The wrong kind of spark

the possible market impact and political fallout from the California fires

“Whenever a theory appears to you as the only possible one, take this as a sign that you have neither understood the theory nor the problem which it was intended to solve.” – Karl Popper ||

Hi everyone!

Today’s email will be shorter than usual as I am going to take a half self-care day 🤒 – I want my energy back.

Below, I look at the potential market impact of the California fires. If any of you are in California, I hope you’re safe. So sad.

(No audio today, no voice!)

IN THIS NEWSLETTER:

The wrong kind of spark: market impact, political fallout

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

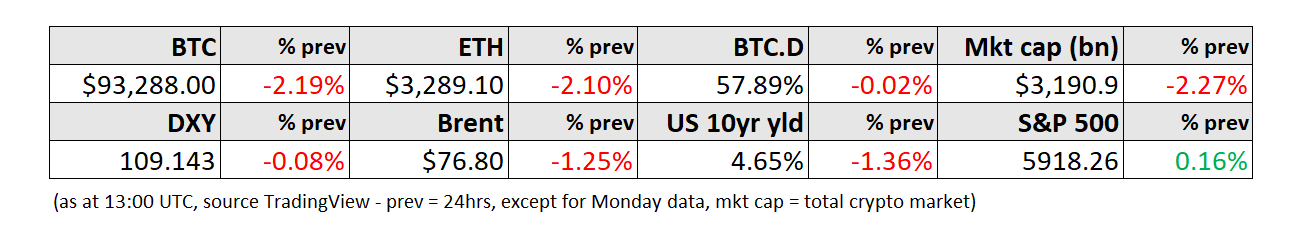

WHAT I’M WATCHING:

The wrong kind of spark

The speed of the spread of California’s fires has been astonishing, and must be beyond terrifying to everyone in the area. Terrifying and heart-breaking – hopefully, few of us will ever have to experience the engulfing sense of loss from the destruction of a home and its belongings.

Beyond the personal tragedy, there is likely to be a significant political cost, as resource mismanagement at both the state and local level will end up being directly attributed to the scale of the damage. There also could end up being a meaningful market fallout as liabilities get redistributed.

Politics and regulation

Starting with the political fallout, recent overregulation and mismanagement will no doubt be laid bare for voters to pore over, and financial plus emotional loss is a powerful force. This morning, X is full of rage at how politicians have “failed”.

Just some examples of policies that increased vulnerability to fires: