The SEC and crypto assets: new definitions, new markets

plus: Visa, Circle, Sui, music tokens, energy finance, who's selling and more

“If you want something new, you have to stop doing something old.” – Peter Drucker ||

Hello everyone! Dunno about you, but this week has felt particularly exhausting – I hope you’re all conserving your stamina!

If you know any Spanish speakers, do nudge them to sign up for this publication’s little sibling Cripto es Macro, ¡en español!

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

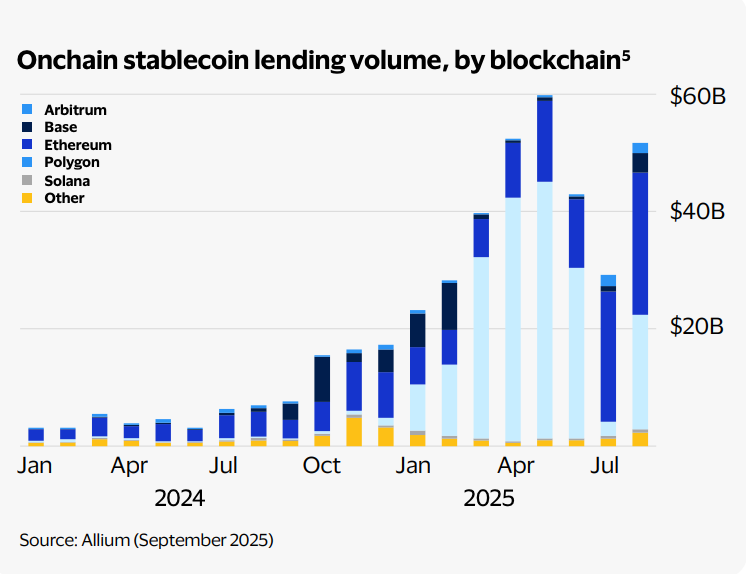

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The SEC and crypto assets: new definitions, new markets

Visa: the fiat-stablecoin blend

Circle: I’m missing something

Sui’s stablecoin: why?

The creativity of Korean markets

Tokenized finance for energy projects

Plus: tense waiting, and who is selling BTC?

WHAT I’M WATCHING:

The SEC and crypto assets: new definitions, new markets

This SEC continues to surprise. Yesterday, Chair Paul Atkins delivered a speech that sketched a new taxonomy for crypto assets, and he said some mind-blowing things. For instance:

“‘Crypto asset’ is not a term defined in the federal securities laws. It is a technological description. It tells you something about how records are kept and value is transferred. But it says little about the legal rights attached to a particular instrument or about the economic reality of a particular transaction, which are key to determining whether something is a security.”

He goes on:

“I believe that most crypto tokens trading today are not themselves securities.”

This could not be more different from the previous SEC’s stance that all crypto assets were securities.

“Network tokens” that power functionality are not securities, according to Atkins. Nor are “digital collectibles”, which include onchain art, music rights, in-game items, memes, etc. And “digital tools” such as identity tokens, credentials, tickets, etc. are obviously not.

Of course, onchain representations of securities are clearly securities. So are crypto assets that are clear investment contracts. But Atkins acknowledges that something can start out as an investment contract but then evolve away from that function. This is an astonishing shift which recognizes that both markets and the nature of assets are changing, which requires a rethink of the definitional buckets.

Tucked away in his speech was another very big deal, the acceptance that new types of marketplaces are required in this new paradigm.

“While capital formation should continue to be overseen by the SEC, we should not hamstring innovation and investor choice by requiring the underlying assets to trade in one regulated environment versus another.”

A key feature of crypto exchanges has been the diversity of assets trading alongside each other, in contrast to the traditional market structure in the US which sees equities and derivatives and commodities all trade on siloed venues. When each uses different plumbing and falls under different regulatory regimes, that makes some sense but also siloes investors and adds friction to those wanting to deploy capital across various asset classes.

Atkins is hinting at a securities landscape that abstracts away the barriers – structural and legal – between different investor and issuer groups. When all assets move on compatible rails, and settle on those same rails, the need to separate becomes less obvious, especially against a backdrop of implicit reorganization of the relationship between the various market regulators.

So far, so mind-blowing. But the part of Atkins’ speech that most clearly drove home the astonishing change of attitude in US markets towards the potential of financial innovation came towards the end:

“In a free society, the rules that govern economic life should be knowable, reasoned, and appropriately constrained. When we stretch the securities laws beyond their proper scope, when we treat every innovation as presumptively suspect, we stray from that core principle.” (my emphasis)

Essentially, Atkins laid out yesterday what most of us in the crypto ecosystem have been hoping to see, but had come to doubt we ever would.