Thursday, June 20, 2024

wealth and crypto investing, Turkish banks, ideological lenses

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.” – William Arthur Ward ||

Hi everyone! I keep trying to make these daily newsletters shorter but I usually fail (so much to talk about!). Today I managed it, though! I even avoided the flashy green Substack message that the post is too long, I usually get those, and while they don’t impede my sending anyway, I end up feeling scolded. So, ha, feeling pleased with myself today, and I’m sure you’ll appreciate the shorter length.

If you find Crypto is Macro Now useful, would you mind sharing it with your friends and colleagues? ❤

IN THIS NEWSLETTER:

Wealthy Americans and crypto

Banks and crypto in Turkey: I’m confused

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

WHAT I’M WATCHING:

Wealthy Americans and crypto

Yesterday, Bank of America published its bi-annual survey of investment trends among wealthy Americans, with some interesting takeaways for the crypto market.

First, for purposes of the survey, “wealthy Americans” means those over 21 years old with investable assets valued at over $3 million. More than 70% of respondents were over 57 years old, with millennials accounting for only 12%. The under-43s, however, delivered the bulk of the surprising and encouraging findings, and when it comes to crypto assets, this is the cohort to watch.

It turns out there are some stark differences in how different age groups perceive the world. For instance, almost half of the 21-43yrs bloc thinks the outlook for the global economy is “very good” or “excellent”. That drops to 6% for those who are older. Maybe it’s the different media the two groups consume? The survey indicates that for under-43s, it’s mainly social media, while those older largely rely on online articles – both are good at catastrophising, so maybe it’s the importance given to each? Or maybe it’s life experience, as in those who are older have “seen this before”?

(chart via Bank of America)

What’s more, respondents did not follow market consensus in their interest rate expectations. The survey was conducted in January and February of this year, when swaps were pricing in five-to-six US interest rate cuts. Yet more than half of respondents predicted rates would stay the same or even increase.

(chart via Bank of America)

Now we get to some eye-opening takeaways for digital asset markets:

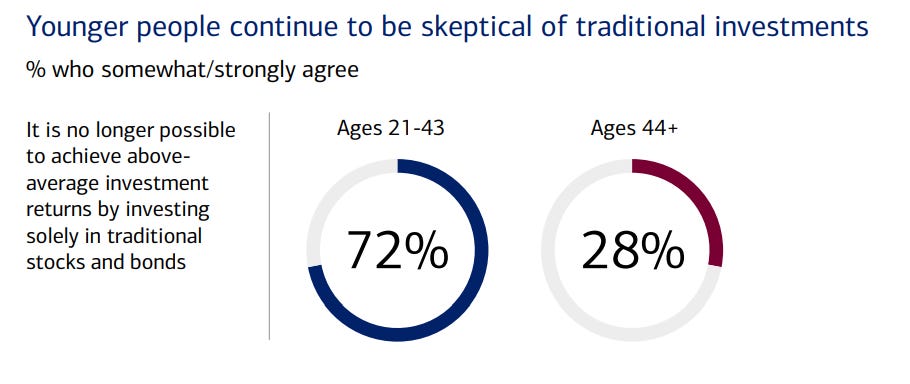

Almost three quarters of the under-43s believe it is no longer possible to get superior returns from traditional assets alone.

(chart via Bank of America)

This group’s preferred asset classes are, in order: real estate, crypto, private equity, personal company/brand, direct investment, and positive impact. For those over 44, crypto is almost at the very bottom of the list.