Tuesday, Jan 10, 2022

“The most important thing in communication is hearing what isn't said.” – Peter Drucker ||

Hi everyone! You’re reading the premium daily Crypto is Macro Now email, where I look at the growing overlap between the crypto and macro landscapes. Nothing I say is investment advice! If you find this useful, please share with friends and colleagues and convince them to sign up to support my work – I’d really appreciate it.

And if you got here from somewhere other than your inbox, or if this was shared with you, I hope you’ll consider subscribing to support my work.

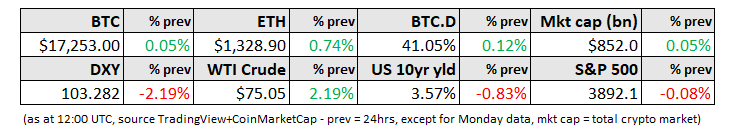

MARKETS

The role of central banks

With leaders from key central banks convening in Sweden this morning, we can expect to get a flood of messaging that focuses on mandate and mission. Key among those relating to mission will be the fight against inflation (more about this below), but mandate issues such as the role of climate change in monetary policy, and the role of monetary policy in the economy will also generate some bigger-picture questions that could help shape the financial landscape of the coming decades. Central banks may seem like remote institutions pulling levers behind closed doors, and to a large extent they are – but they also matter more than most realize to geopolitical alliances via currency moves, and to the disposable income that workers receive.

Arguably, these days it’s much easier to get interested in what central bankers are saying, and I expect Fed Chair Powell’s speech audiences are much larger than those of his recent predecessors. This is unequivocally good, not just because more people are better informed about what central banks do and why it matters, but also because public opinion can go a long way toward holding central banks accountable.

However, this greater familiarity could possibly get in the way of central banks actually doing their job. Familiarity tends to move in the opposite direction to blind faith – the more we know about how central banks work, the more we can criticize with detail. This leads to one of the major problems the US Federal Reserve is facing these days – a lack of trust.