The global shift and why it matters for crypto

plus: markets and divergence, macro, what's ahead for the week and more

“The art of progress is to preserve order amid change and to preserve change amid order.” – Alfred North Whitehead ||

Hello everyone! I hope you all had a great weekend.

We’re heading into choppy publishing season. This week, I’ll be taking off Friday as it’s my birthday, and while I’m not used to celebrating it, it’s never too late to start festive traditions.

🎄

Later today, I’m on Yahoo Finance discussing crypto markets – I don’t have a link to share, but the show starts at 9:30am ET if you’re interested!

🎄

Here’s a link to my op-ed published last week in American Banker (paywall, sorry), in which I question what, in an era when anyone can issue a dollar stablecoin, what does “a dollar” even mean? This matters more than you might think, for the economy and for geopolitics.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

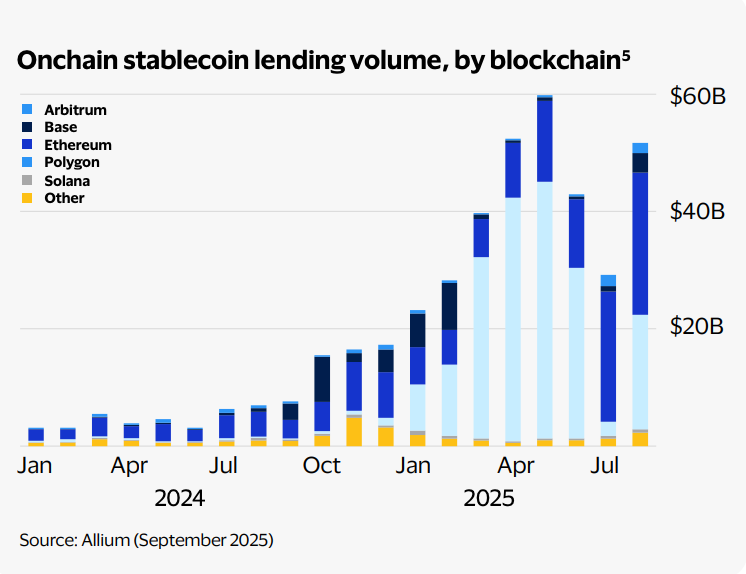

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up this week: FOMC, economic data

The global shift and why it matters for crypto

Markets: a notable divergence

Macro: yawn

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Coming up this week:

It’s Fed week! And there’s some macro data - but otherwise, relatively quiet for a change.

Today, we get the latest consumer survey from the New York Fed, which could show an easing of inflation expectations. We also get US factory orders for September – old news at this stage.

Tuesday brings the NFIB Small Business Optimism survey. We also get the official job openings data for October, and a preliminary read on Q3 non-farm productivity in the US.

Wednesday is Fed day! Another rate cut is pretty much in the bag (although we could see more dissents than usual, given how divided the committee is), so the relevant indicators to watch out for will be: 1) any change of wording in the official statement, 2) changes to the economic projections (with special focus on Fed expectations of interest rates, inflation and unemployment at the end of 2026), and 3) the tone of Chair Powell’s press conference – does he sound more worried about jobs or prices?

Also on Wednesday, we get the US Q3 Employment Cost Index, the Fed’s preferred measure of wage inflation.

The global shift and why it matters for crypto

I’ve finally had time to read through the US National Security Strategy document published last Thursday… and it’s an eye-opener that confirms trends we’ve been seeing in headlines since January, many of which I’ve been writing about. Pieces are falling into place.