Thursday, Jan 4, 2023

my 2024 predictions, Fed minutes and expectations, ETFs and liquidity, US debt

“I see no advantage in these new clocks. They run no faster than the ones made 100 years ago.” – Henry Ford ||

Hi all! You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

Since many of you are new here (hello! welcome!), I should introduce myself again. My name is Noelle, I’ve been writing crypto newsletters with an institutional focus for over seven years now, first for CoinDesk as MD of Research (among other roles) and then for Genesis Trading as Head of Market Insights. I left there in September 2022 to focus on the product you see before you, and on better understanding how crypto is shaping the broader economic and geopolitical outlook.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month ($90/year) for the next few days, going up to $12/month ($108/year) on January 7. I explained some of the upcoming changes for this newsletter in this post here.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER:

Fed minutes just might sober up the market

ETFs and market liquidity

US government debt and the unstoppable, runaway train

My 2024 predictions

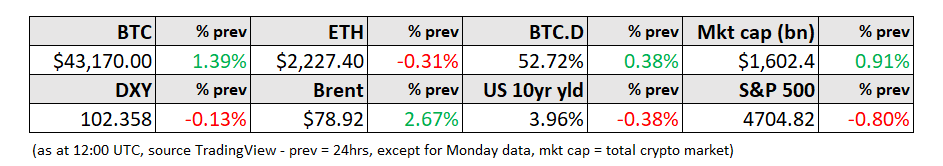

WHAT I’M WATCHING:

Fed minutes just might sober up the market

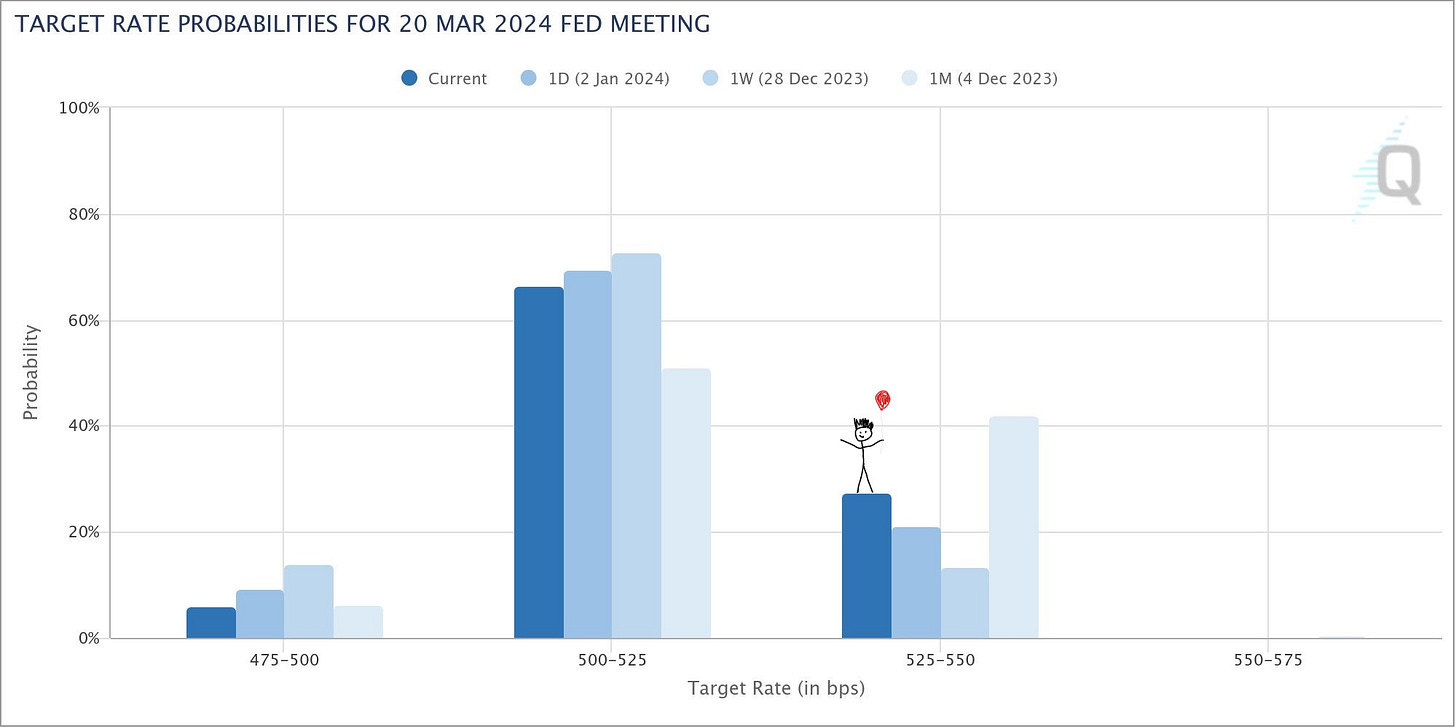

Finally, rates expectations seem to be shifting away from the ludicrous conviction that cuts were coming in or before March. CME futures this morning were indicating a roughly 70% chance of a cut within the next two months, down from 85% a week ago.

(chart via CME FedWatch)

What triggered this move is the minutes of the latest FOMC meeting, released yesterday. These confirmed that most committee members believed that the policy rate was “at or near its peak” (yay, no more hikes) and that it would most likely remain at this level “for some time” (which has to mean more than a couple of months, right?).

Economic and market data continue to suggest that keeping inflation heading down could be harder than expected.

The job market is still resilient: earlier today, we got the Challenger job cuts for the US in December – these were the lowest since July, and down 20% since a year ago.

Inflation is picking up in Europe: this morning, the German year-on-year CPI index jumped 3.8% in December, up from a 2.3% increase the previous month.

And US economic growth is not yet flashing signs of recession, despite the slowdown in manufacturing: Yesterday, the Atlanta Fed upped its GDPNow model’s expectations for Q4 economic growth in the US, to 2.5% from 2.0% – that’s a big jump.

(chart via the Atlanta Fed)

What’s more, the conflict in the Middle East is wreaking havoc with shipping rates.

(chart via Bloomberg)

So, there is no reason to believe the US central bank will be cutting rates in or before March. Fed officials have been saying this. The economic data is insisting the consumer is still strong. And the cost of manufacturing inputs are not heading in the right direction.

What will this expectations shift mean for markets? We’re already seeing it in the main US stock indices – so far this week/year, the Nasdaq is down almost 2%, the S&P 500 is down almost 1%, the US 10-year yield is up, yesterday briefly peeking above 4% for the first time since mid-December.

BTC, on the other hand, is up (and then down and now trending up again).

(chart via TradingView)