The script has velocity

Plus: yippy markets, we're looking at the wrong thing, what’s ahead this week and more

“Almost always, the creative dedicated minority has made the world better.” – Martin Luther King, Jr. ||

Hey everyone! Geez, not a great time for a market holiday yesterday… although maybe we can be grateful it WAS a market holiday.

Anyway, I hope you’re all taking care of yourselves.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

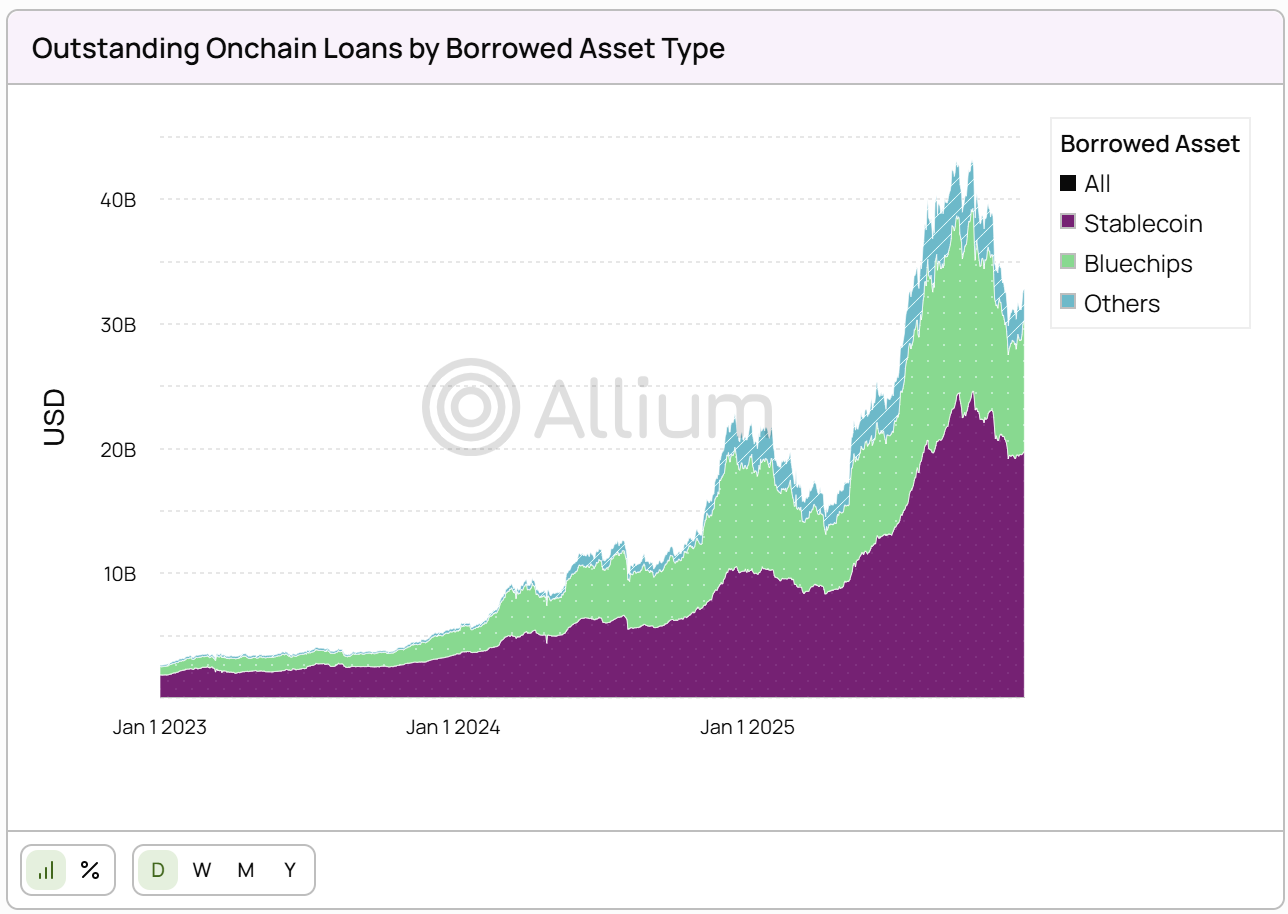

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up this week: diplomacy, Supreme Court hearings, inflation

The script has velocity

Markets: yippy yet? Plus, the distraction effect.

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Coming up this week:

This week the world’s “elite” head to the Swiss mountains for the annual World Economic Forum gathering in Davos – the theme for this year is ‘A Spirit of Dialogue’. President Trump will be in attendance on Wednesday and Thursday.

There is no Fedspeak this week as they are in their pre-FOMC meeting blackout period. Just as well.

And earnings season continues with over 500 companies due to report Q4 results this week. EPS growth for the S&P 500 is expected to be 8.3%, led by the tech sector.

Today (Tuesday), the US Supreme Court takes the bench at 10am ET and releases a set of opinions – these might include a ruling on the lawsuit against the Administration for the use of IEEPA to impose sweeping tariffs. Or they might not. Either way, tensions are high and drama is a given.

On Wednesday, the Supreme Court hears oral arguments in the case of the Administration’s attempt to fire Federal Reserve Governor Lisa Cook. Apparently, Fed Chair Jerome Powell is planning to attend – an unusual move, but understandable given the DOJ investigation of his statements before Congress that Powell has publicly said is an attempt by the Administration to manipulate central bank policy.

On Thursday, we get the US Personal Consumption Expenditure index, the Fed’s preferred inflation gauge. Growth in the core index (excluding food and energy) is expected to hold steady at 2.7%, with the headline index accelerating from that level to 2.8%.

