The G7 swings, roundabouts and balancing act

plus: what's ahead for the week, markets, macro, geopolitics and more...

“The prevalence of surprise in the world of business is evidence that uncertainty is more likely to prevail than mathematical probability.” – Peter L. Bernstein ||

Hello everyone, I hope you’re all doing well! And that you managed to disconnect from market and geopolitical noise at least a bit. May I suggest re-watching the original Jaws in honour of its 50th birthday – a different kind of stress, but unexpectedly cathartic.

I have a rough week ahead in terms of events and recordings, so coverage will be choppy, probably shorter than usual, and I have to miss Wednesday entirely. Geez, it’s not like my backlog wasn’t long already. Still, there are some hopefully languid summer weeks ahead (hahahahaha but one can dream) where I’ll be able to go deeper into some of the key trends I’m seeing.

Production note: I’m at an institutional event for part of this week – I should be able to get a brief and early newsletter out tomorrow before I dash out the door, but I will have to skip Wednesday. Back on Thursday, perhaps with some things to report.

IN THIS NEWSLETTER:

Coming up: G7, GENIUS Act, macro data and more

The G7 swings, roundabouts and balancing act

Macro-Crypto Bits: geopolitics, markets and macro

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up: G7, GENIUS Act, macro data and more

Today sees the official start of this year’s G7 Summit, with global leaders gathering in Alberta, Canada – I comment more on this below.

Tomorrow, the Senate is scheduled to give its final vote on the GENIUS Act – if it passes, the stablecoin bill then moves to a House of Representatives vote.

Tuesday also brings US retail sales for May, which could show signs of tariffs biting – but, with muted inflation impact so far from tariffs, we might see strength here as consumers bring purchases forward. The consensus estimate, however, points to a contraction of 0.6% month-on-month, vs 0.1% growth in April.

And we get US industrial production for May, expected to be flat month-on-month.

The Bank of Japan meets on Tuesday to review interest rates, which it is expected to hold steady. Market attention will focus on the size of government participation in the bond market – if they continue to pull back, Japanese yields will most likely continue to rise, causing ripples in markets concerned about an unwinding of Japanese holdings of foreign debt (such as US treasuries, of which Japan is the largest foreign holder).

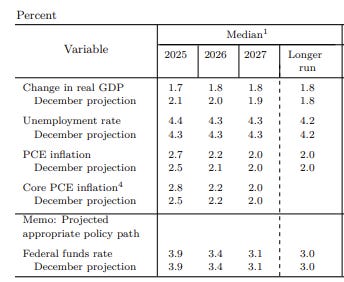

Also, the big macro event of the week, Tuesday kicks off the June FOMC rate-setting meeting, with a statement and press conference on Wednesday. Pretty much no-one expects a cut at this stage, but there could be some surprises in the updated economic projections (SEP). In December, the number of cuts the committee expected on average for 2025 was dropped from four to two, and this was maintained in March’s update – given the “pause” talk coming from Fed officials in recent weeks, we could see this come down to one.

(table via the Federal Reserve)

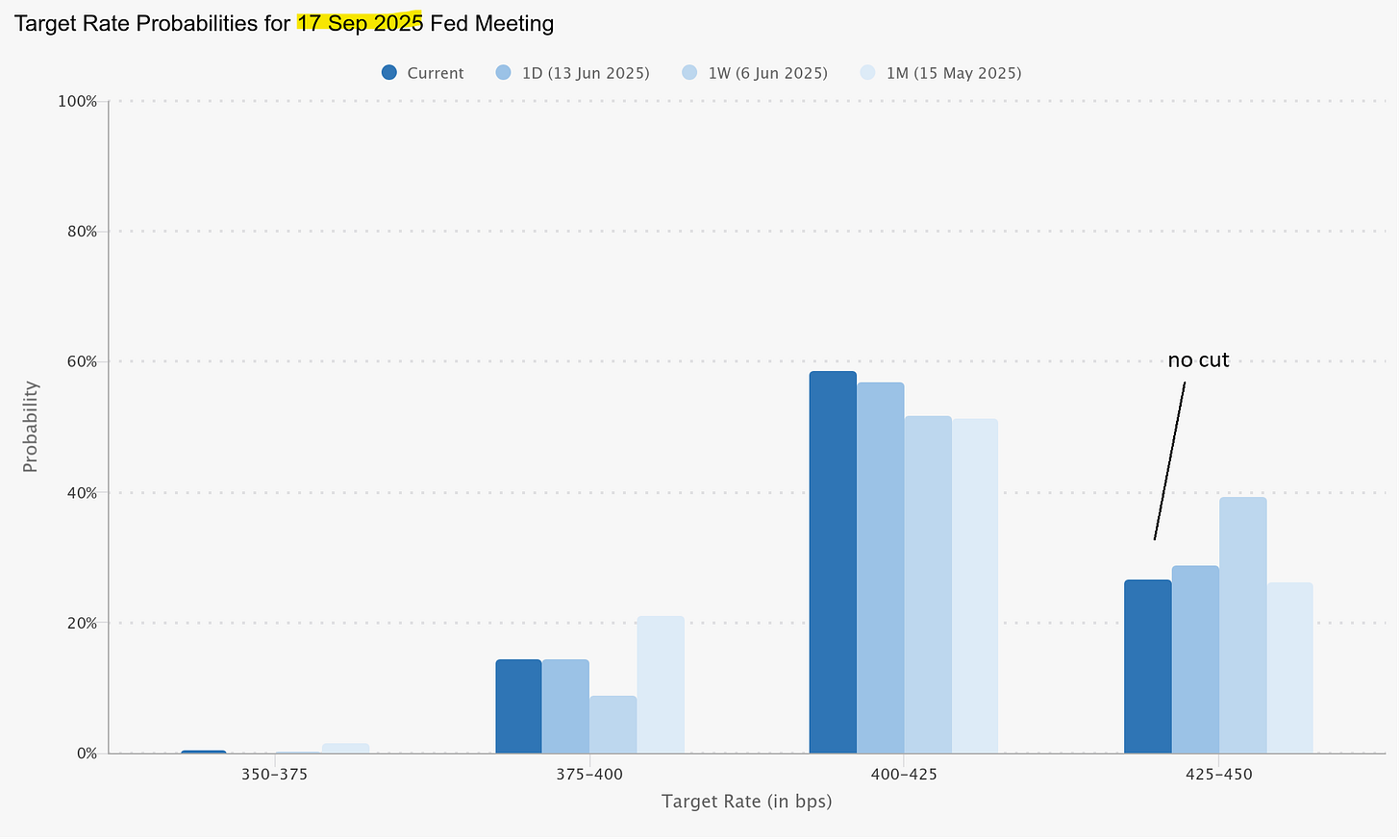

Plus, Chair Powell stressed at the last FOMC press conference in May that the risks of higher inflation had risen, so we could see an upward adjustment to the end-of-year expectation which would push back even further market expectations of a rate cut – as it is, CME options are pricing in a 75% probability of the first cut coming in September.

(chart via CME FedWatch)

Then again, Powell also said last month that there was now more risk to payrolls – holding the inflation forecast steady while bumping up that of end-year unemployment could be signal the Fed was going to pivot focus to jobs, which would suggest a cut sooner rather than later.

Late on Thursday (early Friday Asian hours), we get Japan’s CPI inflation for May, expected to tick up slightly. We also get a rates decision from the People’s Bank of China, expected to hold steady, and a speech from Bank of Japan Governor Kazuo Ueda.

And to wrap up, on Friday we get the US Conference Board’s leading index measure for May, expected to show a contraction for the fifth month in a row, but a moderating one.

The G7 swings, roundabouts and balancing act

As I mentioned above, this week opens with the annual G7 meeting in Canada, which will probably turn out to be more like a G6 vs the US. Expectations are so low as to any agreement on anything that the usual post-event communiqué highlighting a common stance amongst world leaders will not be published this year. They’re not even going to try.