Thursday, July 25, 2024

value rotation, AI doubts, contrasting crypto narratives, economic signals

"If you want to teach people a new way of thinking, don't bother trying to teach them. Instead, give them a tool, the use of which will lead to new ways of thinking." – R. Buckminster Fuller ||

Hi everyone, Noelle here! I hope you’re all doing well! Things are looking a bit dicey out there in markets.

Today I talk about the risk in AI valuations, even after the correction; how this isn’t being helped by economic turmoil, and the impact this is having on crypto markets.

If you find Crypto is Macro Now useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d really appreciate it!

IN THIS NEWSLETTER:

Value rotation – what would AI say?

Still waiting for those clear economic signals

Contrasting crypto narratives

About those AI valuations

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

WHAT I’M WATCHING:

Value rotation – what would AI say?

It looks like it’s started – AI valuations were bound to correct at some time, and in my opinion, they have more to go. This no longer feels like a brief adjustment; the rotation into “value” rather than “growth” is now a strong signal of market inflection. And it could accelerate.

Here is the performance of the S&P 500, the Nasdaq, and the S&P 500 equal weight index.

(chart via TradingView)

Note how the equal weight index outperformed, signalling that the same big tech stocks that propelled the S&P 500 skyward are now bringing it down.

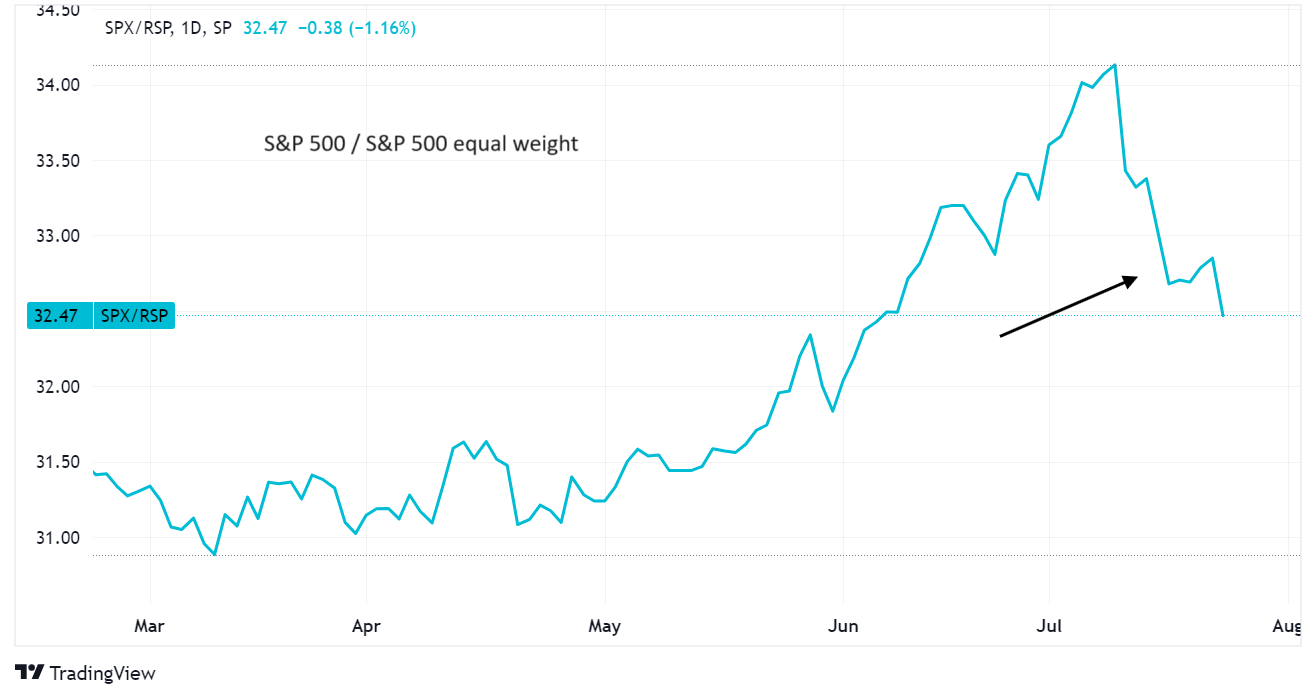

Here’s the S&P 500 divided by the equal weight index, which shows how sharp this rotation has been.

