Tuesday, June 25, 2024

the BTC overreaction, it wasn’t just Mt Gox, Japan’s stablecoins

“If history repeats itself, and the unexpected always happens, how incapable must Man be of learning from experience.” – George Bernard Shaw ||

Hi everyone! Yesterday was brutal in crypto markets – I hope you’re hanging in there ok! Things will get better.

Below, I point out that Mt. Gox wasn’t the only factor driving down BTC’s price yesterday. And, the promised note on recent moves in Japan’s stablecoin sector.

If you find Crypto is Macro Now useful, would you mind sharing it with your friends and colleagues? ❤

Programming note: I’m travelling later this week, so the premium daily Crypto is Macro Now won’t publish on Thursday or Friday. Back on Saturday with the free weekly!

If any of you are going to be at the HedgeWeek event on Thursday, I would love to say hi!

IN THIS NEWSLETTER:

The BTC overreaction

Technical and emotional factors

There’s more going on

Japan’s stablecoins

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

WHAT I’M WATCHING:

The BTC overreaction

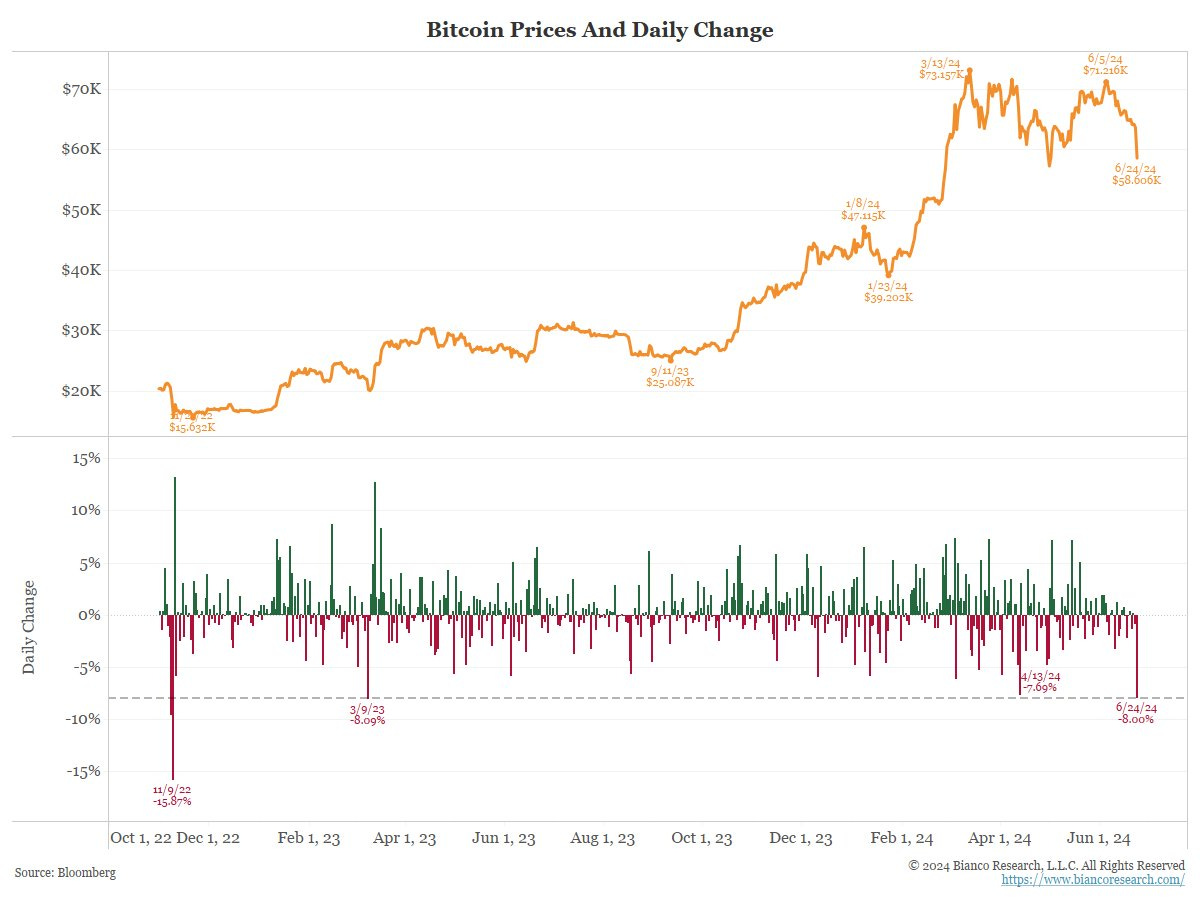

Yesterday was brutal in crypto markets, with BTC at one point down over 8% on the day, dipping below $60,000 for the first time since early May.

(chart via TradingView)

As Jim Bianco pointed out, the last time BTC had this kind of an intra-day drop was in March 2023 as the US banking crisis was unfolding. Back then, though, the “mood” was very different - the market was still bruised from the FTX scandal, the regulatory hostility was just warming up, we were dealing with a lot of “crypto is so over”. Back the, the reaction was sort of “yeah, meh, bring it”.

(chart via @biancoresearch)

Plus, back then, there was a clear negative catalyst: the US banking system was teetering, and some key institutions for the crypto industry were closing down. These days, things are murkier with optimism about new inflows battling against post-halving miner selling and conflicting macro data.

But one clear culprit for yesterday’s carnage has emerged: the news that the trustee of the Mt. Gox bankruptcy estate will start distributing recovered BTC and cash in July.

At current (well, last week’s) prices, this amounts to roughly $9 billion, which is… a lot. For context, it’s more or less where the average daily spot volume for BTC is across all exchanges, according to The Block. That amount dumped on the market at whatever price in a short period of time could do serious damage.

Only, that is infinitesimally unlikely to happen, and – as usual – many headlines are blowing the news out of proportion.