“Almost every wise saying has an opposite one, no less wise, to balance it.” – George Santayana ||

Hi all! I hope those of you fortunate enough to enjoy a long weekend made the most of it, and reconnected with things that energize you. Welcome to April, welcome to Q2, and welcome to what will probably end up being a new market phase once today’s correction is absorbed.

IN THIS NEWSLETTER:

The BTC drop: how bad is it?

Short-term macro BTC drivers not looking good

Longer-term macro BTC drivers still strongDR

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content. And there’s a free trial!

WHAT I’M WATCHING:

The BTC drop: how bad is it?

The almost 4% drop in the BTC price earlier today in just 15 minutes is not an auspicious start to the week/month/quarter for those of us who enjoyed a holiday yesterday.

(chart via TradingView)

As I type, BTC has made a few feeble attempts at rallying, but has largely drifted even lower, breaking below $66,000 for the first time in over a week.

Sharp drops in the most liquid of crypto assets are always interesting (even if discomforting) for what the reactions say about market expectations.

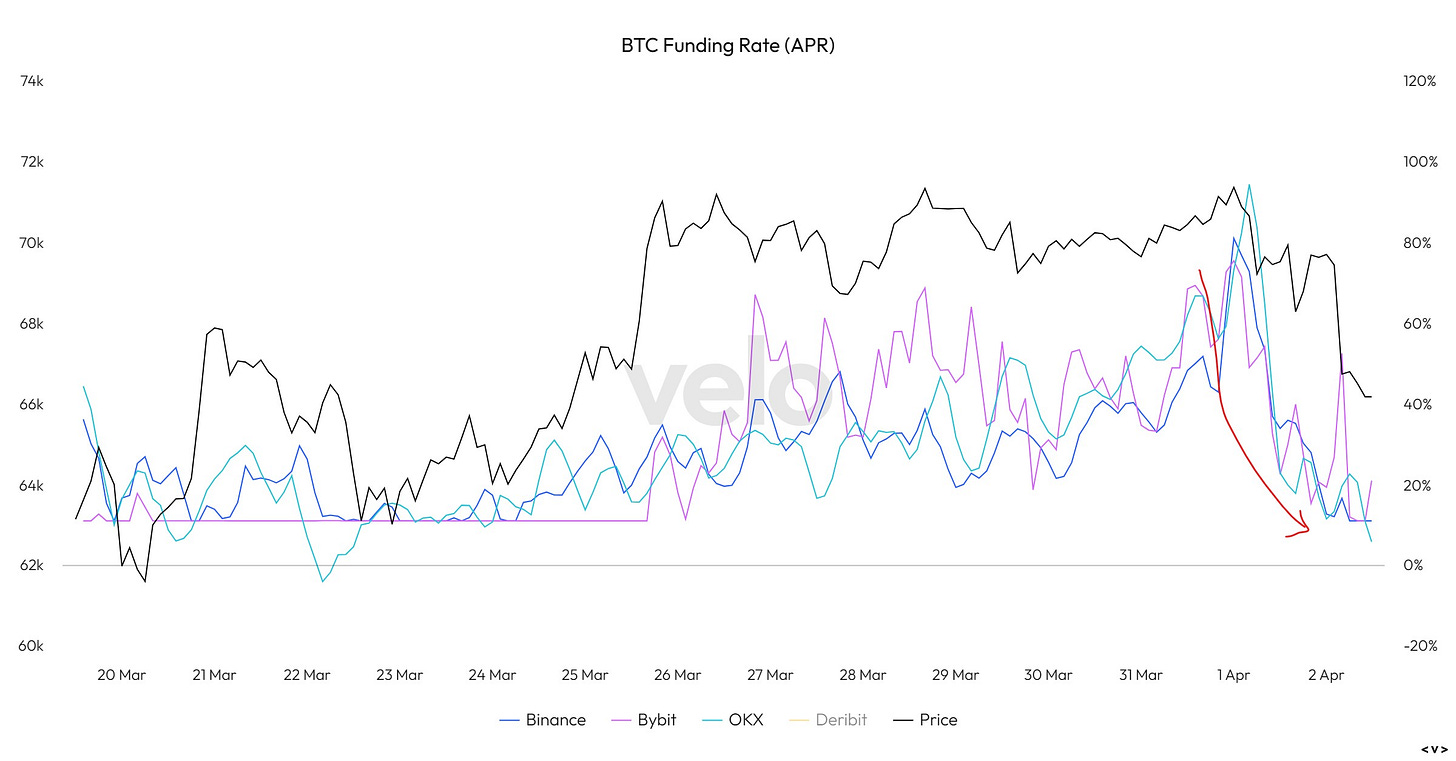

On the one hand, the derivatives market was signaling a move was coming. Yesterday, the funding rate on BTC perpetual futures (an indicator of trader sentiment) started dropping, unwinding the build-up over the past week. (More below on why I think this happened.)

(chart via velodata)

In the BTC options market, 1-week skew started turning more bearish on Sunday – this indicator measures trader preference for puts over calls, and when it is heading up, positioning is turning more defensive.

(chart via velodata)

So, for many, this correction was a matter of time as a sentiment shift made a liquidation event more likely – as margined long positions move swiftly to close out exposure, this triggers automated long position liquidations, exacerbating any price move.

These tend to be especially painful in times of high leverage. Over the past few weeks, BTC futures open interest has surged, consistently breaking through new all-time highs since early March. In sum, the market was ripe for a derivatives-triggered correction.

(chart via coinglass)

On the other hand, a large segment of new BTC investors are probably not prepared for this kind of volatility: spot ETF buyers. It’s one thing to be warned about an asset being volatile, but to actually see it happen is something else, especially if you bought it as a “store of value”. It’s possible the drop could weaken mainstream interest, at least in the short-term.

What’s more, the correction happened outside of US ETF trading hours. I’ve written before about how the biggest risk to the market from the success of the ETFs was the limited window in which to transact. This could exacerbate market moves by piling up redemption orders on the open. Or, it could work as a “cooling off” period – rather than panic sell as many traders are tempted to do in the face of sharp drops, ETF investors could react to the ~5% fall when they check their screens in the morning by shrugging their shoulders and deciding it’s too late to avoid the hit, so they might as well sit it out. We’ll find out later.

Short-term macro BTC drivers not looking good

One of the reasons for the shift in BTC sentiment that triggered this morning’s drop almost certainly related to a move in US rates expectations, delivering yet another reminder that BTC may be a “store of value” to many, but it will also always be a macro-sensitive asset.

There were no surprises in Friday’s US PCE data for February (which itself is not a surprise, since it is calculated using the same dataset from which CPI and PPI are derived) – the core index increased by 0.3% month-on-month, 2.8% year-on-year, both slightly lower than the previous figure. What’s especially notable is the upward revision in January’s core PCE move, which we now know grew by 0.5%, more than the originally reported 0.4%.

The slight deceleration is good news, but not enough to trigger a rate cut in May, and June is looking doubtful. There are two more sets of inflation data due before the June FOMC meeting, but chances that they will deliver nice downward surprises are unfortunately slim.

Keep reading with a 7-day free trial

Subscribe to Crypto is Macro Now to keep reading this post and get 7 days of free access to the full post archives.