Thursday, Mar 2, 2023

War finance, BTC options volumes, markets helping the Fed, Ethereum evolution and more...

“Good questions outrank easy answers.” – Paul Samuelson ||

Hi everyone! Thanks so much for being here! You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems. Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider liking, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day.

MARKETS

All hands on deck

The Fed must be feeling pretty good today. The US 10-year yield yesterday broke through 4.00% for the first time since last November as traders continued to extend their terminal rate forecasts.

(chart via TradingView)

Expectations of a fourth 25bp rate hike in July now exceed those for a pause, and there has been a notable jump in the priced-in probability of a fifth in September (from 7% yesterday to 16% at time of writing).

(chart via CME FedWatch)

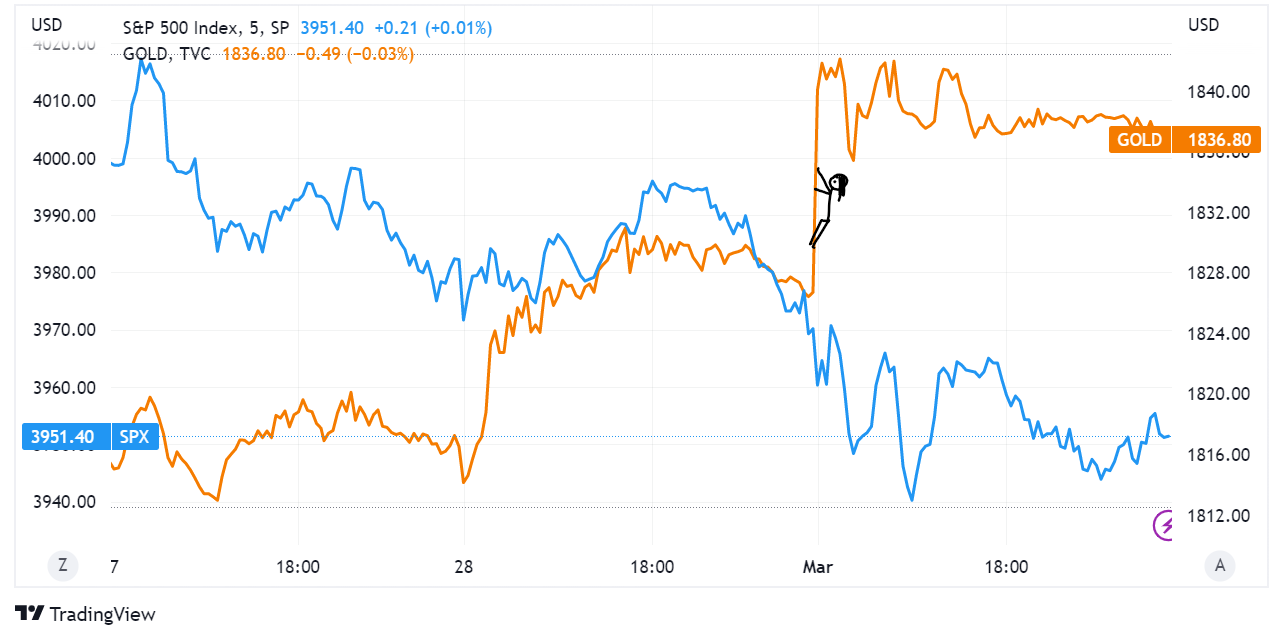

This is the market not only taking on board the Fed’s latest signalling, it’s also sort of taking over the job. Stocks are down on the week so far, while gold is up.

(chart via TradingView)

This relatively sharp rise of US yields since the beginning of the week has not had much of an impact on the DXY, as global rate outlooks keep the dollar index in check. Nor has it had much of an impact on BTC, which has shown notable resilience to both the worsening macro market sentiment and the regulatory headwinds buffeting the entire crypto ecosystem.

War production

You’ll have heard me say before that we’re not talking enough about the impact of the Ukraine war on the outlook for rates, but that’s probably about to change. Yesterday, the EU agreed to propose a three-track plan to boost ammunition production, ramping up the region’s current and future industrial capacity. It’s unclear how much budget this will get, but here’s the issue: Europe is already overextending itself in terms of debt, with plans to ramp up spending to compete with Biden’s Inflation Reduction Act, some climate initiatives and pandemic debt still a heavy weight. Article 311 mandates that the European Union finance itself without borrowing, which means the member states will need to unanimously agree to the collective issuance of new debt. At the end of Q3 2022, the amount of total EU debt stood at 85% of GDP, higher than the 60% limit established by the original treaty.