Tuesday, Nov 15, 2022

“So comes snow after fire, and even dragons have their endings.” – J.R.R. Tolkien ||

Hi everyone! These are draining times for all of us in the crypto industry, whether impacted by the FTX collapse or not. I hope you’re taking care of yourselves. You’re reading the premium daily Crypto is Macro Now email, where I look at market moves and news trends that highlight the growing overlap between the crypto and macro landscapes. For now, the focus is mainly on crypto drama, given the scale and scope of last week’s events, but things will start to settle down soon. I hope you find this email useful – if so, please consider sharing with friends and colleagues.

And if you arrived here from somewhere other than your inbox and would like to receive emails like this every weekday, then do think about subscribing:

MARKETS

After showing some signs of continued optimism regarding an expected Fed pivot, the S&P 500 sentiment turned yesterday afternoon and rapidly wiped out all the days gains. This was in spite of comments by Federal Reserve Vice Chair Lael Brainard’s comments that she thinks that a slower pace of rate increases would be appropriate “soon”. The stock index drop could be an adjustment of the overconfidence displayed in last week’s rally combined with a growing realization that economic weakness is not yet fully priced into share multiples, and Amazon’s announcement yesterday that it will lay off 10,000 workers no doubt rattled sentiment.

(chart via TradingView)

However, hope does seem to spring eternal as European indices are showing some relief this morning and futures are pointing to an up opening for US stock markets, perhaps fuelled by what might be the start of a thaw in US-China relations.

Today sees the release of the October PPI figures (with core expected to remain flat on September’s 7.2% year-on-year increase) and the NY Empire State Manufacturing Index for November (expected to show a decelerating drop of 0.5 vs October’s -9.1).

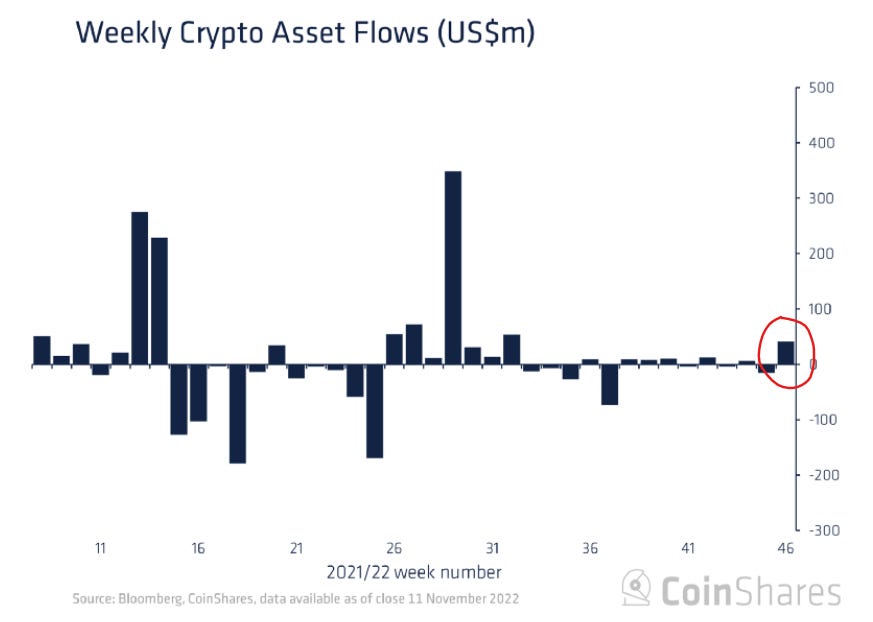

A glimmer of confidence seems to be returning to some pockets of the crypto market, however. CoinShares reports that last week’s inflows into listed crypto funds were the highest since August, with bitcoin funds accounting for almost half of the inflows and short bitcoin funds accounting for just under a third.

(chart via CoinShares)

BTC and ETH both rallied slightly yesterday, outperforming the S&P 500 and Nasdaq for the first time in a while. Negative sentiment is still weighing heavily, however, as can be seen in the increase of puts relative to calls in BTC and ETH open interest.

(chart via The Block Data)

NEWS

Papers, please. More details on FTX’s blanket bankruptcy are trickling in. The filing was presented on Friday with a minimal 23 pages and, unusually, no additional documentation or explanatory statements. On Monday, additional documents were filed revealing that the number of creditors surpasses 1 million. That, plus the complications inherent in valuing self-issued tokens and in untangling who-owns-what, is likely to make this the most complicated bankruptcy proceeding in history.

Liquidity crunch. An excellent report by crypto market data provider Kaiko looked into the impact on market liquidity of the abrupt exit of market maker Alameda Research. It shows that liquidity has dropped sharply, notably more than would be “normal” in times of high volatility. This seems in part due to the absence of one of the industry’s largest market makers, and to the possible impact on the operations of other market makers due to FTX exposure (a few have disclosed the amount of trapped funds). This is material because liquidity breeds liquidity as large investors are more comfortable stepping into low-spread markets. The reverse is also true. The liquidity for BTC is down to June levels, which is still notably higher than the beginning of the year – in other words, not bad. But the contagion is just now starting to work through the system, could deteriorate further, and this is still a step backwards.

(chart via Kaiko Research)

The fallout continues. Over the past day, Ikigai Asset Management, Sino Global Capital and Hong-Kong digital asset platform Hbit have publicly disclosed that they have funds tied up on FTX. Tragically, there will be more. This is all very sad.

Things are weird. In an unrelated development on this crazy timeline, Bitcoin Cash (BCH) could be legal tender in St. Kitts and Nevis by next year, according to the islands’ prime minister. Bitcoin Cash?? With its ~$2 billion in market cap, less than $50 million of trading volume a day and 96% held in the top 1% of addresses (according to data from Messari and Coin Metrics)? This is unlikely to move the needle on anything much – the dual-island state has a population of just over 50,000, according to the World Bank, and the BCH price is up just 1.8% over the past 24 hours at time of writing. It feels, however, like a last gasp of the crypto-as-PR hype that gets some enthusiasts excited and gives some speculators a quick profit. At least one can hope it’s one of the last.

Also…

Matt Levine has a knack for making the complicated seem relatively simple, which he masterfully applies to the FTX situation in a lucid takedown of why this fraud is just so crazy.

A powerful and beautifully written dive by Mario Gabriele into the essence of crypto culture and why it is worth fighting for, how the casino ethos came to be and why we need to change it, and what needs to change within ourselves to lower the odds of collapses like this happening again.

NLW talks about his experience working for FTX and his reaction to the whole debacle in an episode of The Breakdown that practically vibrates with eloquent anger and determination.