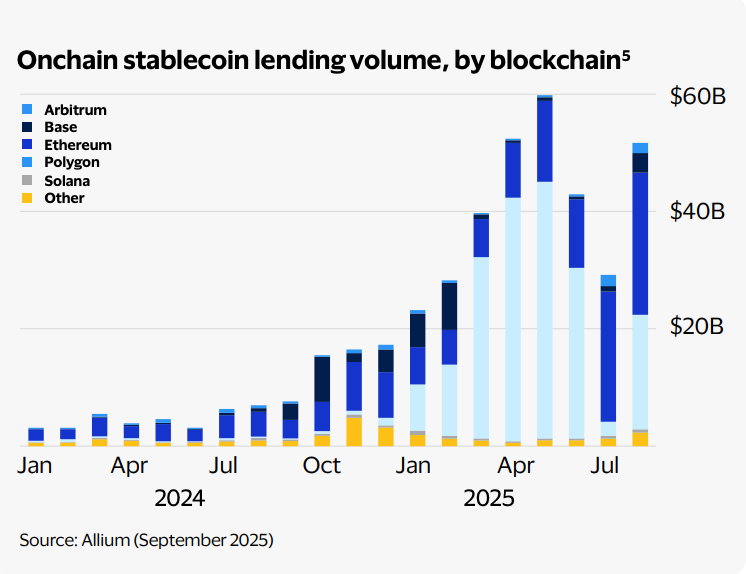

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The FOMC’s overlooked message

Markets: So, what next?

Markets: crypto liquidity

Macro: soft wage inflation

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

The FOMC’s overlooked message

By now you’ve probably seen that the Federal Reserve announced yesterday another cut in the official US interest rate of 25bp, bringing it down to the 3.50-3.75% range and pushing the total number of cuts from the peak up to 175bp.

No surprise there. Indeed, the session contained no bombshells at all, but nevertheless featured some shifts and unexpected confirmations that are worth squinting at, and one continued trend that could have a more material impact on inflation than most expect.

Buying

Apart from the rate move, the other big announcement in Chair Powell’s statement was that the Federal Reserve will buy short-term government debt in the market, starting with $40 billion over the next month starting tomorrow. In his statement, Powell specified that the amount “may remain elevated for a few months”, but decline thereafter.

Many are trumpeting this as a return to Quantitative Easing, when the Fed bought government securities in order to stimulate the economy. Technically, it’s not: full-on QE is about economic stimulus, while the purpose here is liquidity management, to keep reserves at levels sufficient for end-of-year and tax season needs (the central bank really, really wants to avoid a repeat of the September 2019 repo crisis). Nevertheless, the message is that there’s more coming if needed.

Data

I confess I didn’t expect to hear an “official” recommendation to not take the upcoming macro data reports seriously. Chair Powell warned that they would most likely be “distorted as well as volatile”, given limited (if any) collection during the October-November government shutdown. Left unsaid is that the Fed is also flying blind on the impact of their rate decisions and other influences, which could reinforce votes for an extended pause.

Powell also said that the Fed expects the official payroll reports to be overstated by about 60,000 jobs per month (!!), which means, taking the three-month average of recent reports, that the US labour market is in more of a contraction than many of us suspected. This will unnerve many Fed officials who remember how unchecked unemployment can get momentum fast.

Tariffs

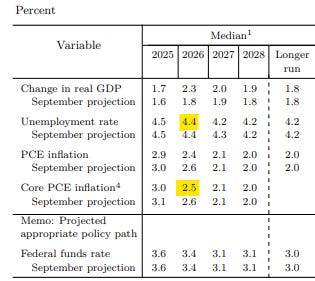

In the statement and the economic projections, the impact of tariffs was nowhere to be seen. The updated economic projections bumped expected GDP growth for 2026 from 1.8% to 2.3% (vs 1.7% expected for 2025); the core PCE inflation forecast came down slightly from 2.6% to 2.5% (vs 3.0% expected for end 2025); and unemployment held steady at 4.4%.

