Thursday, Feb 2, 2023

The market believes the Fed even less now, crypto risk-on sentiment, volatilities are weird, European crypto regulation evolves

“Those who speak most of progress measure it by quantity and not by quality.” – George Santayana ||

Hello everyone! Happy Groundhog Day, for those who observe. You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems. Nothing I say is investment advice! Nevertheless, if you find this useful, do share with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, do please consider subscribing to support my work (or try a free trial!). I’d really appreciate it. 😊

MARKET

What happened?

So, that didn’t go as expected. Yesterday, I suggested that Powell would probably have stern words for us in his press conference because the easing in financial markets that we have seen over the past few weeks could end up derailing the Fed’s tightening efforts. But those stern words were absent. At one stage, Powell was asked if he was worried about the easing conditions reflected in the market, and the Fed Chair waffled.

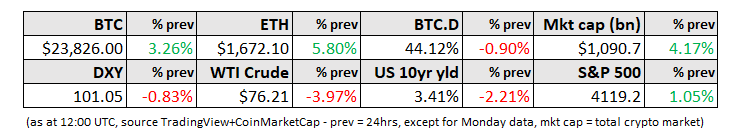

The market took this as vindication, enthusiastically doubling down on its easing indications. The US 10-year treasury yield, already down almost 18% from its October high going into yesterday’s session, dropped further, briefly dipping below 3.4%. The DXY dollar index followed suit, briefly going below 101. If Powell was in any doubt as to whether or not conditions were easing, surely that is put to rest now.

(chart via TradingView)

During the post-statement question period, Powell confirmed that he expected a “couple more” hikes to get to a level that is “appropriately restrictive”. The market isn’t buying it. CME futures are pointing to one more 25bp hike next month, a pause for a few sessions, and then the first cut in November (although odds are climbing for a cut in September). The probability the market is assigning to the Fed’s official projections that end-of-year rates reach 5-5.25%? Less than 1%.