Thursday, May 2, 2024

the FOMC performance, the market reaction, crypto narratives and drawdowns

“To live is the rarest thing in the world. Most people exist, that is all.” – Oscar Wilde ||

Hello everyone! I hope you’ve had a good start to May, despite the markets. Where I live, it’s the month where you can finally put away your sweaters, which is something to look forward to.

I have to pause the audio recordings for a few more days, apologies. I’m working on some new ideas on this front.

If you find this newsletter useful, would you mind sharing it with your friends and colleagues? ❤

IN THIS NEWSLETTER:

Pause for thought

Some good, some bad

Crypto in Asia

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

WHAT I’M WATCHING:

Giving pause for thought

In Tuesday’s newsletter, I talked about the best-, not-so-terrible- and worst-case scenarios for Powell’s FOMC statement and press conference, delivered yesterday.

We got something pretty close to the best-case.

Powell insisted that rate hikes were not being considered, but that rate cuts would most likely take longer to get consensus. The FOMC will continue to be “data-dependent”, no surprise there, and is keeping a close eye on employment data (its other key mandate). And you’ll be pleased to hear that the Fed is convinced that its policy is restrictive (despite plenty of evidence to the contrary).

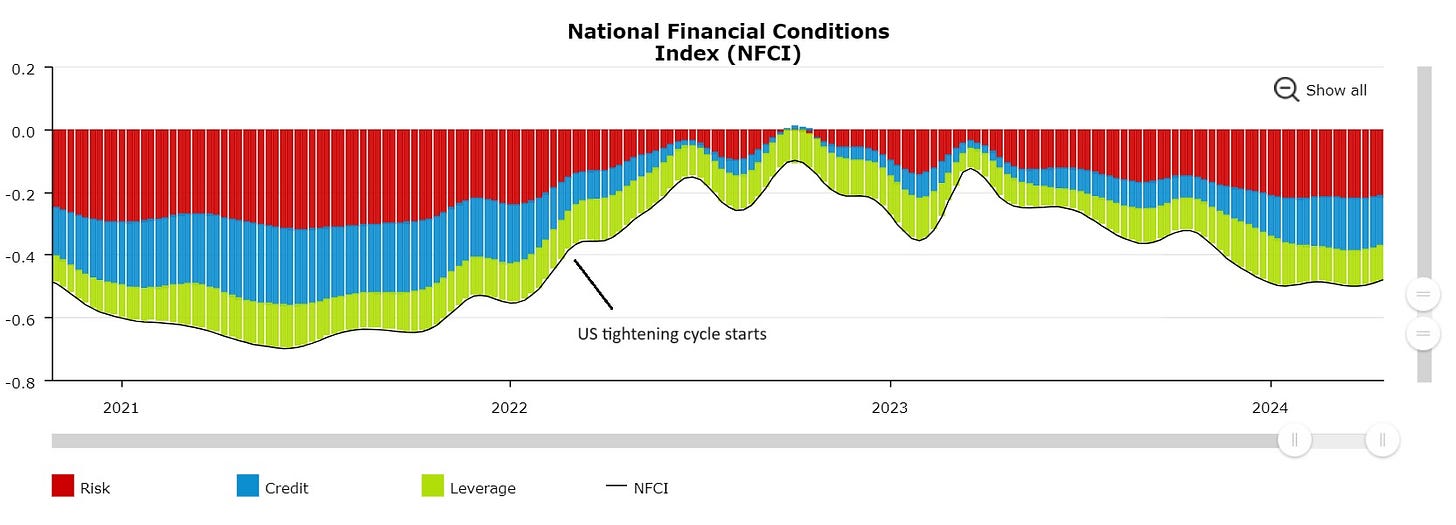

(chart via the Chicago Fed)

All that is reassuring, but there were some worrying signs, mainly in what Powell didn’t say: in March, his opening statement signaled rate cuts “at some point this year” – there was no such phrase this time. Also, in March, Powell said: “we believe that our policy rate is likely at its peak for this tightening cycle”. That was absent in yesterday’s statement.

Also, the Fed announced a tapering of its quantitative tightening program, in which proceeds from maturing treasuries are not reinvested, effectively shrinking the size of the Fed’s balance sheet. As of June, the limit on the amount of roll-off will be more than halved, from $60 billion a month to $25 billion, a larger reduction than most had been expecting. This should lend some support to the market, in that the Fed will not be as strong a net “seller” (counting not reinvesting matured bonds as selling).

Meanwhile, however, economic data continues to send conflicting signals.

Yesterday, we got the latest read from the ISM manufacturing activity indicator, which dropped back into contraction territory after signalling expansion last month for the first time since 2022. Even more worrying, inflationary pressures from the manufacturing sector picked up, with a much higher read on the prices index than economists had been expecting. So, slowing activity with rising prices? One of my favourite moments from Powell’s press conference yesterday was when he said: “I’m not seeing any stag and I’m not seeing any flation.” 😂

And the ISM manufacturing employment gauge came in higher than expected, although lower than the previous read and still in contraction territory. Employment in manufacturing may be relatively soft, but it’s not weakening as much as expected.

Also, the number of posted position openings and the quits rate (the number of people who have voluntarily left their jobs) both dropped in March, with the latter reaching the lowest since August 2020. This suggests a weaker employment market with a lower rate of hiring, and less confidence from workers in a job that they will get better conditions elsewhere.

On the other hand, employees on average are earning more. On Tuesday, we got the quarterly Economic Cost Index, which measures salaries and benefits, providing a broad indicator of wage inflation. This came in at 1.2%, the most in a year and notably higher than both the expected 1.0% and Q4’s 0.9%. Wage growth, a key driver of inflation, is still strong.