“When you are wrestling for possession of a sword, the man with the handle always wins.” – Neal Stephenson ||

Hi everyone! I had hoped to get in a recording of the newsletter before having to dash out the door for a commitment, but a tech issue means that’s not going to be possible, sorry! Today’s edition is also slightly shorter than usual, for the schedule squeeze. But I cover some interesting stuff, with more to come!

IN THIS NEWSLETTER:

Markets signal new tension

Conservative banking and crypto

Sounding the privacy alarm

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content. And there’s a free trial!

WHAT I’M WATCHING:

Markets signal new tension

Sigh. I miss the days when an active consumer was good for markets.

Yesterday’s US retail sales data for March came in much stronger than expected. Core retail sales for March grew 1.1% month-on-month, the steepest jump in over a year, and more than double the consensus forecast. Yikes. What’s more, the core retail read for February was revised up, to double the original 0.3% month-on-month climb. It turns out forecasters last month weren’t too optimistic in consumer strength after all.

(chart via Investing.com)

This understandably pushes rate cut expectations even further back, with the CME-priced odds of at least one rate cut by July down to 50%, from 75% just a week ago.

(chart via CME FedWatch)

The US bond market was not too happy with this, and 10-year yields surged past 4.6% for the first time since last November.

(chart via TradingView)

The stock market didn’t like it either; Nasdaq closed down 1.8% on the day, the S&P 500 lost more than 1% for the second consecutive session, and both broke below their 50-day moving averages, which apparently means something to chart watchers.

(chart via TradingView)

And BTC again became a macro asset, dropping along with pretty much everything else.

(chart via TradingView)

Let’s go back to the bond yields for a second: the last time the US 10-year yield was above 4.6%, the S&P 500 was at 4407, 13% lower than today. And BTC was at $39,900 almost 40% down from the current level. Something feels off.

(chart via TradingView)

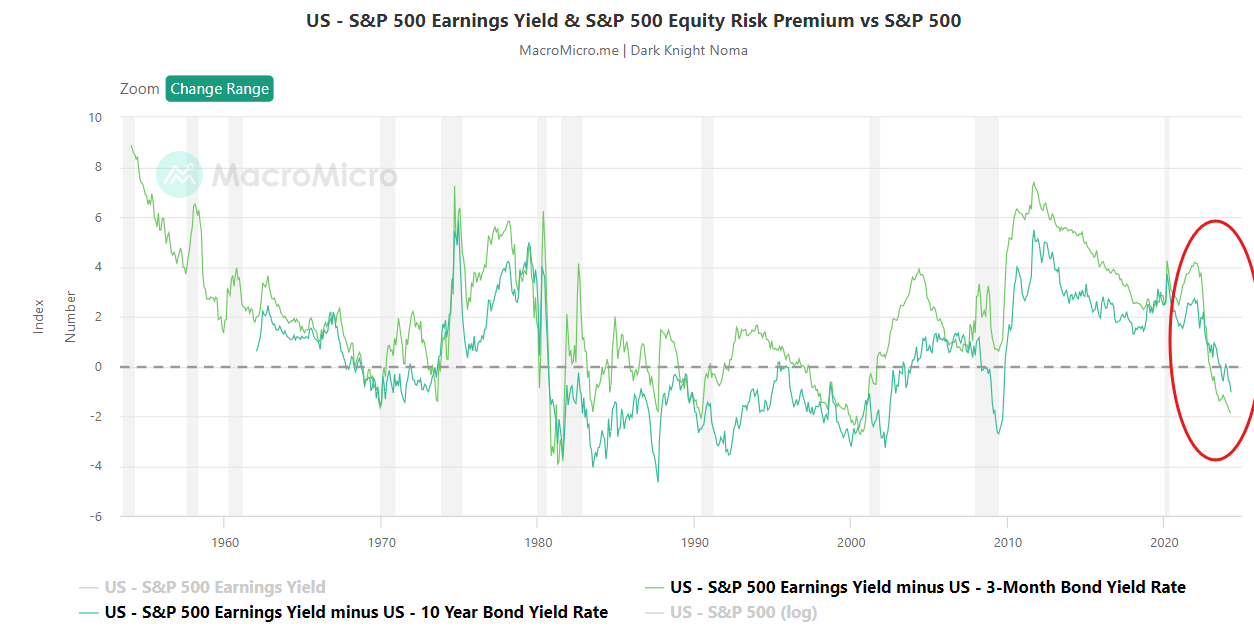

What’s more, take a look at this: the earnings yield on the S&P (EPS/price) is now below that of both 3-month and the 10-year US treasuries. It should be higher, to compensate for the higher risk implicit in owning stocks rather than bonds. The market is now signaling that it thinks US government bonds are riskier. The last time this happened was in 2001.

(chart via macromicro)

None of this feels sustainable, but it’s not clear what will break first.

My expectation is that it is the stock market (although I’ve been saying this for a while, and I’ve been wrong). If that drops sharply, BTC and other crypto assets could get temporarily hit as well. The crypto drop would be short-lived, though, as other ongoing narratives – store of value, halving, currency hedge, new use cases, growing adoption – will encourage accumulation at lower levels.

In what could be a sign of trouble brewing, the VIX index – an indicator known as the “fear” gauge that tracks options-priced volatility expectations – is surging, now at its highest since last October.

(chart via TradingView)

That is also when US treasury yields were last at current levels. Coincidence?

Conservative banking and crypto

When thinking about global financial innovation (which I’m sure you all do often, right?), Germany is not usually the first jurisdiction to come to mind.

As well as a struggling manufacturing sector and messy politics, Europe’s largest economy is known for its conservative and rigid financial sector dominated by banks rather than by markets.

It is, therefore, somewhat of a surprise to see its banks lead Europe in the exploration of an entirely new type of market.

Keep reading with a 7-day free trial

Subscribe to Crypto is Macro Now to keep reading this post and get 7 days of free access to the full post archives.