Tuesday, Jan 9, 2024

the significance of the ETF fees, Nigeria's stablecoin, speculator positioning

“Both optimists and pessimists contribute to society. The optimist invents the aeroplane, the pessimist the parachute.” - George Bernard Shaw ||

Hello everyone! Ok, I confess I’m kinda looking forward to this ETF frenzy being over. There, I said it. It’s fun ‘n all, but the noise is getting a bit noisy. Nevertheless, below I talk about the potential significance of the fee war, which I think is overlooked.

(Apologies for the late publication again today, more ER adventures this morning – should be back on track tomorrow!)

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER:

Nigeria’s stablecoin experiment

The significance of ETF fees

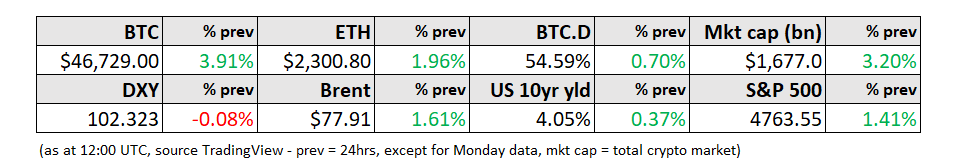

Key figures

WHAT I’M WATCHING:

The significance of ETF fees

After yesterday’s flurry of updated BTC spot ETF proposals, we now have clarity on the fees the issuers will charge.

With the exception of Grayscale (which will convert its trust to an ETF and lower its fees from 2% to 1.5%), the issuers appear to be scrambling to undercut each other.

The lowest is Bitwise, which is waiving fees for the first six months or until $1 billion AUM is reached, and then raising them to 0.24%.

Then we have ARK/21 Shares, which is also going for a fee waiver for the first six months or $1 billion in AUM, 0.25% thereafter. This is lower than its originally suggested 0.8%, highlighting the last-minute nature of the fee drops.

BlackRock’s fees are a surprisingly low 0.20% for the first 12 months or until $5 billion AUM is reached, 0.30% thereafter.

Invesco/Galaxy is also offering zero fees for the first six months or until the first $5 billion in assets, then 0.59%.

These fees are low, super-low, compared to those on European ETPs which tend to be over 1%.

They also raise the question of just how these issuers are going to cover costs – overheads are not insignificant, given the trading and compliance requirements, not to mention the marketing. Higher AUM means higher income for practically the same effort, so grabbing market share by charging little is obviously part of the revenue strategy.