Thursday, Feb 22, 2024

what the FOMC minutes didn't say and why that matters, BTC ETF vulnerability, an improving market infrastructure

“What is now proved was once only imagined.” – William Blake ||

Hi all! Google informs me that today is Nina Simone’s birthday, which inspired me to share my favourite version of one of my favourite of her songs – link at the very bottom.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but I don’t give trading ideas, and NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! You’ll get a ~daily newsletter that goes deeper into some of the things I’m looking at, mainly how crypto fits in to the broader economic landscape, why it matters, and where this is all heading. With audio!

As I mentioned yesterday, I was on Scott Melker’s Wolf of All Streets morning show! Link here.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER

The post-ETF market infrastructure

Do the ETFs make Bitcoin more vulnerable?

What the FOMC minutes didn’t say and why that matters

WHAT I’M WATCHING

The post-ETF market infrastructure

We’re getting some signs that the launch of the BTC spot ETFs has indeed improved market liquidity! This was expected, but it’s good to start to see it in the numbers.

First, overall BTC spot trading volumes are picking up.

(chart via The Block Data)

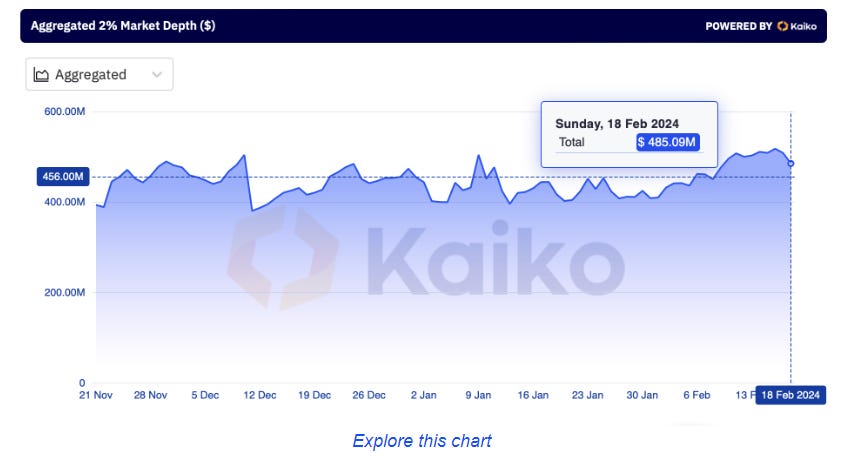

According to Kaiko, market depth to 2% (which measures the aggregate bids and asks up to 2% either side of last price) has increased by 23% over the past three months. That’s material.

(chart via Kaiko)

What’s more, the overall US share of market depth is picking up, which implies that the BTC spot ETFs are playing a significant role here.

(chart via Kaiko)

Institutional involvement is picking up, as can be seen by the increase in the average BTC trade size.

(chart via Kaiko)

This is much more noticeable on Coinbase than on Binance, which suggests that it is largely due to the ETFs.

(chart via Kaiko)

(By the way, if you don’t subscribe to the Kaiko newsletters, I thoroughly recommend you do so, they invariably come up with original and data-oriented insights accompanied by simple, attractive charts.)

Here’s another indicator: the BTC futures open interest on the CME vs that on other exchanges. When the CME dominates, US-based institutional interest is high. Notice that the CME now has the highest amount of BTC futures open interest, more so even than Binance, but this is not the same for ETH, where the CME comes fifth.