Thursday, Apr 20, 2023

Volatility vs volumes, harnessing NFT engagement, an upcoming webinar, and more...

“People can foresee the future only when it coincides with their own wishes, and the most grossly obvious facts can be ignored when they are unwelcome.” – George Orwell

LAST CHANCE TO SIGN UP! Later today, I’ll be hosting a fireside chat with a team of experts from data and analytics provider Coin Metrics to discuss crypto markets, pricing challenges, valuation factors, why regulators are paying attention, and much more. We kick off at 10:30am ET, so get your questions ready and sign up here!

Hi all! You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Nothing I say is investment advice. Nevertheless, I hope you find it useful – if so, please consider hitting the ❤ button at the bottom and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would really make my day. 😊

WHAT I’M WATCHING

BTC liquidity. Yesterday’s sharp market drop – which now looks like it was triggered by a large sell order on Binance – is a reminder of the market’s current low liquidity. So, why is volatility so low? More on this below.

NFT engagement. Yesterday, Starbucks dropped its second limited-edition series of NFTs, which went more smoothly than the first one. But the story here is not about the drop, it’s about not calling them NFTs. More on this below.

Stablecoin yield. Blockchain-based lending protocol Maple Finance has started onboarding investors to its new cash management pool that invests in 1-month US treasuries. I’m still trying to get my head around using crypto assets to earn fiat-based yield, especially given the relative ease of just using dollars to do this with fewer fees and less counterparty risk. There’s no lock-up, however, so it could save stablecoin holders the hassle of redeeming or selling, while giving them a yield yet preserving the potential agility to deploy their stablecoins in opportune trades. Significant demand for this type of product could be taken as a vote of confidence in the crypto market, as investors choose trading flexibility over the greater safety of buying treasuries or money market funds directly.

Buckle up. Ray Dalio has published an update on where we are in his “Changing World Order”, stressing 1) the enormous levels of debt, 2) widening internal divisions of wealth and values, 3) intensifying international conflict, 4) acts of nature, and 5) technological shifts. He repeats his argument that we are at an inflection point, and ends with some sobering but helpful advice: “If we are prepared for the worst, we will be fine.” It’s not a big leap to conclude that this would be a good time for some “insurance” assets, such as those that run on non-fiat systems and have programmatic hard caps.

MARKETS

The volume/volatility disconnect

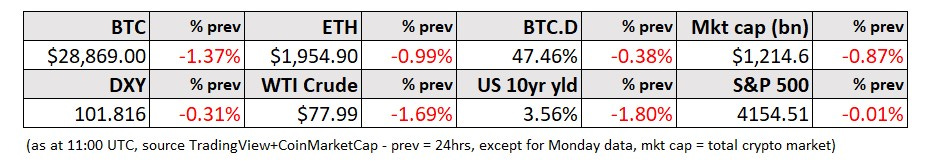

Yesterday’s sharp drop across the crypto markets at approximately 08:00 UTC had most of us scratching our heads – we couldn’t see any macro data or obvious announcement that would have triggered it, and the breadth of the move suggested that it wasn’t asset specific. Macro markets, although weak, did not reflect similar moves. In retrospect, fingers are now pointing to a large sell order emanating from Binance that pushed prices lower which in turn triggered liquidations which pushed prices further down, in typical crypto-recursive fashion. Intriguingly, volatility did not spike as it usually does with similar drops – BTC’s 30-day realized volatility has been dropping sharply over the past couple of weeks, and is now around mid-January levels.