The silver lining in the market rout

plus: the Czech central bank and BTC

“This ‘telephone’ has too many shortcomings to be seriously considered as a means of communication” – Western Union internal memo, 1876 ||

Hello everyone, and HAPPY FRIDAY!!! What a week…

The Friday series of tradfi/crypto profiles is moving to Monday to alleviate the bottleneck of news I want to get to. I mean, we knew things would accelerate into the end of the year, but geez…

My latest op-ed for American Banker is out (paywall, sorry), this week about how banks and fintechs come at stablecoins from different angles, which will have a material impact on the onchain and offchain landscape.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

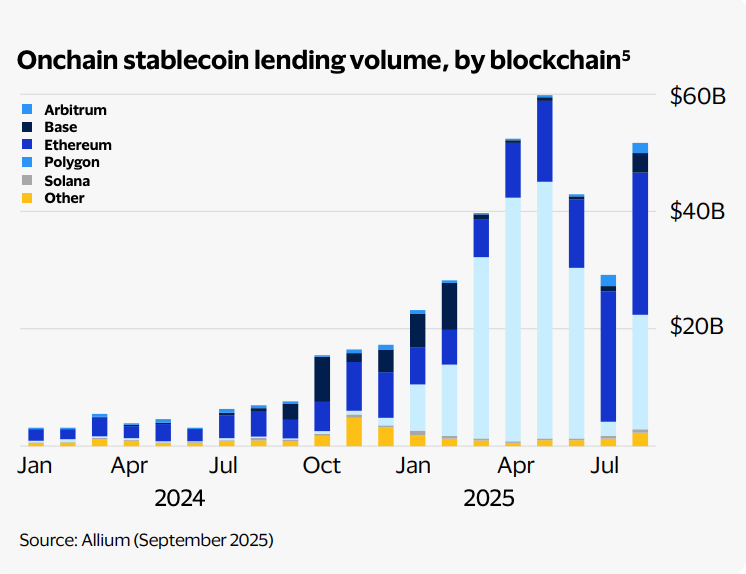

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The silver lining in the market rout

The Czech National Bank and BTC

(Note: I have to push comment on the CashApp, MoonPay, Circle, JPMorgan, Kyrgyzstan and other stablecoin/tokenization announcements to next week – sigh, my aching backlog.)

WHAT I’M WATCHING:

The silver lining in the market rout

Ok, yesterday was not a good day in markets, not good at all. But I’m here to offer some upbeat perspective, which might surprise regular readers who know I’ve been warning about short term correction risk for a while.

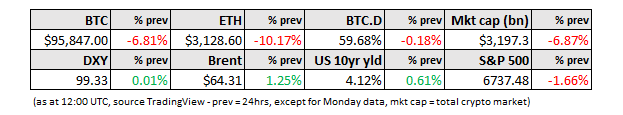

Yesterday, the S&P 500 dropped 1.7%, the Nasdaq fell 2.3%. Futures are pointing to another bad open today. Asian market performance today was also bleak, and European markets are a sea of aggressive red.

As always when risk assets are dumped, BTC got hit hard, and as I type is down almost 7% over the past 24 hours, with ETH down 10%. BTC is now almost 25% lower than its recent peak of ~$126,300, which officially puts it in a bear market.

(BTC/USD, chart via TradingView)

What’s more, the recent slump was no doubt aggravated by liquidations of open derivatives positions, but the slope suggests it was mainly driven by market selling, which suggests we won’t see the usual sharp bounce after a sharp fall.

The culprit? As always, there are many factors in play, but the trigger here is rates expectations.