A CBDC alternative to SWIFT?

Plus: a market overreaction?, CBDC avoidance and US CDS

“One thing that’s missing but will soon be developed is a reliable e-cash, a method whereby on the Internet you can transfer funds from A to B without A knowing B or B knowing A” – Milton Friedman, 1999 ||

Hello everyone, and a belated welcome to November! Terrifying to think that there are only two months left in 2023.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now, with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

IN THIS NEWSLETTER:

Refreshing over-reactions

A CBDC alternative to SWIFT?

US debt confidence

Little retail interest in CBDCs

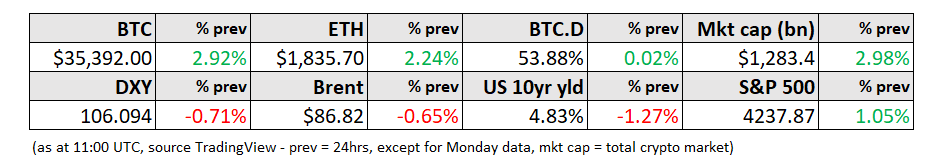

WHAT I’M WATCHING:

Well, that was refreshing

Risk sentiment seems to be back, which is perplexing. The FOMC statement and press conference yesterday seems to have gone down well with markets around the world, even though the economic outlook is not much different today than yesterday or the day before.

True, there was some relief in the release of the Treasury’s auction calendar, with less issuance in the long end than expected. But there’s still a hefty amount of issuance at the long end, which will keep the interest rate bill and therefore the deficit high.

And, true, the ADP employment data for the US came in lower than expected, which suggests that the rate hikes might finally start to have an impact on consumption and thus bring inflation down further. But yesterday’s ISM manufacturing data was much worse than expected, which signals a slowdown. That does not bode well for earnings.

So, I’m struggling to see the risk-on message in yesterday’s news and comments.

My takeaways:

Rate cuts are still a long way off – at one stage, Powell said: "the question of rate cuts just does not come up"

There seemed to be less emphasis on the “rebalancing” of the labour market, which is necessary in order to ease inflation pressures.

Powell did seem to signal that a rate hike in December is much less likely, even though the Summary of Economic Projections released in September has one more as the consensus forecast from Fed officials. A few times he stressed that the projections are more forecasts than a plan. But this is not a surprise – the futures market had been pricing in a low likelihood of this anyway.

And language used by Powell and the FOMC statement suggest that the Fed is looking to long-term Treasury yields to do some of the tightening work for them. In other words, another rate hike is less likely if yields stay high. Well, yields dropped sharply yesterday. The 10-year US treasury yield dropped below 4.7% for the first time since mid-October. This is great news for liquidity conditions and stock valuations. But if yields drop much further and markets along with consumer confidence rebound, the Fed may be back to talking up the possibility of another hike again.

(chart via TradingView)

So, I confess that I don’t see what the markets are so happy about. But, I’ll enjoy it while it lasts!

Bitcoin gave us some wild swings yesterday, which is an encouraging sign that volatility is coming back.

(chart via TradingView)

And, according to a report from CoinDesk yesterday, Jane Street, Virtu, Jump Trading and Hudson River are in talks to be BlackRock ETF market makers, responsible for creating and redeeming the BTC ETFs. If true, this suggests that the big-name liquidity providers will be coming back into the bitcoin market. That would be very good news.

A CBDC alternative to SWIFT?

Stepping back from markets, today I want to highlight one of the most intriguing central bank digital currency (CBDC) trials currently ongoing: the mBridge project.

There are more ongoing cross-border CBDC trials with cute names than one can possibly keep track of (Cedar, Icebreaker, Jasper, Mariana and many more). But the mBridge project stands out for the following reasons:

It is designed to bypass the US dollar-based global financial system

It involves 23 central banks, including the BIS

It is almost ready to go live

Assuming it meets its target schedule, mBridge is set to become the first functioning blockchain-based payment platform involving official entities. Its nucleus is in Asia, but organizations from all continents are also involved. And while it is unlikely to knock the dollar off its global reserve currency perch, it could end up impacting international flows, trade agreements and the power of sanctions.

