Tuesday, March 12, 2024

ETH spot ETFs, how the CPI could matter, crypto ETNs in the UK

“The only organization capable of unprejudiced growth, or unguided learning, is a network.” – Kevin Kelly ||

Hi all! Happy CPI day! I hope you’re all doing ok, and finding some quiet amongst the market noise (I know, spoken like a true introvert).

IN THIS NEWSLETTER:

Where the CPI could matter

Crypto spot ETFs in the UK?

Misplaced excitement about ETH ETFs

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content. And there’s a free trial!

WHAT I’M WATCHING:

Where the CPI could matter

Later today we get what is arguably one of the more meaningful CPI reads of the year. You may remember that January’s US consumer price index increased by 3.1% year-on-year, less than December’s 3.4% but more than the consensus forecast of 2.9%. Core CPI inflation did not deliver the expected year-on-year deceleration, holding steady at 3.9% – still far from the official target of 2.0%. Even more worrying, the month-on-month increases for both the core and headline indices accelerated, reinforcing conviction that it was too soon for rate cuts.

However, January inflation reads tend to be distorted by annual contracts adjusting for the previous year’s CPI increases. And the Bureau of Labor Statistics has attributed part of that month’s gain this year to an adjustment in how rental contract prices are calculated.

February takes all that out of the picture, and delivers a more “organic” read which just could be to the downside, especially since shelter has a much stronger influence on CPI data than on the Fed’s preferred personal consumer expenditure (PCE) indices – the impact of the calculation change should be smoothed out. Consensus forecasts for February’s CPI are for another acceleration in the headline figure to 0.4% from 0.3% month-on-month, but a corresponding deceleration in the core index growth.

Whatever happens with the CPI today, will it matter for markets?

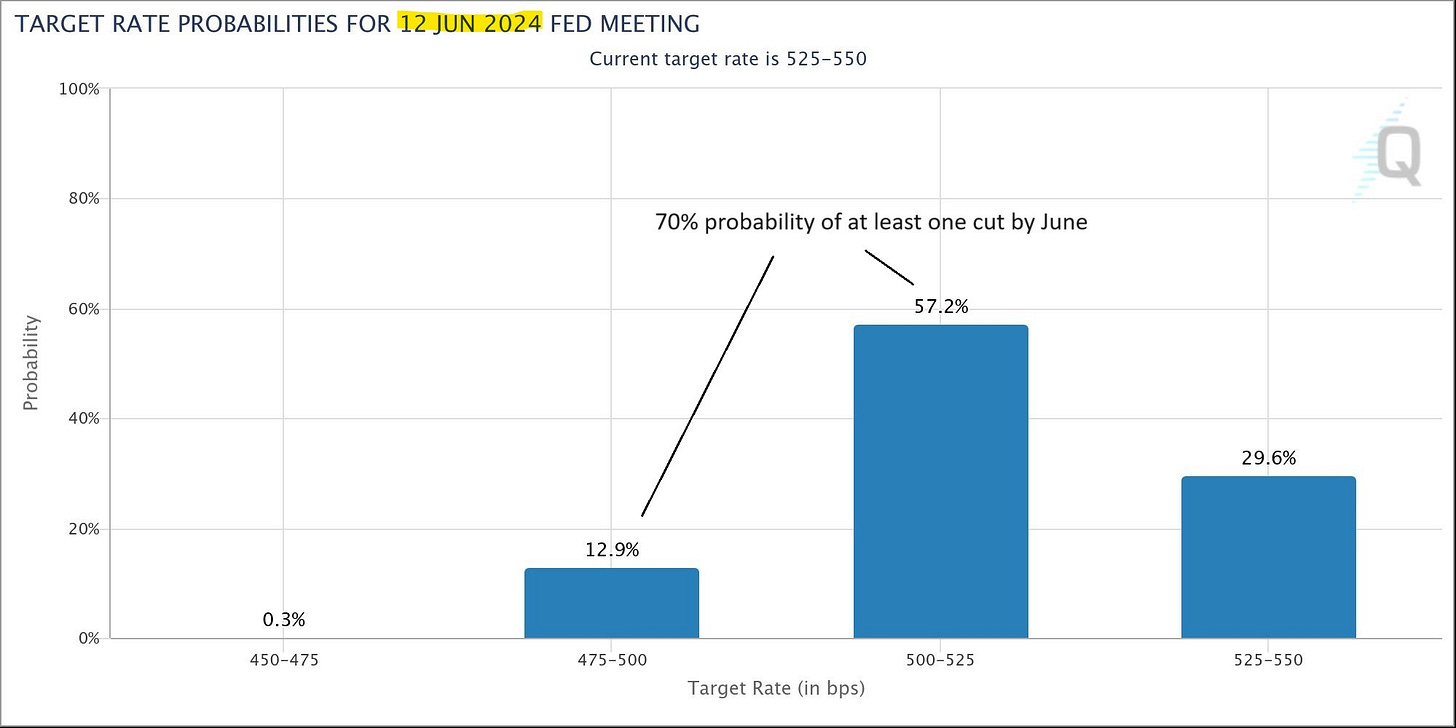

CME pricing suggests traders are not expecting a rate cut until June, and there are two more CPI reports before then (not counting today’s). If CPI growth comes in lower than expected, we could get some wild swings in bonds and stocks (and maybe crypto), but it’s unlikely to bring the consensus bet forward to May – the Fed seems pretty entrenched in its insistence on waiting for more confidence, and only one more CPI read after today’s data is unlikely to be enough, even if it also delivers a nice surprise.

(chart via CME FedWatch)