Tuesday, Feb 21, 2023

Strong growth indicators driving market jitters, rates expectations on the move, what happens when the war ends, and a couple of intriguing news headlines...

“Tell me and I forget, teach me and I may remember, involve me and I learn.” – Benjamin Franklin ||

Hi all! You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems. Thanks so much for being here! Needless to say, nothing I write is investment advice, or legal advice, or any kind of advice at all. But I hope you find it useful – if so, please consider liking, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day.

MARKETS

Good news bad news again

Today’s weakness in European exchanges and what looks like a soft US opening yet again highlight the still-perplexing duality of economic narratives. European PMI indices for January out this morning beat expectations pretty much across the board with the exception of manufacturing (which accounts for a declining percentage of GDP). Even more significant, in Germany, France and the UK, composite PMI moved from contraction into expansion territory, and in the EU as a whole, it moved even deeper into the positive section (from 50.3 to 52.3, vs 50.6 expected), recording the highest level since June 2022.

(chart via Investing.com)

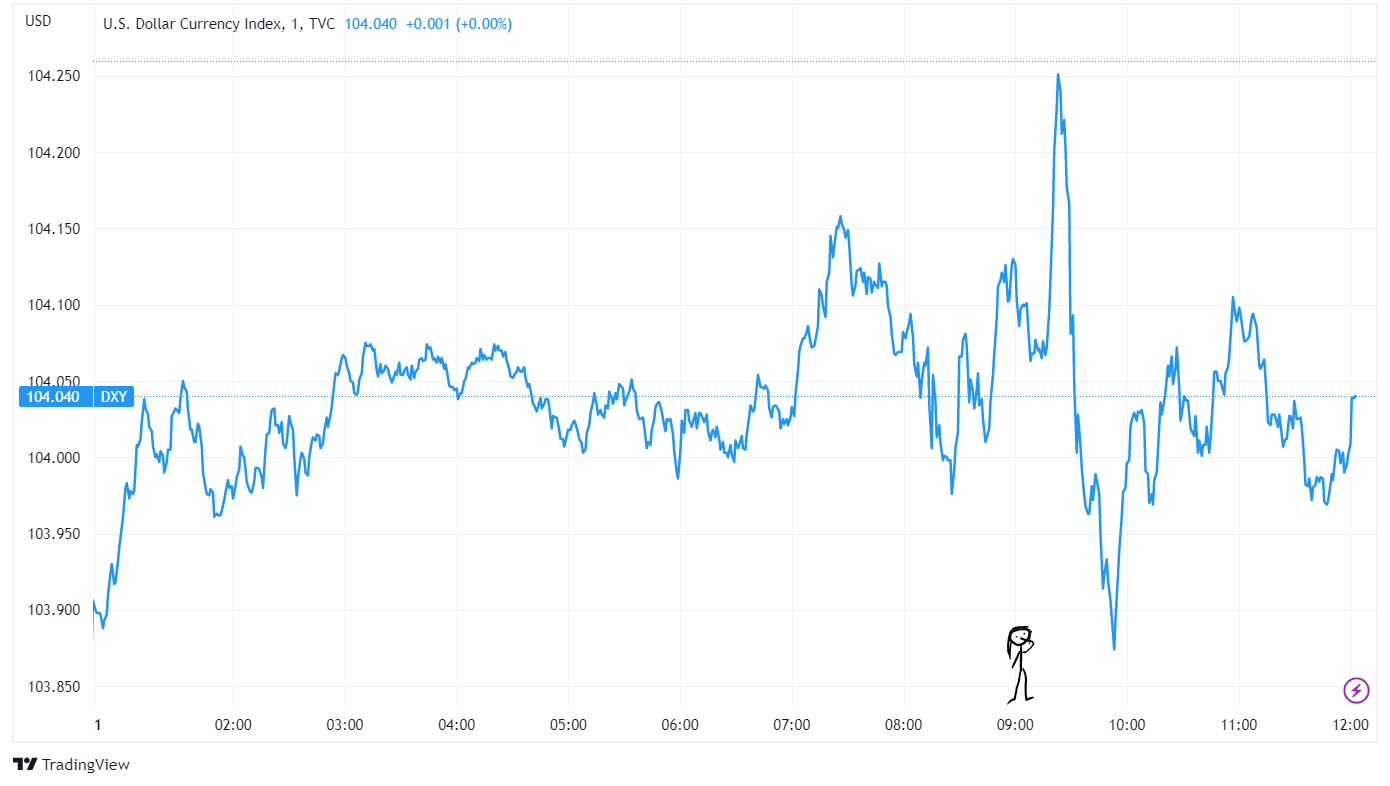

This sends a strong signal that European economies are on the whole doing better than feared, which could mean dollar pressure ahead – the release triggered a sharp wobble in the DXY index as traders extended expectations of EU rate hikes.

(chart via TradingView)

It also signals a potential surprise with the US PMIs out later, although consensus estimates still have the main indices showing contraction: the composite is expected to increase from 46.8 in December to 47.5 for January.

Yet, as expected in these markets, good news is bad news, and rates expectations continue to climb, with Goldman Sachs officially predicting another three 25bp increases over the next three FOMC meetings. A month ago, CME-priced odds favuored a December 2023 rate of 4.25-4.50%; now, the probability of the year ending a full percentage point higher are almost at 30%.

(chart via CME FedWatch)

Bitcoin building

The dollar wobble did not seem to impact BTC’s price, which is unusual. Overnight, BTC continued to creep upwards, and when I checked my phone early this morning (yes, I have become one of those people), it was at $25,000. That did not last long, however, and a sharp drop at around 08:30UTC brought it back to around $24,600, where it had been hovering for most of the past weekend.

This drop does not feel like a sentiment shift, more like a technical adjustment. Call open interest [edited for clarification] is concentrated around the $28,000-30,000 strikes, signalling expectations of further increases.