Thursday, April 4, 2024

Data dependency, BTC support, ETF resilience

“It was the mark of a barbarian to destroy something one could not understand.” – Arthur C. Clarke, 2001: A Space Odyssey ||

Hello everyone! Happy symmetry day (4/4) for those of you that love numbers. 😁

Many of you are new here (hi!! welcome!!), so I’ll take the opportunity to introduce myself again. I’ve been researching crypto use cases since 2014, and following institutional interest while writing crypto newsletters since 2016. After five years at CoinDesk and one at Genesis Trading, in September 2022 I started focusing on the intersection between the crypto and macro landscapes. The result is the product you see before you. I hope you find it useful! And if so, I’d be thrilled if you could share it with your friends and colleagues. ❤

IN THIS NEWSLETTER:

“Data dependency” and BTC support

The reassuring resilience of the BTC spot ETFs

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content. And there’s a free trial!

WHAT I’M WATCHING:

“Data dependency” and BTC support

The US Federal Reserve, as Chair Powell is fond of reminding us, is now “data dependent”, which presumably means its decisions will depend on the economic data the organization receives.

The main advantages of a central bank declaring it is “data dependent” are 1) the public-facing reassurance that reality matters more than theory, and 2) the flexibility to adapt to events. The main disadvantages, however, are 1) data tends to be backward looking, which risks delayed action, and 2) there is little agreement as to which metrics matter.

This latter point is key, in my opinion, as it highlights how tenuous “data dependency” advantages are.

If data points are sketching out very different stories, it’s hard to know which ones matter. And if we don’t know which ones matter, how do we know what “reality” is? I’m not getting metaphysical here (tempting as that may be), I’m pointing out that we don’t have clear picture of what’s going on despite a constant stream of data, and more probably won’t help much.

Inflation is a good example. Some measures show it coming down, others suggest it is picking up, and there is little agreement on how it should be calculated, what points should be excluded, or where it’s going from here.

Also, reported inflation, whichever metric you use, paints a limited picture when the Fed’s mandate is price stability going forward. Even the Fed acknowledges that inflation expectations are important. Reported inflation has some impact there – but what really moves expectations often tends to be out of the Fed’s control.

Take oil prices, for instance. These matter for inflation expectations – a lot, it turns out, which is not surprising since they are a frequent and highly visible cost for US motorists, which makes them one of the key drivers of family budgeting. The Points of Return newsletter this morning has a chart that compares moves in the oil price to those in breakeven inflation expectations as priced by inflation-indexed bonds.

(chart via Bloomberg)

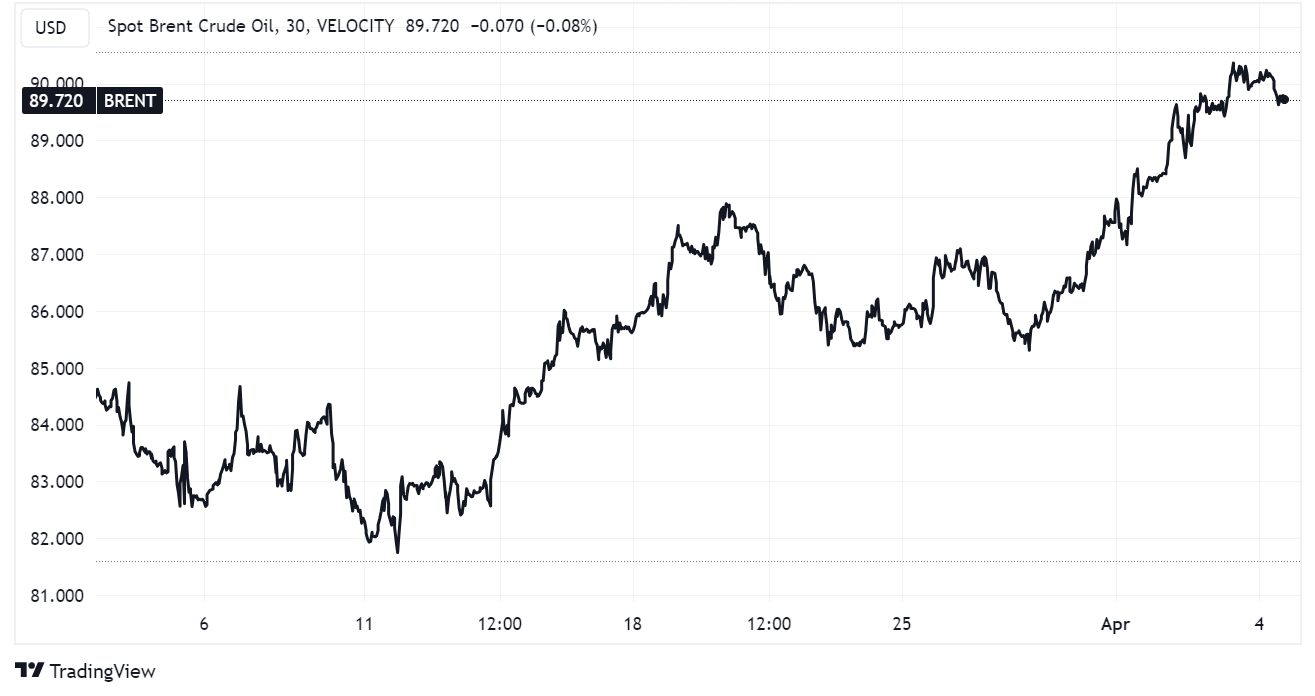

Worryingly, oil prices have jumped after the intensification of the conflict in the Middle East coupled with the extension of OPEC+ production cuts. From $85/barrel just a week ago, Brent shot above $90/barrel yesterday for the first time in more than five months (although it has pulled back slightly this morning).

(chart via TradingView)

And while energy is taken out of the inflation measures the Fed keeps an eye on, climbing oil prices do feed through to other input prices via transportation costs, chemicals, manufacturing processes, etc.