(table via the Federal Reserve)

I couldn’t find any sign of tariff pass-through to prices, or employment moves from reshoring or business closures. And when Powell was asked point-blank about the tariff impact, he pretty much said “I don’t know”. To be fair, much depends, as he explained, on the timing of the tariff application (could take months) and on the Supreme Court deliberations, so “I don’t know” is the most believable answer. But it does question the credibility of the projections – more on this below.

Dissent

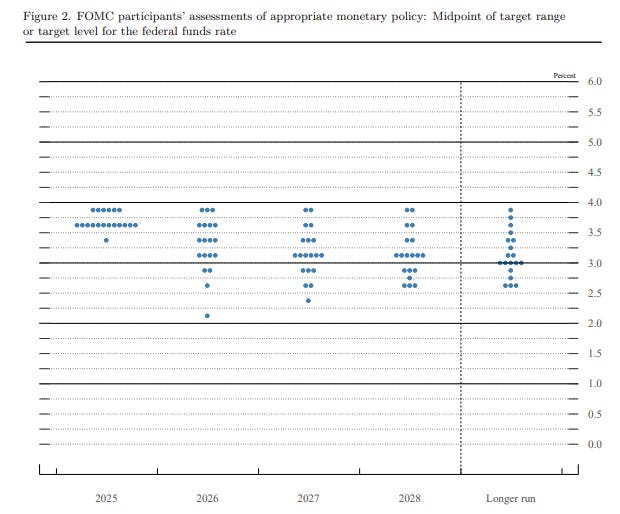

The most overlooked takeaway from yesterday’s session is, in my opinion, the broadening dissent – not so much that it’s happening, we can all see that, but for what it means for inflation.

There were three dissents on this decision: Governor Stephen Miran wanted steeper cuts, and two regional presidents (Goolsbee of Chicago and Schmid of Kansas City) thought the Fed should hold.

Yet the actual dissent runs deeper. On the dot plot, where Fed officials (including those not voting on the FOMC this year) signal the level at which they thought rates would end 2025, we see that six thought they should hold steady in the December meeting. This is still a minority within the squad of 19, but it’s not insignificant.

(table via the Federal Reserve)

And in the implementation note, we see that eight of the twelve presidents recommended not lowering the discount rate, at which the Fed lends directly to banks.

That’s amazing.

Some will insist this doesn’t matter because the regional presidents’ terms are up for renewal in February and Trump will make sure they are replaced with those favouring rate cuts.

Only, two things on that:

1) Trump doesn’t get to choose Fed presidents. They are chosen by the regional Fed’s board of directors, with final approval from the Federal Reserve Board of Governors. Three of the seven governors were appointed by Biden, with one, Jerome Powell himself, appointed by Obama (Trump elevated him to Chair). Powell is a registered Republican but is unlikely to be aligned with Trump on interest rate policy. So, four of the seven governors are not necessarily going to do what Trump wants on approvals. This goes some way towards explaining Trump’s attempts to remove Governor Cook (a Biden appointee) – but oral arguments on the Supreme Court hearing on the case aren’t until the end of January, with a decision expected well after the February regional president renewals.

And 2) the dissents will already have had their impact on trust.

Before anyone dismisses trust as a “soft” quality irrelevant for monetary policy, let’s think about what kept inflation in check during most of this century, up until the pandemic. There is a range of opinions on this, many of which overlook the role of expectations.

Again, expectations are also often dismissed as “soft”, but they undoubtedly influence consumer behaviour. If consumers expect moderate inflation, they and companies will behave accordingly, and inflation remains moderate (of course, this assumes no external shocks which is unrealistic, but most economic modelling is). If consumers expect high inflation, well, they’ll probably get it – this is the main reason the Fed and many analysts pay close attention to the consumer surveys. They may not be “real”, but they’re relevant (and, no, the partisan divide in some reports does not invalidate them – consumers’ opinions matter whatever their affiliation).

One thing that is essential for moderate expectations on inflation is trust in the central bank’s ability to contain it. When the public sees central bank officials disagree on policy, they read that as confusion which weakens their trust in the central bank’s competence.

Of course, for us academics dissent is preferable to group-think, at least for the sake of thorough thought and stress-testing debate. But for messaging from the institution entrusted with price and employment stability, the public wants consensus. They’re not getting it.