Trade optimism boosts overconfident markets

Plus: CPI, economic activity, geopolitics and more

“The reason most people fail instead of succeed is they trade what they want most for what they want at the moment.” – Napoleon Bonaparte ||

Hi everyone! I hope you all had a great weekend. Here in Europe we changed our clocks yesterday, so I will do my BEST to get the newsletter out earlier so as not to miss my 9-10amET goal. It’s not nearly as easy as it sounds, let me tell you, there’s always so much I want to include.

My latest op-ed in American Banker (paywall, sorry) looks at how stablecoins’ lack of fungibility is changing our understanding of what money is, from something that meets certain characteristics to something that does things, from stasis (being) to doing (action) – this in turn shifts our mindset about money innovation going forward.

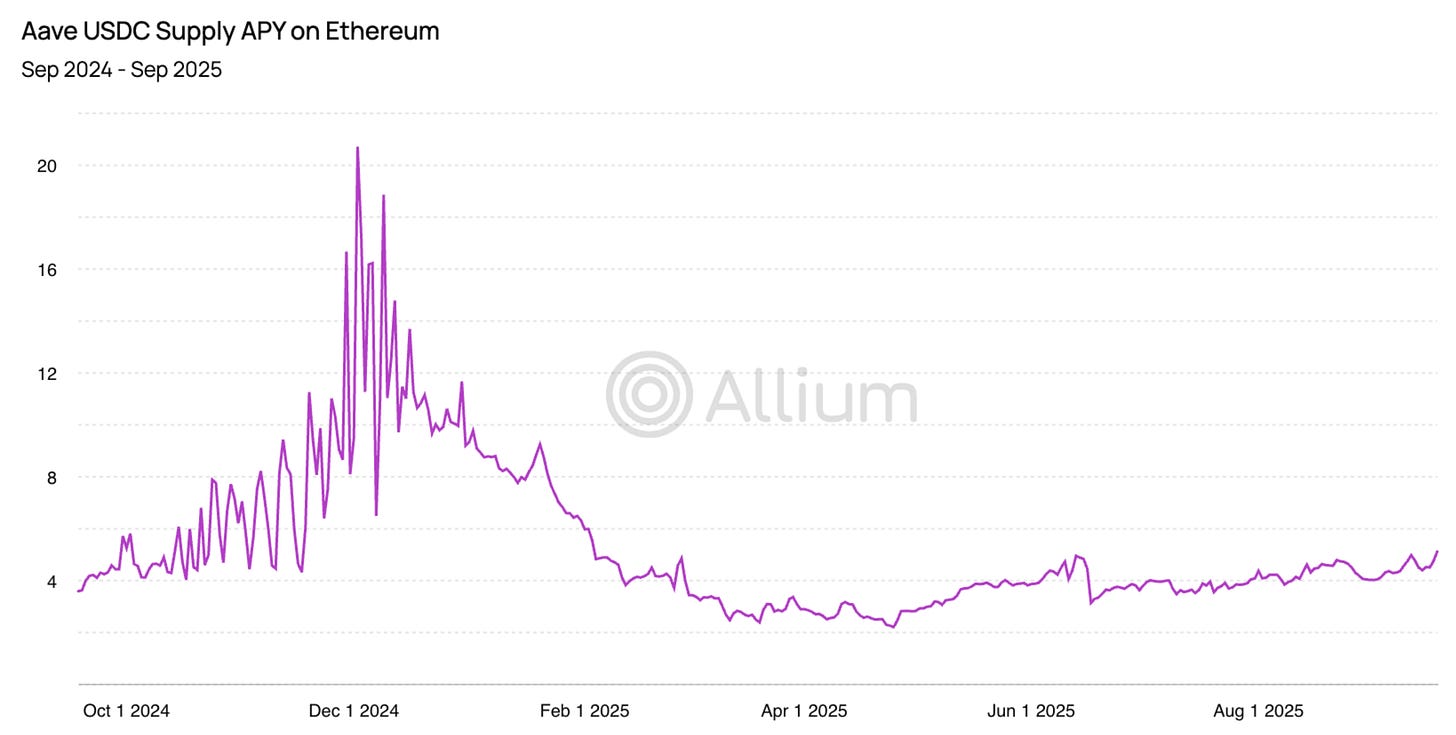

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Trade optimism

Macro-Crypto Bits: institutional stablecoins, CPI, PMI, market celebration

Also: CFTC nomination, Asian politics and more

WHAT I’M WATCHING:

Coming up:

Yet another week with scant economic data, but heavy on geopolitics and market movers:

Over the next few days, we can expect news on trade and alliances as nations gather for the ASEAN summit in South Korea.

President Trump arrived in Japan earlier today, has already met with Emperor Naruhito and will meet with Prime Minister Sanae Takaichi – we can assume security alliances and trade are on the agendas.

On Tuesday, we get the US Conference Board consumer confidence data, which is expected to deliver the third month of decline.

On Wednesday, the Dutch go to the polls to elect a new government after Geert Wilders’ far right party failed to gain sufficient coalition support.

And the FOMC releases its decision on the federal funds rate, almost certain to be a 25bp cut. Chair Jerome Powell will deliver a statement and answer (or dodge) press questions about why they are doing this despite a data blackout with the government shutdown, and amid signs inflation is sticky.

Also on Wednesday, Meta, Alphabet and Microsoft report Q3 earnings.

On Thursday, Trump meets with President Xi Jinping in South Korea.

The Bank of Japan meets to discuss the economy and interest rates – no move is expected for now.

And Apple and Amazon report Q3 earnings.

On Friday, China releases updated manufacturing activity data via the Purchasing Managers Index data – this is expected to show a slight slowdown, moving further into contraction territory. We also get Chinese services activity data, expected to show futher expansion.

Trade optimism

So far, President Trump’s trip to Asia has delivered good news for markets. After a series of pre-summit meetings between the US and Chinese trade negotiators, US Treasury Secretary Scott Bessent said in an interview that: