Tuesday, May 2, 2023

Upcoming catalysts, hidden risk and the technological evolution of markets...

“It takes considerable knowledge just to realize the extent of your own ignorance.” – Thomas Sowell ||

Hello everyone! If you live in one of the many countries (I believe all except the US, Canada and Australia?) that had yesterday off, I hope you had a wonderful long weekend. 🦋

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Nothing I say is investment advice. Nevertheless, I hope you find it useful – if so, please consider hitting the ❤ button at the bottom and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would really make my day. 😊

Programming notice: This newsletter will be taking a pause from this coming Friday, May 5, back in your inboxes on Tuesday, May 16. If you’re a paying subscriber (thank you so much!), your subscription period will be extended an equivalent amount of time.

WHAT I’M WATCHING

Banks, again. The intervention of First Republic Bank by the FDIC and the subsequent sale to JPMorgan feels like a “right, next?” moment as investors seem to have largely positioned for more strain to come. More on this below.

Hints of increasing unemployment. Just skimming headlines this morning, I’ve seen four announcements from large companies of pending or actual layoffs. There’s probably many more I haven’t seen. Unemployment is currently the key catalyst for market sentiment, this matters. More on this below.

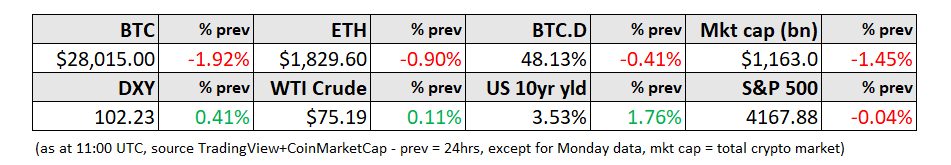

Crypto nerves. The BTC and ETH markets feel nervous at the moment. It’s not just yesterday’s sharp drop early in the day and then steady drift lower (BTC and ETH are now about 4-5% lower than on Friday), it’s also the general air of waiting for a breakout to the upside or the downside. Much depends on the overall risk mood at the end of the week, which in turn depends on the FOMC comments and Friday’s employment data.

Nigeria. Tokenized securities are about to make strong inroads in Africa. More on this below.

MARKETS

Another banking crisis put to bed.

So we finally get some resolution on the lurking First Republic problem, with the (forced?) purchase by JPMorgan (this sounds uncomfortably familiar). Unfortunately, the resolution will do little to calm the market as everyone is now asking “who’s next?”. I’ve lost count of how many times I’ve heard “there’s never only one cockroach” over the past 24 hours.

Keep reading with a 7-day free trial

Subscribe to Crypto is Macro Now to keep reading this post and get 7 days of free access to the full post archives.