Thursday, Feb 1, 2024

why I'm skeptical of the China liquidity narrative, and what Powell didn't talk about

“The single biggest problem in communication is the illusion that it has taken place.” – George Bernard Shaw ||

Hi all, welcome to February! And, cool, we have a whole extra day of it this year.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but I don’t give trading ideas, and NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Note: I’m speaking at BlockWorks’ upcoming Digital Asset Summit conference in London on March 18-20. Normally I say no to conferences, but this is one of the very few worth travelling for. If you’re thinking of going, it’d be great to say hi, and here’s a discount code you can use: CIMN10.

IN THIS NEWSLETTER

What Powell didn’t talk about

Why I’m skeptical of the China rescue narrative

(Why I might be wrong on this will follow on tomorrow!)

WHAT I’M WATCHING

What Powell didn’t talk about

Maybe I missed it, but I didn’t hear anyone ask Chair Powell in his post-FOMC press conference yesterday about the worrying earnings from New York Community Bancorp (NYCB). This is strange, since I think bank concerns were an even stronger pull on yesterday’s market moves than the Fed pushback on expectations of a rate cut in March.

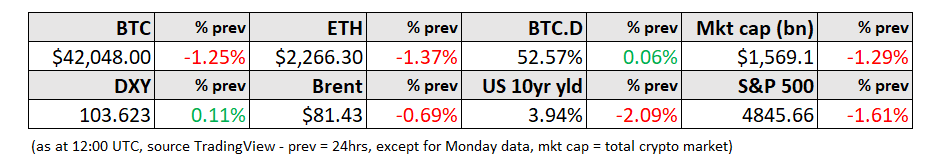

Before the open, NYCB reported an unexpected loss and cut its dividend, renewing fears of a wave of bank failures. Its share price plummeted almost 40% and dragged the KBW Regional Banking Index down 6% by the close, its steepest drop since the dark days of last March’s banking crisis.

(chart via TradingView)

Talk about unfortunate timing. In the released post-meeting statement yesterday, the FOMC removed the following language that has appeared in some form in all statements since last March:

“The US banking system is sound and resilient.”

And yet most commentary has focused on Powell’s insistence that a rate cut in March is extremely unlikely.

It makes sense that this would push down stock prices, as the market has been expecting a softer stance from the Federal Reserve. Bond prices also dropped once the FOMC press conference got under way, as yields adjusted upward in line with new rates expectations.

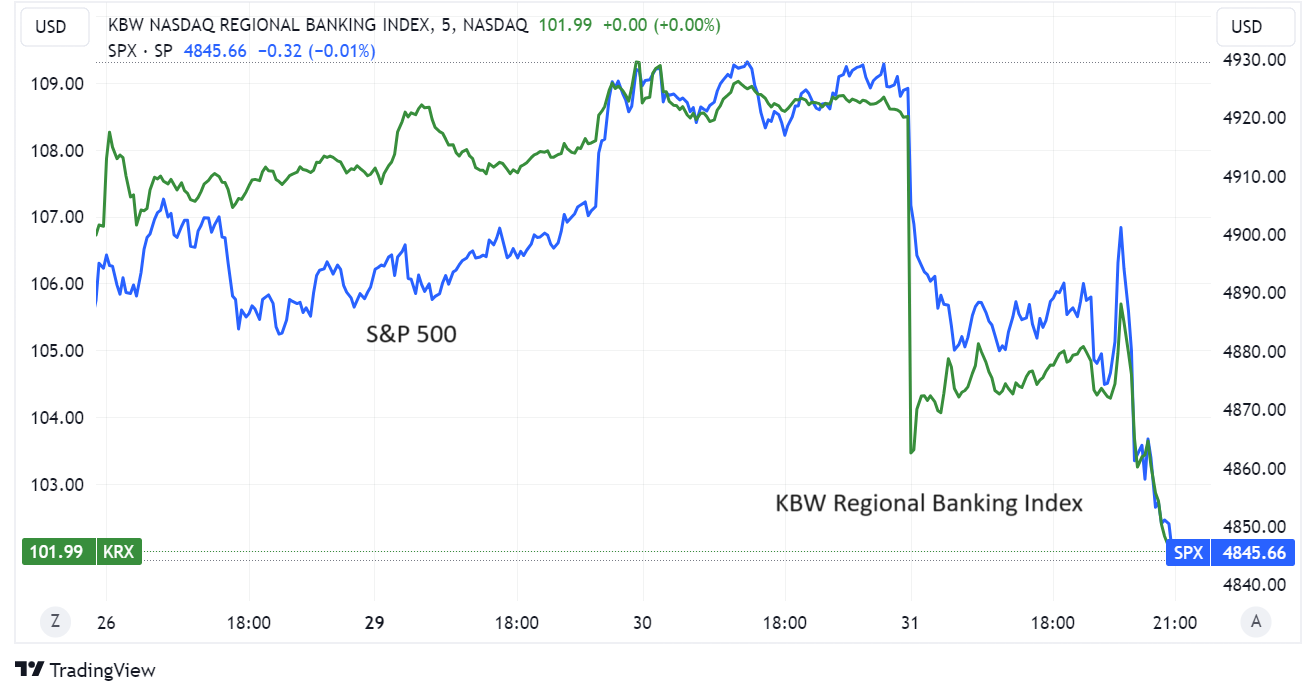

But bond prices were more affected yesterday by banking fears, as we can see in the sharp move in the benchmark 10-year treasury when the New York Community Bancorp news came out.

