Tuesday, Apr 11, 2023

NEW FORMAT! Plus, the BTC price! And the evolving “insurance” narrative, ETH unlocks, crypto politics and more.

“The most difficult thing is the decision to act, the rest is merely tenacity.” – Amelia Earhart ||

Hi all! I hope those of you that managed to take a long weekend enjoyed some quality time doing what energizes you.

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Since many of you are new here, I’ll introduce myself again: I’m Noelle, and I’ve been writing crypto-focused newsletters for almost seven years now, first for CoinDesk and more recently as Head of Market Insights for Genesis Trading. Now that I’m focusing on an independent research project, it felt only natural to continue. Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider hitting the ❤ button at the bottom and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would really make my day. 😊

NOTE: Some more formatting changes! To hopefully make this more useful and punchier, I’ll open with a few short points on things I’m watching before diving into a longer-form market ramble commentary. And the “A Year Ago Today” section will move to the weekly. Feedback welcome!

WHAT I’M WATCHING

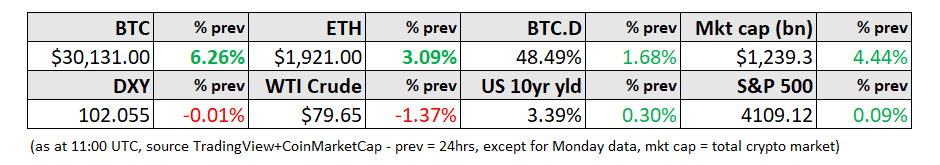

The BTC price! Above $30,000 and holding! This is a strong psychological boost as well as a welcome relief to miners and holders with underwater positions, and the move could start to bring in the momentum chasers. It’s US tax week, however, which could deliver some selling. More on this below.

Narrative intensification: hard on the heels of a banking crisis which reminded everyone that accounts are not necessarily safe, we have an NYT article about how banks can (and do) close accounts without explanation or recourse. The “insurance” narrative is developing more layers. More on this below.

Crypto politics. Democratic presidential candidate Robert F. Kennedy Jr. published a thread yesterday taking issue with the administration’s hostility toward cryptocurrencies. The tweet is a bit incoherent and Kennedy’s candidacy is not (yet?) taken seriously, but it highlights the potential role crypto will play as a platform in the upcoming elections.

A growing market. The bitcoin price now appears in search results on Douyin, China’s version of TikTok, which has approximately 700 million daily active users. For scale, that is more than double the entire population of the United States. On top of China’s implicit support for Hong Kong’s evolving crypto regulatory framework, this signals growing acceptance of crypto assets in a potentially massive market that has a different cultural approach to speculation than more conservative Americans and Europeans. (NOTE: As I was about to hit “Publish”, @alex_dreyfus informed me via Twitter that the price ticker had been removed. So, perhaps not the signal I thought, but still worth commenting on.)

One more hike. CME futures are now pointing to consolidating expectations of an interest rate hike at the next FOMC meeting, but that this will be the last one. I’ll talk more about this tomorrow, along with CPI expectations, since today’s email is already kind of long.

MARKETS

A new phase

Well, that’s nice to see! Earlier today, BTC broke through $30,000 for the first time since June of last year, and at time of writing seems to be holding. Technical analysts had been saying a breakout was imminent and it looks like they were right, and the slope of yesterday’s jump to above $29,000 suggests that it was triggered either by a large order hitting a thin order book, or a short squeeze. The key part of this leg of the story is that the price then held for a short while before climbing further, suggesting that profit takers had no problem finding willing buyers and that new interest is starting to come in.

(chart via TradingView)

We know by now that BTC’s price is one of its best advertisements (not particularly idealistic, but it is what it is), and so far today I have had a few non-crypto people reach out to ask what’s going on. A move up could easily trigger a much stronger move up, since 1) the market is still relatively thin compared to a year ago as some key market makers have withdrawn or scaled back, and 2) many investors missed the last rally and won’t want to have to explain why they missed the current one.