We also get the final reading of the US Q3 GDP, with the previous report showing annualized growth of 4.3%.

On Friday, the Bank of Japan holds its first meeting of the year – the consensus estimate is for no move on rates, but Governor Ueda’s remarks will be scrutinized for hints at how long this pause might last, a speech that will be complicated by the Prime Minister’s expected dissolution on Friday of the lower house of Parliament to set the stage for snap elections. Japanese inflation also due out on Friday is expected to come in at 2.9%, further extending the more than 4-year stretch above target. Meanwhile, the 10-year Japanese bond yield seems to have liftoff (see below).

We also get the November leading index report from the US Conference Board, as well as the initial “flash” reads for the January S&P Global Purchasing Managers’ Index which should give a hint as to US economic activity in the start of the year.

And we have the final read of the University of Michigan consumer survey – the last report showed 1-year inflation expectations steady at 4.2%

The script has velocity

Geopolitics and trade relationships seem to have devolved into an insane game of chicken.

If you’ve been ignoring the headlines this weekend (you have my undying respect), the catch-up is as follows:

Trump wants Greenland (for reasons).

Europe is not happy about this, and late last week sent a handful of troops (accounts suggest less than 30) to Greenland for “exercises”.

Trump hated this move and slapped another 10% tariffs on the participating countries: UK (which apparently only sent one officer), Norway, Denmark, Sweden, Finland, Germany, France and the Netherlands. This will go up to 25% in June if Greenland hasn’t been handed over.

The EU is now contemplating retaliatory tariffs, and there is talk of invoking the Anti-Coercion Instrument, also known as the “trade bazooka”. This is a law passed in late 2023 that gives the EU wide berth to craft a trade-based response to attempts to pressure any or all members to support a measure – unlike tariffs, it can target services, intellectual property, financial market access and more. Plus, unlike most EU trade measures, it doesn’t require unanimity, just a roughly 55% majority.

US Treasury Secretary Scott Bessent is calling the EU’s bluff, telling reporters: “I imagine they will form the dreaded European working group first, which seems to be their most forceful weapon.” Ouch.

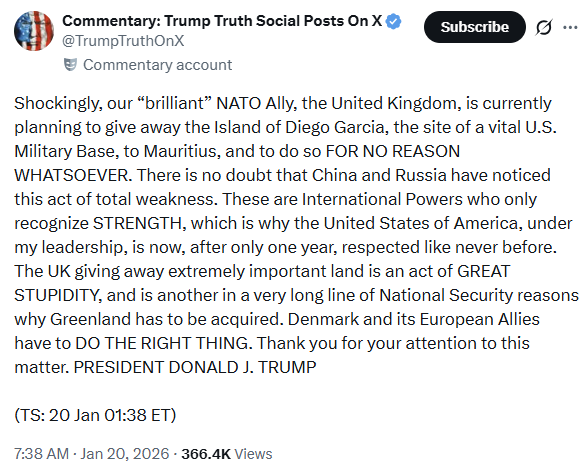

Trump seems to have just noticed that the UK is handing back the Chagos Islands to Mauritius and is apparently livid. The archipelago is in the middle of the Indian Ocean (you’ll need a magnifying glass to find them on the map) and home to the strategically significant Diego Garcia US military base. This, he says amidst a liberal sprinkling of all-caps, is another reason why Greenland has to be acquired.

(post via @TrumpTruthOnX)

And on Sunday he sent an astonishing text to the prime minister of Norway pointing out that the snub of awarding the Nobel Peace Prize to someone else means he no longer has an “obligation to think purely of Peace”, and why does Denmark have a right of ownership to Greenland anyway?

Meanwhile, details are firming up on Trump’s Board of Peace for the reconstruction and running of Gaza, due to be formally announced at Davos on Thursday. Trump, of course, is chairman “for life”. The executive board will be comprised of “trusted representatives” such as US Secretary of State Marco Rubio, Jared Kushner, Steve Witkoff, Apollo Global Management CEO Marc Rowan, World Bank President Ajay Banga, US National Security Adviser Robert Gabriel and former UK prime minister Tony Blair. The list of invited participants includes: Vladimir Putin, Morocco’s King Mohammed VI, Hungarian Prime Minister Viktor Orban, and representatives from Canada, Germany, France, the UK, Albania, Argentina, Egypt, India, Turkey and Vietnam – I have no idea why some of these names are on the list, but apparently members can be permanently appointed for a $1 billion fee.

France has declined, which Trump seems to be taking personally and is threatening tariffs of 200% on French wine and champagne.

We can only hope that some fresh mountain air this week crystalizes some common sense as world leaders meet in Davos to discuss the Greenland crisis. And there is something about seeing people in person that calms tempers and restores some semblance of sanity. Danish officials are reportedly not making the trip, however, perhaps so they can focus on amassing the troops they have said they are sending to their now disputed territory.

The pre-existing global order is now irrevocably dead; even if a seasoned diplomat wins the White House in 2028, new alliances will have formed and trust in institutions will look very different. New landscapes end up triggering a deep questioning of existing systems, at a time new technologies are poised to carve out new schemas.

If this all weren’t so serious, the timeline over the past few days would be incredibly funny. Last week, the EU’s foreign policy chief Kaja Kallas reportedly told lawmakers privately that now might be a “good moment” to start drinking (possibly one of the smartest things she has said during her tenure).

Me, I’m off to the shops to stock up on bourbon which is appparently on the EU’s retaliatory tariff list. Back in a minute.