Thursday, Feb 9, 2023

Changing rates expectations, Ethereum activity, donations for Turkey, crypto AI, some gating rumours

“Our knowledge can only be finite, while our ignorance must necessarily be infinite.” – Karl Popper ||

Hi all! So, I step away for one day, and wow, a lot happens! Below I briefly cover some of the major twists to the crypto/macro tale – others will be fed into larger stories soon. Scroll down for addresses for crypto donations to the victims of the quakes in Turkey and Syria, if you feel you want to help.

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems. Nothing I say is investment advice! Nevertheless, if you find this useful, do share with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll consider subscribing to support my work (or try a free trial!).

MARKETS

Get in line

It seems that recent economic data and comments from Fed officials have finally jolted the market into closer alignment with the Fed, although this could change quickly. The swaps curve shows closer alignment on the peak, although not on its timing.

(chart via Bloomberg)

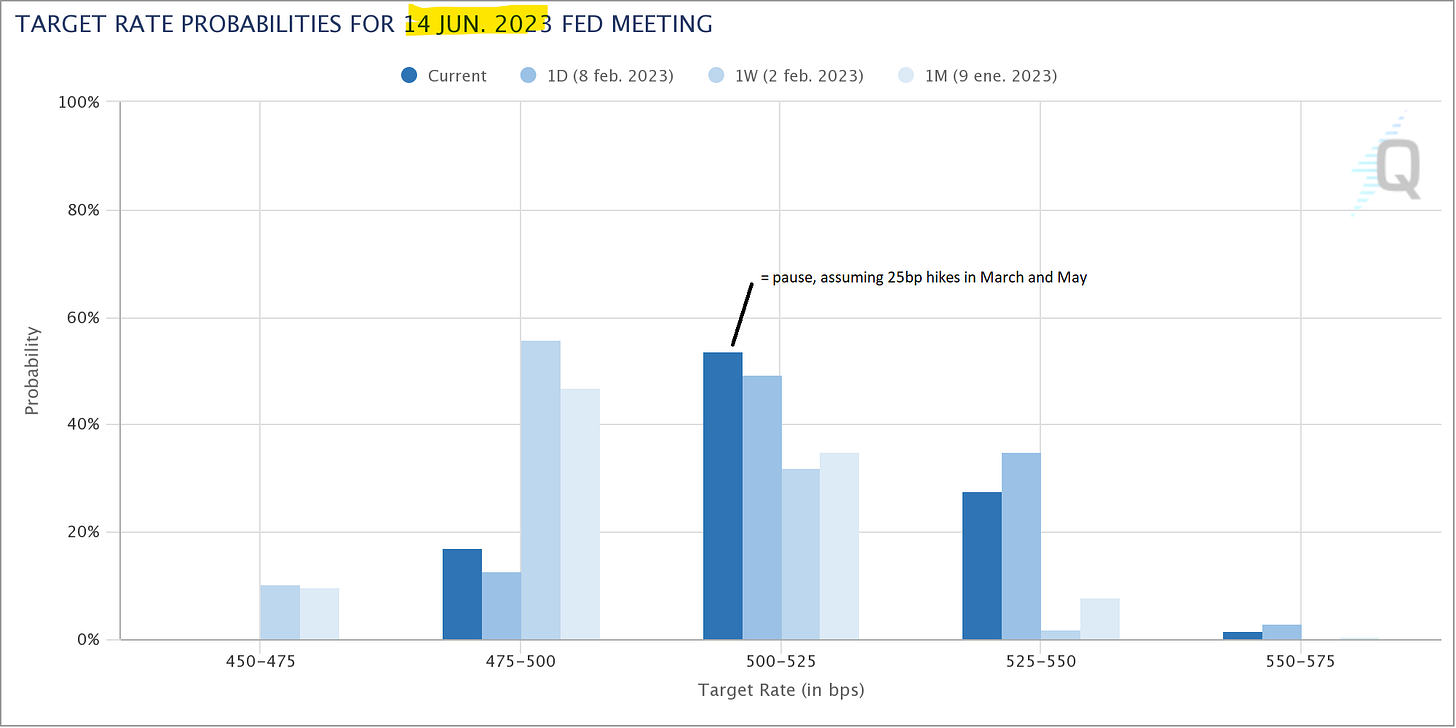

This week has seen a significant bump in hawkish positioning, with some traders betting big that the central bank rate will reach 6%, a full 100 basis points higher than the peak estimate just a week ago. Odds are still looking good for a pause in June, according to the CME FedWatch, but are showing less confidence in cuts by year-end.

(chart via CME FedWatch)

The usual weekly US employment data just out showed a slight increase in jobless claims, but these releases don’t tend to move the market much. All eyes and nerves are now turning to the US CPI print next week, which could, just could, deliver a nasty surprise. I’m not saying it will, and hopefully it won’t, but signals are getting louder that personal consumption may be weakening but is far from weak.