(chart via TradingView)

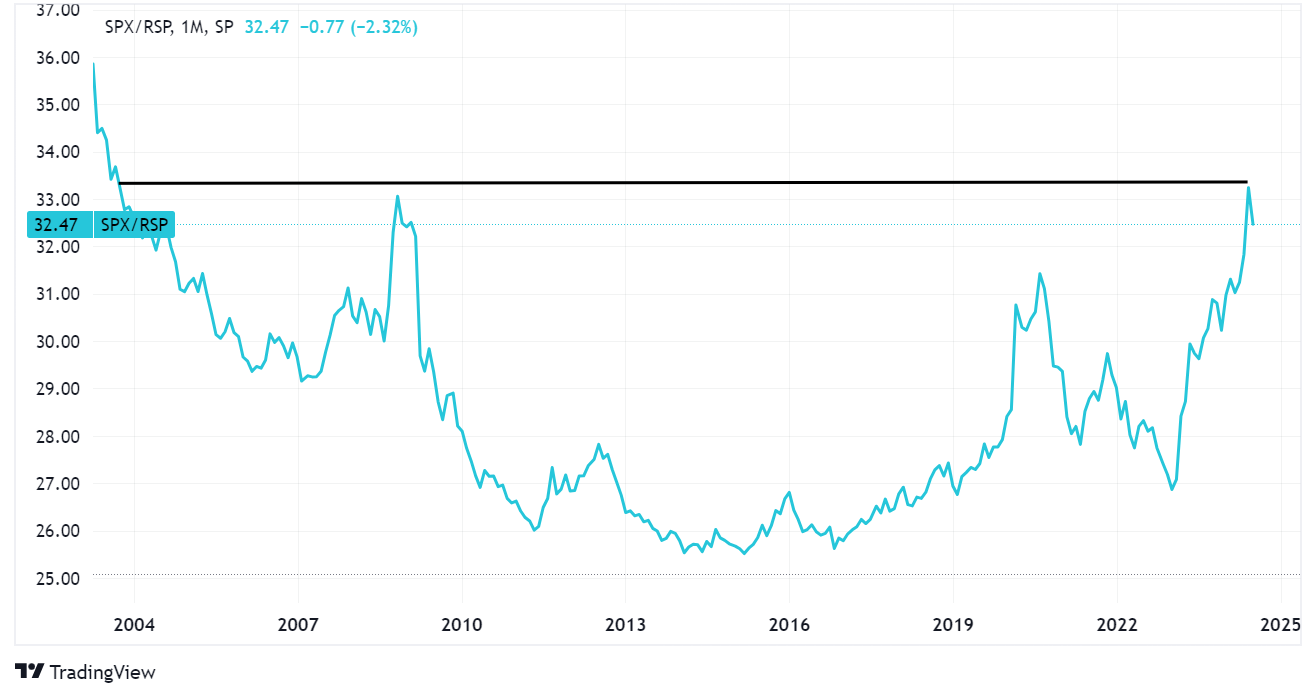

But, zooming out, it’s a small correction from an unnatural level – last month, the ratio reached its highest level since 2003.

(chart via TradingView)

What changed?

The trigger was most likely doubt about the sustainability of AI-related earnings expectations, which shows that relevant questions are finally being asked (more on this below).

Alphabet’s reported earnings came in line with expectations, but the market was disappointed they weren’t better (this is nuts when you think about it, and highlights how complacent the market had become). The ~5% correction afterwards shows that valuations are now being questioned, which is healthy.

The risk is more in the slipperiness of the slope, as sentiment and fear kick in. Even if you are convinced the market is wrong and the P/E valuations of a couple of weeks ago were right, even if you see this as a buy-the-dip opportunity, you’re probably focusing now on what other people are thinking. Investors tend to move in packs which accelerates trend shifts, and in this case, there is career risk in being on the wrong side of this trade.

And the change in sentiment has spilled across borders, with the Nikkei now in technical correction after a 3.3% drop in today’s trading, the steepest since June 2021. The Eurostoxx 600 is down 3.5% over the past couple of days, the French CAC index is down almost 4%, and so on.

When corrections come, they come fast.