The Russia memo

Plus: EU tokenization, markets and more

“Fantasy is an exercise bicycle for the mind. It might not take you anywhere, but it tones up the muscles that can.” – Terry Pratchett ||

Hi all, and happy Friday! What a crazy week… I hope you have some quality disconnect time planned this weekend.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

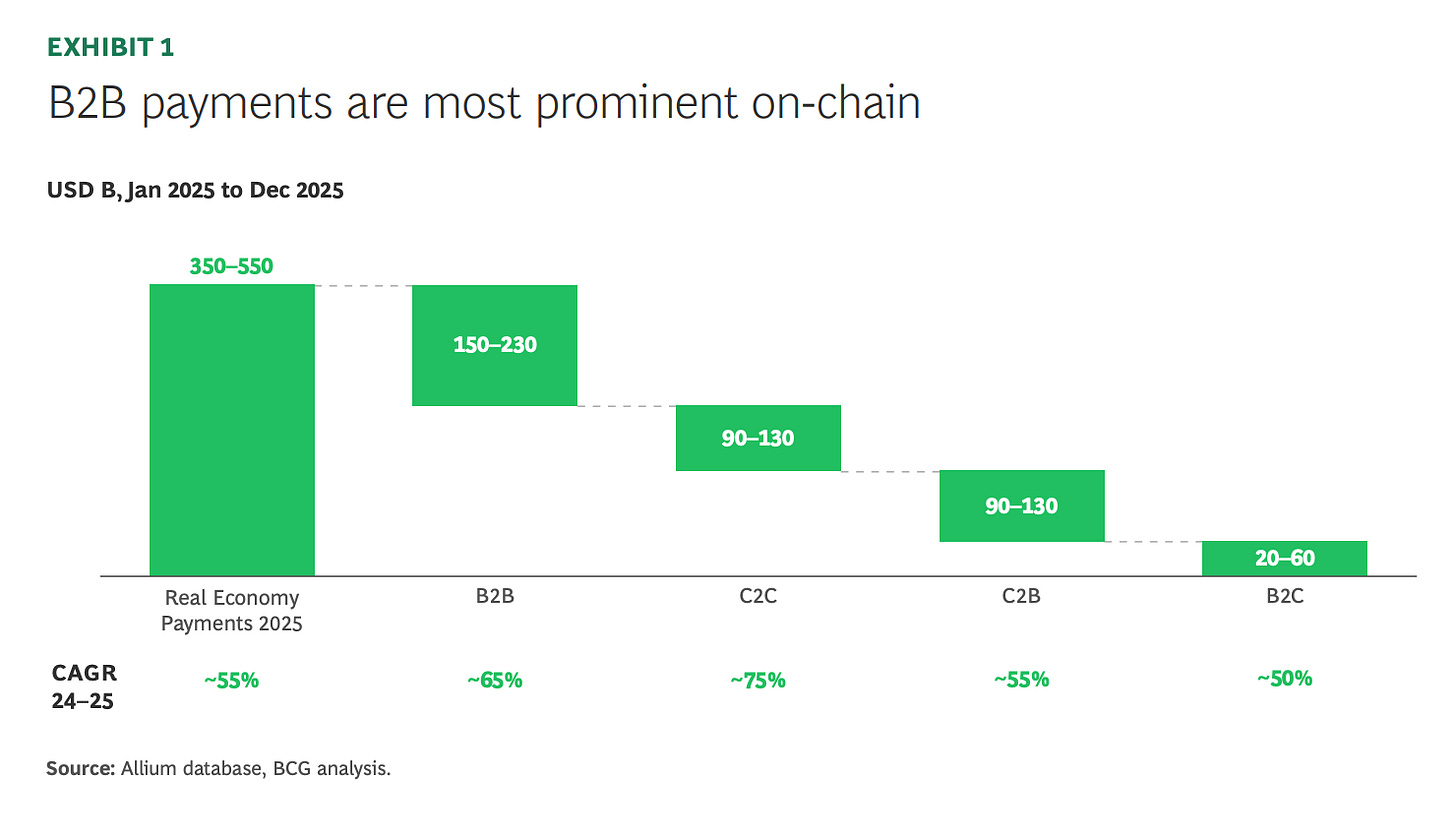

The latest whitepaper published with BCG, Stablecoin Payments: The Truth Behind the Numbers, examines how stablecoins are being used in the real economy today. The analysis estimates $350–550B in on-chain payments in 2025, led by $150–230B in B2B activity, with consumer flows contributing another $200–320B.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The Russia memo

The EU DLT Pilot Regime: let’s move faster

Markets: breathe

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

The Russia memo

Yesterday, Bloomberg reported on a memo allegedly drawn up by Russian officials that outlined a proposal to “re-join” the global dollar system.

