Tuesday, Dec 5, 2023

crypto liquidity, SEC troubles, COP hedges

‘A lie will go round the world while truth is pulling its boots on.’ – Old proverb ||

Hello everyone! Thanks so much for reading – I want you to know that I appreciate you all!

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now ($12/month as of January), with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

Programming note: It’s a public holiday where I live on Friday, so this newsletter will take a short break, back in your inbox on Saturday! I also have to miss next Wednesday’s publication. I know, I know, great timing, right?

IN THIS NEWSLETTER:

Crypto “liquidity” is climbing

The SEC is in legal trouble

COP28 and the global balance

WHAT I’M WATCHING:

Crypto “liquidity” is climbing

Monetary liquidity is not the only type of funds flow that matters for the crypto market. A related but separate and arguably equally as important metric is the total amount of money in stablecoins.

This matters because dollar-backed stablecoins are still the main trading pair for crypto assets, with almost half based in Tether’s USDT stablecoin.

(chart via CryptoCompare)

So, an increase in the amount of USDT in circulation could be interpreted as an increase in demand for crypto assets. And, whaddyaknow:

(chart via TradingView)

The overall increase is not as steep as it may seem from the above chart, because inflows into USDT have been partially offset by outflows from Circle’s USDC stablecoin – this tends to be more sensitive to interest rates as its user pool is more interested in yield and returns than in access to dollars.

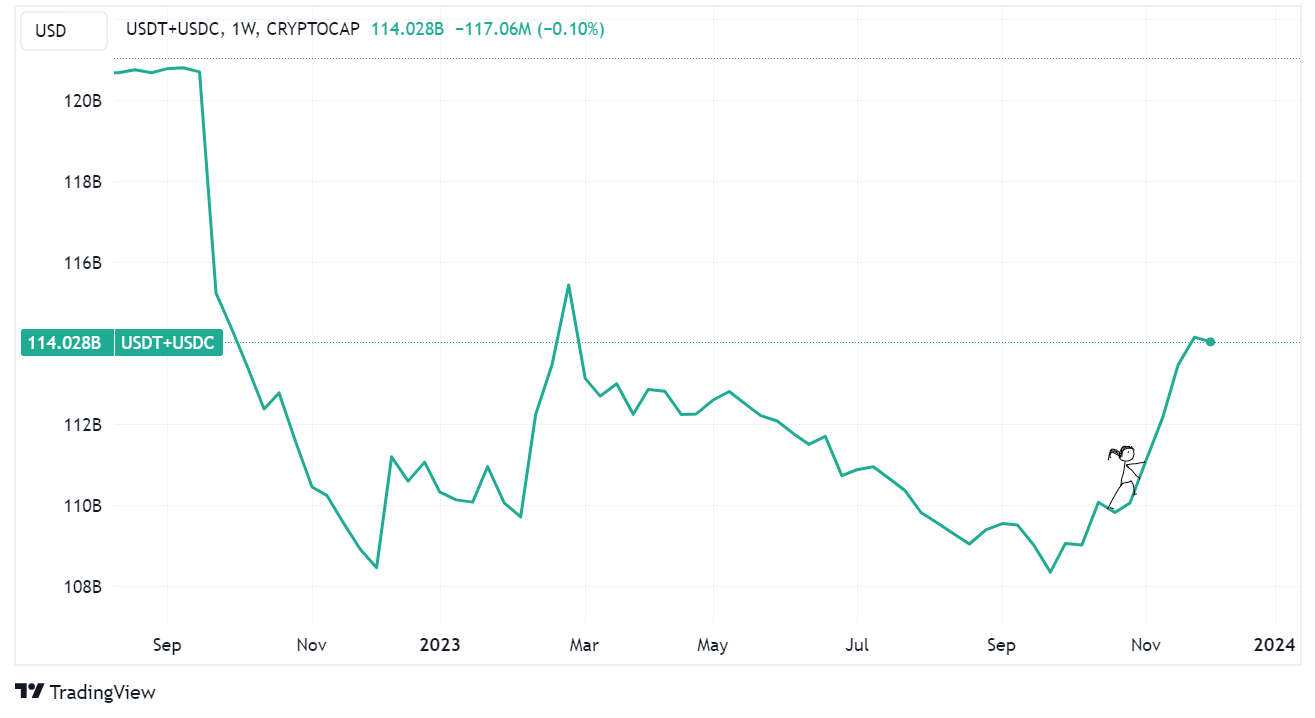

(chart via TradingView)

But the net impact is positive.

(chart via TradingView)

Nevertheless, the moves need to be put into context – the trend seems to be up, which should be bullish for crypto assets as it signals growing investor interest. But, it’s still early as the total stablecoin market cap is still well below levels from earlier this year, when the outlook was arguably much worse than it is today.

(chart via The Block Data)

The SEC is in legal trouble

The SEC could be about to get its knuckles rapped by the Supreme Court of the United States.