Let’s dive into the where, why and what of mBridge:

CBDC frictions

Wholesale CBDCs (which involve the exchange of value between banks, rather than between people) have often been touted as a potential solution to the frictions of cross-border trade. These include transaction costs, currency illiquidity, opacity and documentation.

The problem is, the frictions are often due to differences between systems, both financial and commercial. Changing these systems, many of which are deeply embedded in a country’s economic governance, is going to be difficult, to say the least, especially since there is as yet no agreement on how they should change. Even if governments are convinced that a wholesale CBDC is in their best interests, any application would require profound modifications to accounting and documentation processes.

As yet, there are no unified regulatory frameworks. What’s to guarantee that a CBDC from one jurisdiction will be treated as “good money” by another? How can the CBDC of one country spread through the financial system of a trading partner? If it can’t, how would swaps work? Beyond bank processes, which laws need updating? And, obviously, all trading partners agreeing on one common token is probably out of reach, given the potential impact on local currencies.

That doesn’t mean we won’t get regional alliances, however – trading partners that see the advantages of a common payment platform that not only removes frictions, but also bypasses the SWIFT choke-hold on global finance. Right now, most cross-border payments rely on SWIFT messaging to coordinate payments. The dependence is such that being shut out of SWIFT is pretty much the same as being shut out of global trade. SWIFT is one of the key tools in the US sanctions box, since – even though the platform is based in Brussels and is jointly owned by more than 2,000 banks – it is largely controlled by the US.

Do it together

One such alliance worth watching is mBridge. It officially launched in 2021 as a joint venture between the innovation arm of the BIS (the official global organization for central banks) and the central banks of Hong Kong, China, Thailand and the UAE, specifically to test the viability of central bank digital currencies (CBDCs) for cross-border trade. The key aim is to streamline payments between commercial banks in different jurisdictions by connecting them to a network co-managed by their central bank.

Beyond the use case of cross-border trade, the project has been working with commercial banks (including all the large Chinese institutions, Goldman Sachs, HSBC, SocGen and others) as well as exchanges to trial blockchain-based security issuance, multi-jurisdiction insurance payments, programmable trade finance, FX settlement and more.

Earlier this week, the BIS published an updated document on mBridge showing that, in addition to the five principal participants, 25 other official entities have signed on as observers. These include the IMF, the World Bank and the central banks of 23 countries, including Saudi Arabia, Turkey, South Africa, Namibia, Malaysia, France, Italy, Norway, Chile, Australia… every continent has representation. Even the US central bank is present, via the Federal Reserve Bank of New York. The European Central Bank is also in the group. Observers have access to a “sandbox” for experimentation. According to the BIS, 11 have been taking advantage of this.

Until recently, mBridge was running on a proprietary blockchain based on Ethereum’s Solidity language (which might imply some compatibility?) and developed “by central banks for central banks”, unlike other initiatives that run on blockchains built by third parties.

A couple of weeks ago, Chinese press reported that mBridge was transitioning to the Dashing protocol, which was developed by the PBoC’s Digital Currency Research Institute and Tsinghua University (affiliated with and funded by the Ministry of Education of China, and President Xi Jinping’s alma mater). I don’t know what language Dashing uses, but apparently it achieves higher scalability and lower latency.

This is significant in that it highlights just how much mBridge is a Chinese project, with international add-ons. China is the main trading partner for all the other key participants, and the UAE has been making moves to also deepen its investment and military relationship with the region. The UAE central bank representative on the project, Shu-Pui Li, spent 17 years at the HKMA. And the CEO of the UAE’s principal sovereign wealth fund is also the Presidential Special Envoy to China.

The blockchain does seem to be relatively decentralized. Each participating central bank operates a validator node which participates in establishing network consensus. Commercial banks will be able to operate non-validator nodes.

Polishing the details

Last month, the Hong Kong Monetary Authority said that it would go “live” with a minimum viable product (MVP) next year. What’s more, Chinese press has reported that Tencent (owner of the ubiquitous WeChat app) will be involved.

