Thursday, Mar 30, 2023

Why the market is wrong, what that means for BTC, US exchanges moving offshore, and more...

“The past is not what it was.” – G. K. Chesterton ||

Hello, everyone! Hoo boy, almost at the end of the first quarter of 2023. A few things have happened, right? You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider hitting the like button at the bottom, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day. 😊

Programming note: 🌺 Easter is rapidly approaching and it’s a big deal where I live, so this newsletter will be taking off Friday, April 7, through to Monday, April 10, including the weekend edition. 🌺

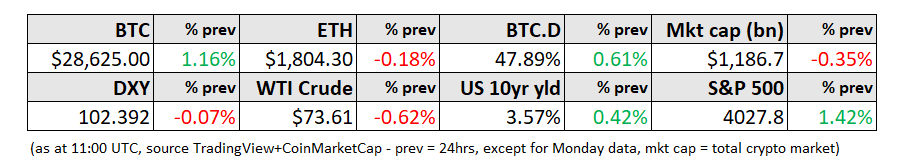

MARKETS

What’s wrong?

I had a fun chat yesterday with Ash Bennington on the Real Vision broadcast which was supposed to be about macro but ended up also being about crypto because it is getting harder to disentangle the two balls of twine these days (and because Ash knows a lot about both). One question posed from a viewer was “Do you think the markets are wrong in expecting a rate cut?” (or something similar, I don’t remember the exact words) and I said “Yes” – I thought this would be a good space to expand on why, and what that means for markets:

1) From comments I’ve heard, most expectations that rate cuts are imminent is because “something broke” and therefore more things will break and the Fed has to put the sanctity of the financial system before fighting inflation. However, banking stress seems to be calming down, and it’s not a given that more things will break at a systemic level. We may see some small banks either close or be absorbed by others, especially if commercial real estate continues to ratchet up worries, but I don’t think that would be enough for the Fed to pivot. Not yet, anyway.