Thursday, Mar 23, 2023

Yesterday's BTC whiplash, the Fed's message and the Coinbase Wells notice

“Nothing can stop the man with the right mental attitude from achieving his goal; nothing on earth can help the man with the wrong mental attitude.” – Thomas Jefferson ||

Hello everyone, and happy World Bear Day! I presume those that decide these things are talking about the cute-sinister hairy creatures and not the market pessimists, but the timing is uncanny…

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks for being a subscriber! Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider hitting the like button at the bottom, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day. 😊

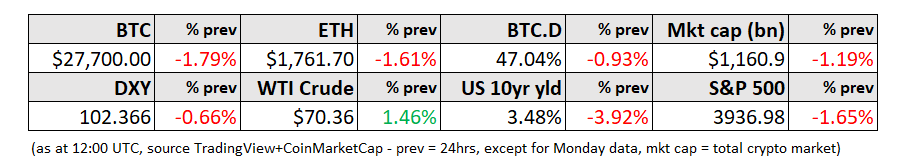

MARKET

Backroom tightening

Well, that was dramatic, in unexpected ways.

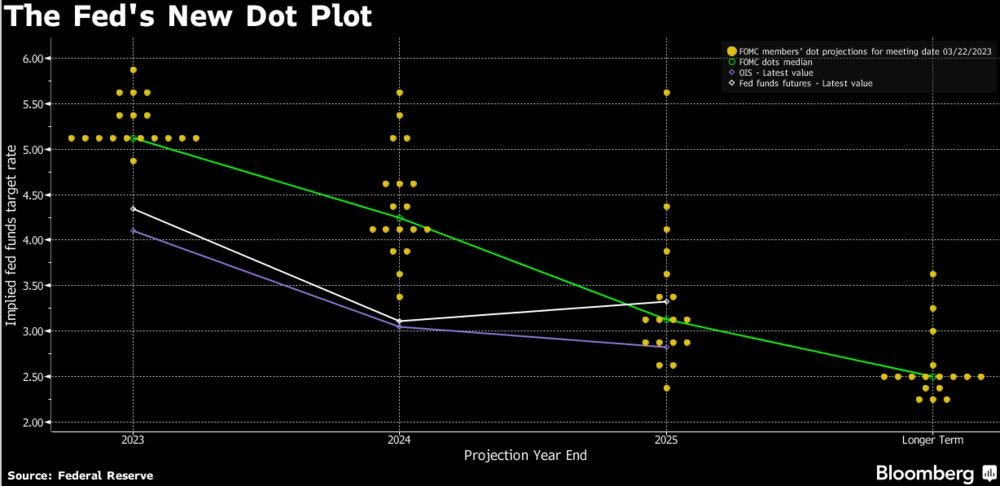

To recap, the FOMC meeting delivered another 25bp hike, the second in a row and the ninth upward move since the current tightening cycle began a year ago. This was the consensus market expectation, so no big deal there, but there were some surprises in the dot plot, the language regarding future hikes, and in what initially seemed like a conflicting message from the Treasury department on bank insurance.

The dot plot surprised in its lack of movement. Given the resilient inflation indicators released in recent weeks (and the Fed’s stress on being “data dependent”), I expected them to move the end-2023 forecast fed funds rate up a notch or two. That didn’t happen – it is still at 5.1%, which reflects a reassuring awareness of the potential economic impact of bank lending tightening after the recent interventions. Indeed, Powell mentioned several times in his press conference that resulting withdrawal of credit-driven liquidity, expected to continue, is the equivalent of rate hikes – what they don’t know is how many. Encouraging on that front.

(chart via Bloomberg)