Thursday, Feb 23, 2023

BTC's sudden move, macro market realignment, media business models, European bank interest and more...

“Men are disturbed not by things, but the view they take of them.” – Epictetus ||

Hello everyone! As I was writing this, the BTC price started falling sharply, which of course altered the narrative I had been working on. I’m still not sure what’s going on, but below I tease out some possibilities and share some charts. I imagine more will become clear as the day progresses, and by the time you read this, things could have corrected. Never a dull moment.

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems – I’m glad you’re here. Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider liking, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day.

MARKETS

Why is BTC dropping?

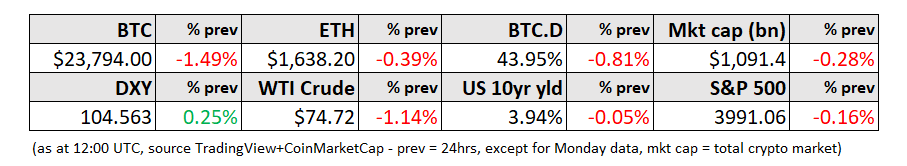

Things are on the move. As I type, the BTC price is dropping fast, much more than the ETH price, as can be seen by the below chart which compares the two.

(chart via TradingView)

I first noticed this when I opened up the chart on bitcoin dominance to see if the trend had shifted, and did a double-take:

(chart via TradingView)

Macro indicators are not exactly flashing bullish signals, but nor are they doing anything particularly weird. Some on Twitter are speculating that this could be because Binance allegedly (this is not yet confirmed) closed out the bulk of open BTC perpetual futures positions in Australia, to comply with local regulation.

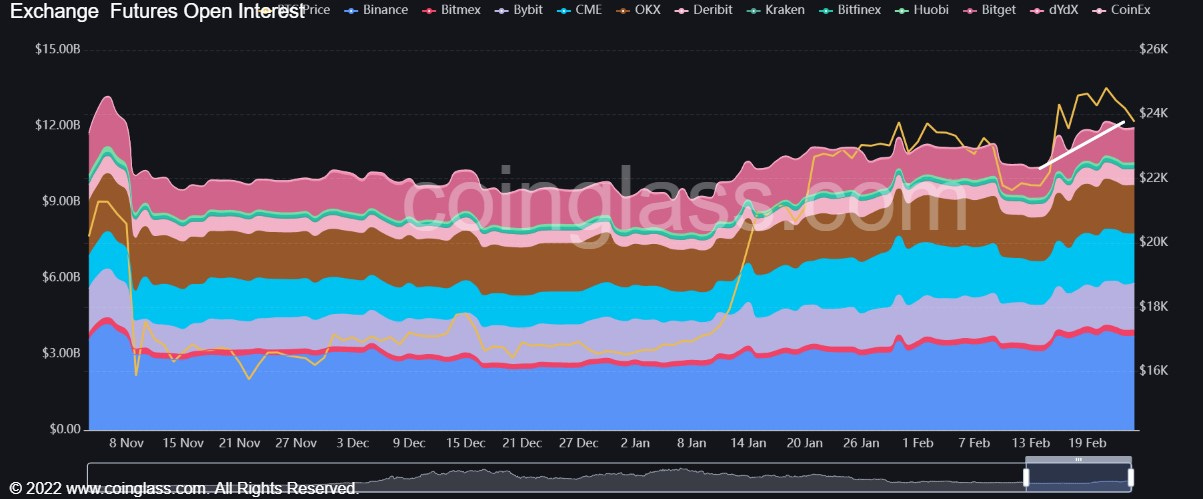

From what I can see so far, it seems to be structural. BTC futures open interest had jumped more than 16% over the past week, according to data from coinglass – this signals a build-up of leverage. (Admittedly, this is in USD terms – in BTC terms, the increase is around 5%.)

(chart via coinglass)

Given the slope of the drop, the concentration of the move in BTC and the size of the liquidations over the past hour, it seems this could be a structural move – a large BTC derivatives position being closed out, or perhaps several.

(chart via coinglass)