This feels off on so many fronts.

First, its not clear how “official” this memo is, or whether the Russian government is even aware of its existence. Down at the very bottom of the article, the reporter discloses that the source is… Ukrainian intelligence.

Even without that red flag, this memo is such a departure from Russia’s typical strategy that reasonable minds should be questioning its authenticity. It reads like a “you win, we surrender”, extremely uncharacteristic given that virtually all messaging so far has been about projecting strength.

Second, the proposals – joint ventures, dollar settlement, cooperation on energy and minerals – don’t hold up to scrutiny. There is no way that Russia will want to return to the dollar settlement system if that means re-accumulating dollar reserves – it has good reason to not trust the US to respect either the value or the custody of dollar assets in Russia’s name. Restoring access to SWIFT would no doubt be convenient, but full reliance on its connection service is firmly in the past. Russia has invested considerable effort over the past few years in building alternative systems, and its CBDC is expected to launch this year. It is unlikely to publicly declare defeat on its aim, especially when it seems to be having some success.

Also, allowing US companies to extract Russian oil and LNG? Minerals and rare earths? In today’s commodity scramble, that does not sound likely. Choosing American AI technology over Chinese? Russia may not trust the Chinese, but they trust the US less.

It’s also extremely unlikely Russia would poke the Chinese bear at this stage, by threatening to divert planned aviation and machinery purchases to its economic adversary.

In sum, the idea of Russia opening its arms for a US embrace is just not credible.

One of the clauses listed in the Bloomberg article gives a clue as to the ultimate aim here:

“Working together to push fossil fuels as an alternative to climate-friendly ideology and low-emission solutions that favor China and Europe.”

I’m sure much is lost in the translation, but this reads as a deliberate taunt aimed at climate-conscious Europe, one designed to provoke a panicked scramble to dedicate more money and weapons to the war effort.

And the explicit mention of “ideology” highlights how the list is all about narratives, leveraging European touchpoints to ramp up fear of a US-Russia alliance.

If this is a plant from Ukraine intelligence (supposition, but it feels likely), we have to marvel at the genius of the timing. Europe is torn between sacrificing Greenland or Ukraine – it will have to choose one or the other, and if it doesn’t do so soon, it will lose both. Meanwhile, the world’s geopolitical attention is distracted by more US naval hardware sailing to the Middle East. And the US and China have a big summit coming up in April, which will add striking visuals to the sinking realization that Europe can no longer count on US military support. Sharpening EU fears of a resounding Russian victory following total US abandonment in the resistance effort would be a sure-fire way to get their attention and their funds.

But the effort feels sloppy, and markets do not seem to be taking it seriously.

Perhaps they should, though, or at least in part – a deal between Russia and the US is, after all, the way the war will end. It will be a hostile deal, with no trust on either side, but one that will give US companies an opening into Russian businesses and consumers.

In that scenario, would commodities surge or plummet? There are arguments for each, but I expect to see higher prices as it’s not as if Russia hasn’t been selling into the market all along. Put differently, there may be some easing of supply chains, but there is more likely to be even more chaos as Ukraine’s government topples, neighbours freak out, factional fighting muscles in and overall security does not improve. Plus, there’s the likely materials demand for reconstruction efforts, with infrastructure barons from various countries rushing to make profit out of the disorder.

The dollar might also get a bump as Russian sanctions are lifted, but it could be short-lived as the world realizes just how much both Russia and China have moved off the dollar system.

Bitcoin could do well as a hedge against “crazy” and as expectations of liquidity jump pretty much everywhere.