The slippery slope: politics and debt

plus: the BTC high, gold, Japan's reaction, Chinese stablecoins and more

“The fact that an opinion has been widely held is no evidence whatever that it is not utterly absurd; indeed in view of the silliness of the majority of mankind, a widely spread belief is more likely to be foolish than sensible.” – Bertrand Russell ||

Hi everyone! I hope you had a great weekend. Absolutely stunning weather here in Spain: blue skies, gentle breezes and the kind of temperature you don’t notice.

How about that all-time BTC high!

Programming note: Apologies, I have to skip publication on Wednesday due to a teaching conflict.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: not much actually, unless the government shutdown gets resolved

The slippery slope: politics and debt

The message from markets

Macro-Crypto Bits: stagflation, shutdown mood, Japan’s reaction

Also: Europe, Russia, Chinese stablecoins and staking distribution

WHAT I’M WATCHING:

Coming up:

It looks like we have yet another week’s respite from, I mean absence of official US economic data reports.

Tuesday marks the second anniversary of the massacre in Israel by Hamas terrorists, with hopefully (hopefully hopefully) a peace deal nearing agreement. But there could be more pro-Palestine demonstrations across the West, further adding to the growing unease (more on this below).

Chinese and South Korean markets are closed for part of the week for Golden Week and Thanksgiving holidays respectively.

The slippery slope

A negotiated peace seems within reach in Gaza for the first time since terrorists attacked Israel two years ago. According to reports, Hamas has agreed in principle to release the remaining hostages, and parties are at the table in Egypt, hashing out more details.

Yet, the societal conflicts the resulting war unleased are not, unfortunately, likely to be over any time soon. The weekend saw violent anti-Israel protests damage property across Europe.

The absence over the past few years of violent demonstrations (or, recently, any demonstrations at all) in support of Ukraine highlights that these protests are not really about Palestine. If the Peace Deal is accepted by both sides and Gaza can rebuild with opportunity and hope, the swelling throng of protestors will find another cause. People, especially the young, are understandably angry, and the “system” (currently represented by Israel but there will be other proxies) is to blame.

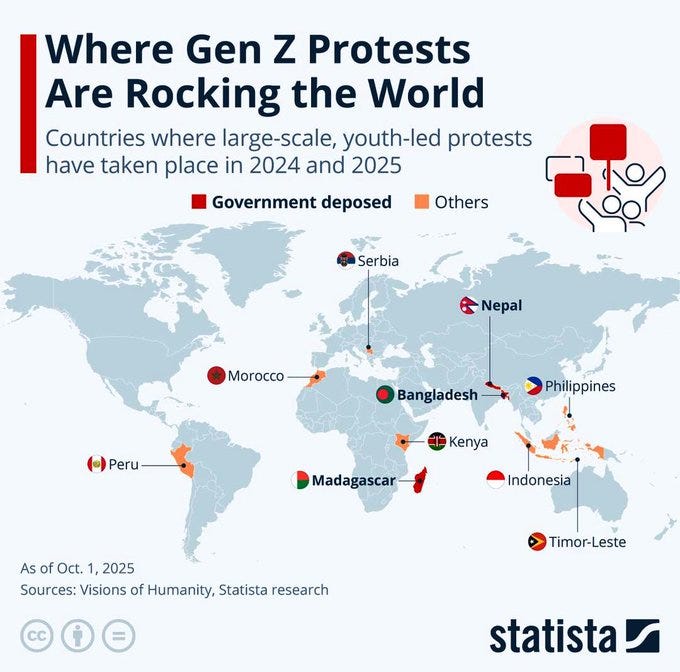

One way to gauge the kinetic force being unleashed is to see the protests in Europe as part of the same wave behind the increasingly violent GenZ protests in developing countries that have toppled one government (Nepal) and contributed to the dissolution of another (Madagascar).

(chart by Statista, via @vtchakarova)

The UK has come up with what it thinks is a solution: ban protests. Over 500 people were arrested in Trafalgar Square over the weekend and police resources are “strained” (don’t get me started), so the Home Secretary is giving police new powers to curb demonstrations while contemplating legislation to ban them outright. She recognizes that the right to protest is a “fundamental freedom”, according to a statement, but obviously we don’t want to bother the neighbours.