Tuesday, March 26, 2024

GDP vs GDI, another mainstream myth, a broader technology lens

“Not everything that is faced can be changed, but nothing can be changed until it is faced.” – James Baldwin ||

Hello everyone, I hope you’re all doing well! There’s no audio today, apologies, am away from my desk, things should be back to normal tomorrow.

IN THIS NEWSLETTER:

GDP vs GDI: are we looking at the right data?

“Crypto is no longer decentralized”: Yet another mainstream myth

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content. And there’s a free trial!

WHAT I’M WATCHING:

GDP vs GDI: are we looking at the right data?

You know how the US Federal Reserve keeps stressing that it will be data dependent? The idea is that it will let, you know, actual trends inform its rates decision-making process. This is reassuring in that established theory has not done a great job recently in predicting economic outcomes, so being “data dependent” suggests a more reliable and reality-based approach.

Excuse me, I have to step away for a moment, can’t type for chuckling too much.

Right, I’m back. Here’s the thing: data is backward looking. And relying on data for policy decisions implies being reactive rather than proactive, and runs the real risk of reacting too late to change an unfortunate trend.

Still, I can acknowledge that it’s better than citing out-of-date theories to justify unrealistic expectations. Another issue I have with “data dependence” is: what data? For each key economic metric, there is often more than one data point, sometimes with diverging messages.

For instance, overall economic activity, which is key for determining both interest rates and whether or not the US is in a recession. There’s GDP, which measures economic output. At the end of January, we got the preliminary read for Q4 economic growth of 3.3%, way above the consensus forecast of 2.0%. The revision issued at the end of February brought this down slightly to 3.2%, and the second revision due on Thursday isn’t expected to change much.

We could see more of a surprise in the Gross Domestic Income (GDI), which sums what all participants in the economy take in (wages, profits, taxes, etc.). Essentially, it measures the incomes earned and costs incurred in producing GDP.

According to the Bureau of Economic Analysis, the two measures are “conceptually equal”, which makes some sense: in theory, economic outputs should equal inputs, and spending should equal income. However, again according to the BEA, occasionally the two differ because of statistical discrepancies, including sampling errors and timing differences.

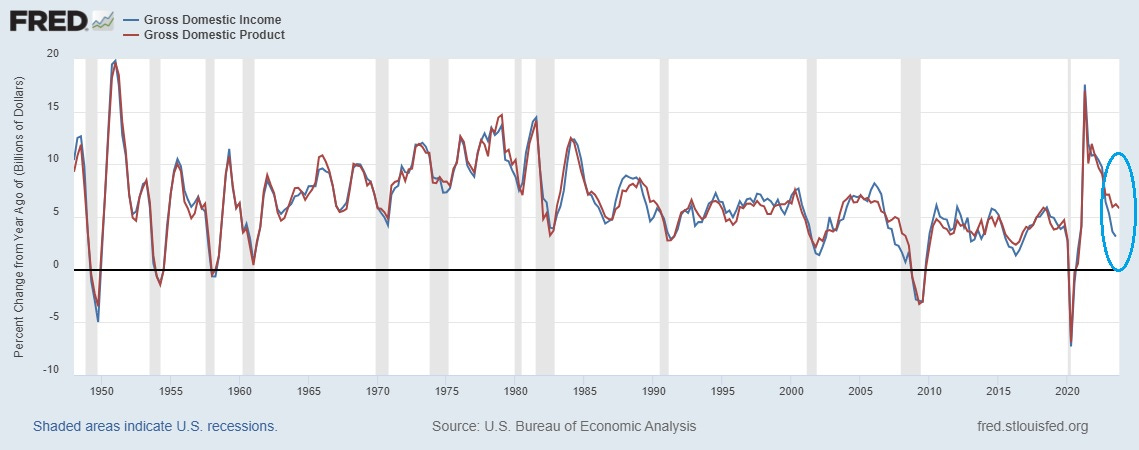

However, recently the two have diverged by more than can be justified by mere “discrepancies”:

(chart via the St. Louis Fed)

And taking the percentage change from a year ago, you can see that GDI is slowing alarmingly, while GDP is powering on.

(chart via the St. Louis Fed)

Things get really weird when you look at the “real” inflation-adjusted figures. Year-on-year real GDI growth is negative. Only slightly, sure, but still negative.