The mBridge project is much more than a few organizations tinkering with tokens and addresses. The project has committees focused on key issues such as the legal framework, the policy implications, governance, redemption terms, ownership rights, AML compliance. It is leagues ahead of most other cross-border investigations, and is moving forward while the US is using CBDC resistance as a way to score political points.

Stepping back, this is not surprising. The US already dominates the global financial landscape, it has no incentive to design a new system. It is happy with the current one. China, on the other hand, has long been working to expand its economic reach beyond its borders – with smoother and broader trade comes greater global influence. Throw in a growing number of countries struggling to obtain enough dollars to pay for imports, as well as many concerned about the fracturing geopolitical landscape that could see the current system become even more weaponized, and you get a simmering and widespread demand for an alternative.

There is a chance mBridge is not that alternative. China’s heavy influence in the group may deter some. And even if not, it’s possible that it doesn’t get much traction. But even if the use remains geographically limited to China and its main trading partners, that’s still potentially a lot of volume. And China already has a functioning CBDC that could make the initial launch smoother.

The exact timing of an mBridge launch is unclear – Hong Kong’s claim it will be next year feels ambitious. It’s a daunting task as the pieces are fragmented, complex and changing. But mBridge’s development is far along, its launch will happen, and when it does, we will have yet another strong sign that the established balance of power is shifting.

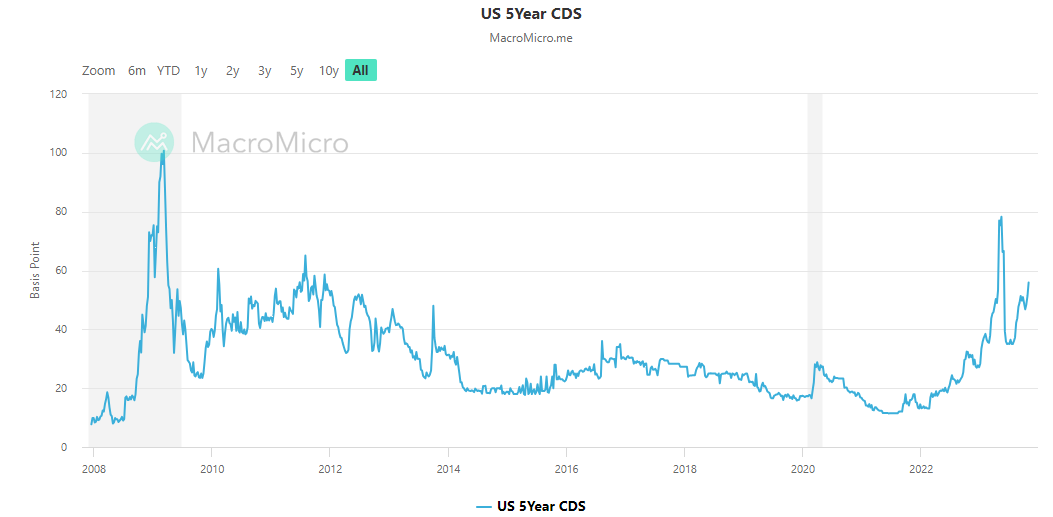

#uh-oh

The price of credit default insurance on US government debt is not where it was during the May debt ceiling crisis, nor is it near where it was at the height of the 2008 financial crisis, but it IS heading up – this does not transmit confidence.

(chart via MacroMicro)

#crazy

A survey by the Bank of Spain/Ipsos asked respondents how they feel about a “digital euro”, or EU CBDC:

Only ~20% knows what one is (same as in 2022)

65% said they would not use one, no way, don’t see the need (up from 58% in 2022)

Only 4% said they would be willing to use it *instead of* cash (down from 8% in 2022)

Only 3% said they would be willing to use it instead of online bank payment

A big surprise: almost 50% of 18-25yr olds use cash daily! Would have thought it’d be less.

ALSO:

In China, Halloween is not just about dressing up in scary costumes – some use it for subtle social protest.