Thursday, Sept 28, 2023

BTC surprisingly resilient, ETH outperforming, stocks wobbly, things are weird

“When a thing ceases to be a subject of controversy, it ceases to be a subject of interest.” – William Hazlitt ||

Hi all! Good to be back! It was an interesting couple of days conferencing at the Stellar Meridian event here in Madrid, but I confess I’m out of practice… Fascinating, stimulating, but it’s a relief to be back at my desk and focusing on screens and narratives and data, which says a lot about my social life I guess.

I will say that I was very impressed with the Stellar community and their focus on impact rather than price speculation. This is very relevant for the crypto-macro overlap I focus on, and I’m looking forward to seeing the results of the rollout of their smart contracts and disbursements platform. Payments matter. They need to involve less friction and offer greater transparency.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but nothing I say is investment advice!

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now, with a free trial – the price of two cups of coffee in NY!

May I suggest you tune in to the CoinDesk Markets Daily podcast, which I am now hosting?

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER:

Things are getting jittery

…yet the BTC price is surprisingly resilient

…and ETH is starting to outperform – perhaps because of the ETFs?

“Soft landings” in 2007

SEC overreach

Economic orthodoxy is crumbling (again?)

WHAT I’M WATCHING:

Things are getting jittery

Historically, September has been the worst month for the S&P 500, with an average performance since 1979 of -1.1%. So far this month, the index is down 5.2%.

(chart via Yardeni Research)

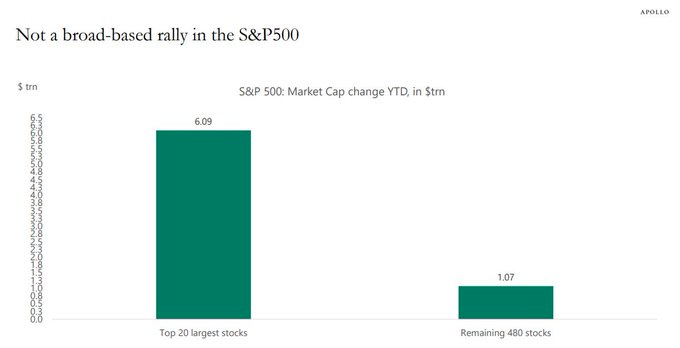

Is this a dip before resuming its rally? I think not. The S&P 500 has been kept buoyant by the strength of a few stocks. According to The Kobeissi Letter, the top 20 stocks in the S&P 500 have accounted for 85% of the index’s performance so far this year. That’s a dangerous level of concentration, and has largely been driven by tech hype which, as we have seen many times, tends to get overblown and then deflate.

(chart via @KobeissiLetter)

Also, the S&P 500 earnings yield (the inverse of the price/earnings ratio) is now almost at the same level as the US 10-year treasury yield, despite having much more risk! Not only is this likely to tempt more investors to move from stocks into bonds, it is also a clear signal that stocks are overvalued. The current spread is even narrower than in 2007.