Thursday, Sept 14, 2023

regulatory overreach, and the non-reaction to CPI

“Well, all information looks like noise until you break the code.” – Neal Stephenson ||

Hi everyone! I hope you’re all well, and I appreciate your being here.

You’re reading the premium daily version of Crypto is Macro Now. In this newsletter, I give some depth on factors I’m keeping an eye on that highlight the growing overlap between the crypto and macro landscapes – my focus is on how crypto is affecting the global economy, and vice versa. There is often a market discussion as well. Nothing I say is investment advice!

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now (I will be raising prices in the autumn), with a free trial – the price of two cups of coffee in NY!

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER

CPI: Just what we thought

The SEC goes after creators

Regulating DeFi

WHAT I’M WATCHING

CPI: Just what we thought

Yesterday’s US CPI data came in slightly worse than expected – the index came in as expected for August with a month-on-month rise of 0.6% vs July’s 0.2%, but the annual increase was slightly higher than forecast at 3.7% vs July’s 3.2%. Month-on-month core CPI inflation, stripping out energy and food prices, was also slightly higher than expected at 0.3% vs July’s 0.2%.

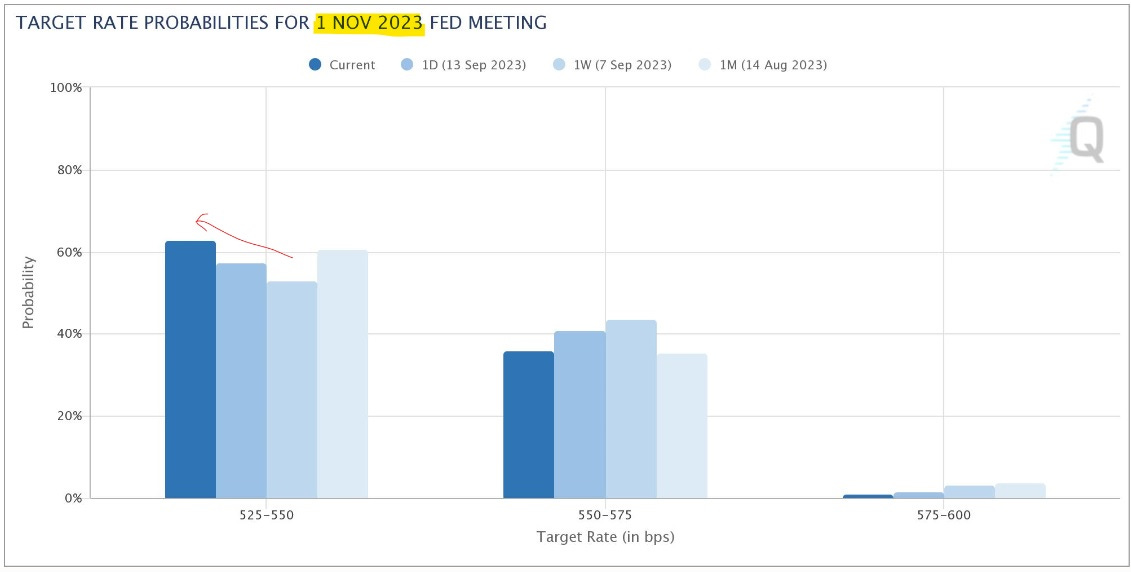

This reinforced market conviction that we’re at peak rates: a pause at next week’s FOMC meeting is pretty much a lock-in (at 97% probability), but the likelihood of a pause at November’s meeting moved up to 63% from 53% just a week ago. Not conclusive yet, but signaling that the swaps market didn’t think the inflation bumps were anything to worry about.

(chart via CME FedWatch)