(chart via TradingView)

The hit to rates sentiment took over for a brief spell during the press conference, but the impact was muted. And then check out that sharp jump later in the day – this suggests trader conviction that rates will be coming down sharply, despite what Chair Powell said.

Why would they do that? It wouldn’t be because of more signs that inflation is under control. We got some of that yesterday, with the US Employment Cost Index for the fourth quarter climbing 0.9%, less than expected and the lowest increase since 2021.

No, it would be because of banking troubles and the fear that they could spill over into the Treasury market.

So, from the two charts above we can see that the S&P 500 was dancing more with banks than with bonds. We can also see that bonds were nervous both at the open and the close of the trading day.

The outlier, strangely, is BTC.

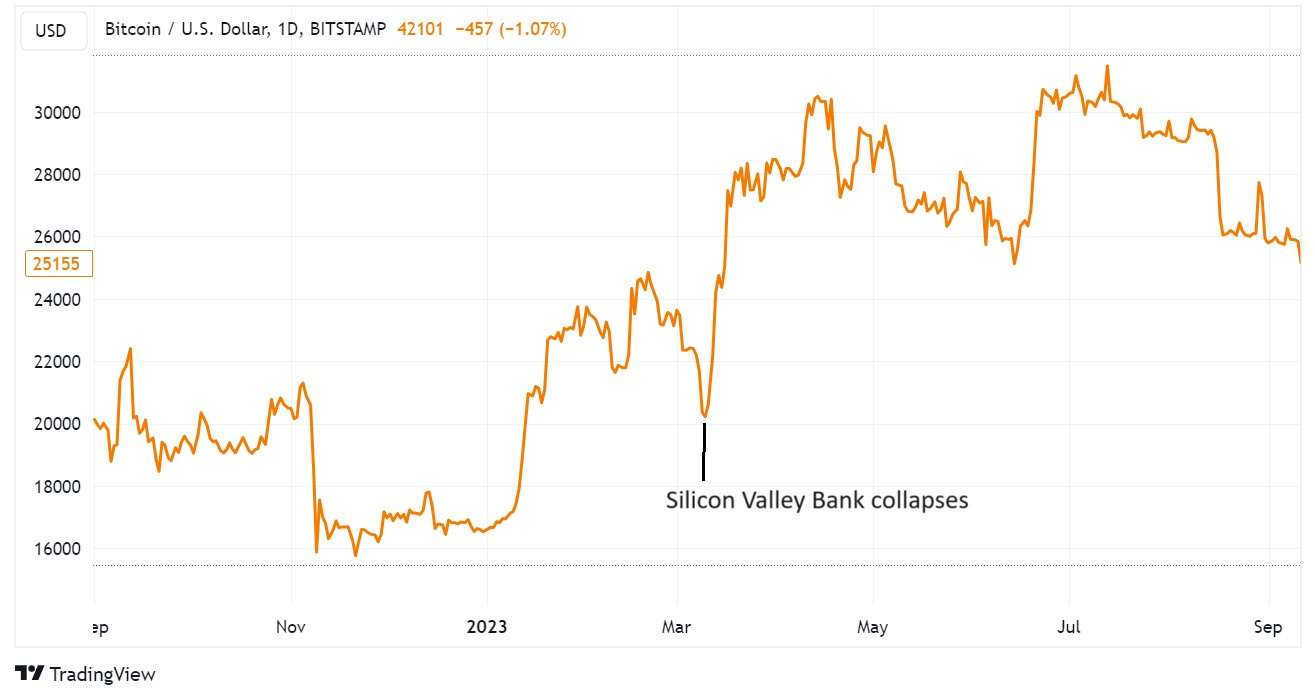

While the mood yesterday was “risk off”, during the banking crisis of March 2023 BTC spiked as an “alternative” to the US banking system started to look attractive.

(chart via TradingView)

We didn’t get that yesterday.

(chart via TradingView)

Maybe there’s a delayed reaction ahead? Maybe the possible bank stress will soon be forgotten as we pivot to obsessing about this Friday’s employment data? Maybe there’s some offsetting selling pressure this time around?

Whatever the reason for BTC’s “risk off” behaviour yesterday, it highlights the fascinating yet confusing duality of the BTC market – sometimes it’s a macro risk asset, sometimes it’s a hedge against macro risk.

Why I’m skeptical of the China rescue narrative

China liquidity! This is a mantra familiar to most crypto traders and investors, and the theory goes like this: