The geopolitics of stablecoin demand

also: market euphoria, stock yields, weirdness and more

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury.” – Alexander Fraser Tytler ||

Hello everyone! I hope you’re all taking care of yourselves.

To all of you who are premium subscribers, THANK YOU!!! You are very much appreciated. 😊

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

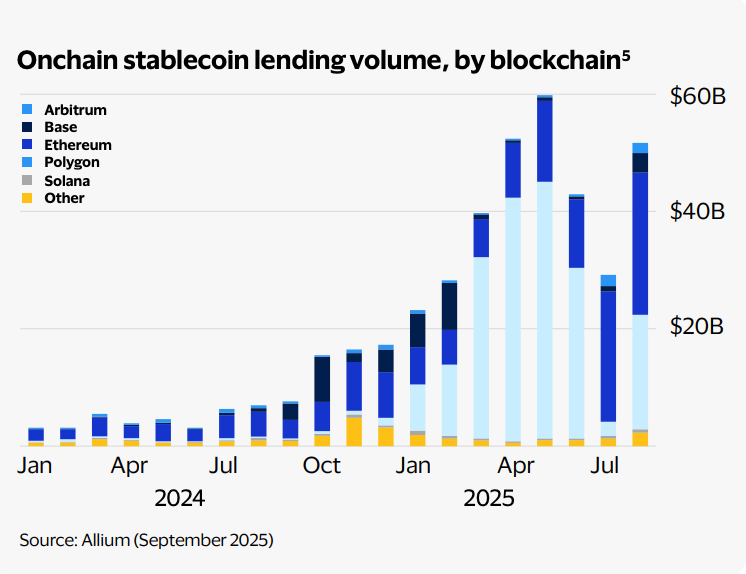

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The geopolitics of stablecoin demand

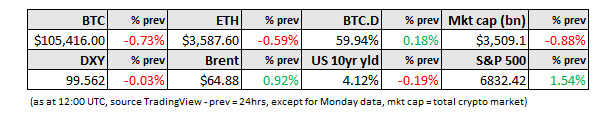

Markets: relief from what?

Markets: equities, bonds and jobs

WHAT I’M WATCHING:

The geopolitics of stablecoin demand

This morning, I finally got around to reading the text of Federal Reserve Governor Stephen Miran’s speech last week at the Harvard Club about stablecoins.

His focus was the impact of stablecoins on the macro economy, and he made some key points that tie into what I’ve been trying to map out recently – where will stablecoin demand come from? This matters for their impact on treasuries, banks and dollar demand.

Most of what he said, I agree with, especially when it comes to the importance of foreign demand. But he’s complacent in a couple of areas, which I’ll tackle further down.